Data published by The Council of Insurance Agents & Brokers showed premiums rose by an average of 5.1 percent across all account sizes in the third quarter of 2024, from the 5.2 percent increase in the previous quarter.

Medium-sized account premiums saw the highest increase out of all three account sizes, at an average of 5.6 percent. Carrier competition for small business likely led to small account increases coming in as the lowest of all account sizes, at 4.4 percent.

Apart from umbrella, all lines of business saw lower increases in premiums in this quarter than in the second quarter of 2024. Similar to last quarter, three lines of business recorded premium decreases this quarter: workers’ compensation, cyber, and D&O.

Looking specifically at excess and surplus (E&S) lines, one can observe a growth surge by double-digit percentage rates for five consecutive years. Solid underwriting results created profitability due to emerging new risks and declining capacity in admitted markets, according to the Insurance Information Institute’s (Triple-I) Excess and Surplus: State of the Risk report.

“By meeting the insurance needs of risks with lower claim frequency and higher claim severity, the E&S lines have seen significant growth, though the trend of expansion appears to be slowing down a bit,” says Dale Porfilio, Triple-I’s chief insurance officer.

A significant part of E&S growth can be seen in lines such as liability, fire, earthquake, flood, and ocean marine insurance. Since 2018, the E&S share of total property lines direct premiums written has grown the most in three markets: Florida, California, and Louisiana.

Amwins shared its insights into the property market by stating, “Despite pending losses from Hurricanes Helene and Milton – as well as other named and severe convective storms (SCS) this season – the property market has continued to soften overall. New capacity continued to enter the space in 2024, forcing existing markets to become more flexible with their pricing and overall appetites. Many carriers also increased their line sizes, making layered and shared deals easier to place. Rates remain softer on the East Coast than the West as well as for insureds with large TIV overall.”

The US insurance brokerage market is estimated at $67.89 billion in 2024 and predicted to grow at a CAGR of 3.96 percent until 2029.

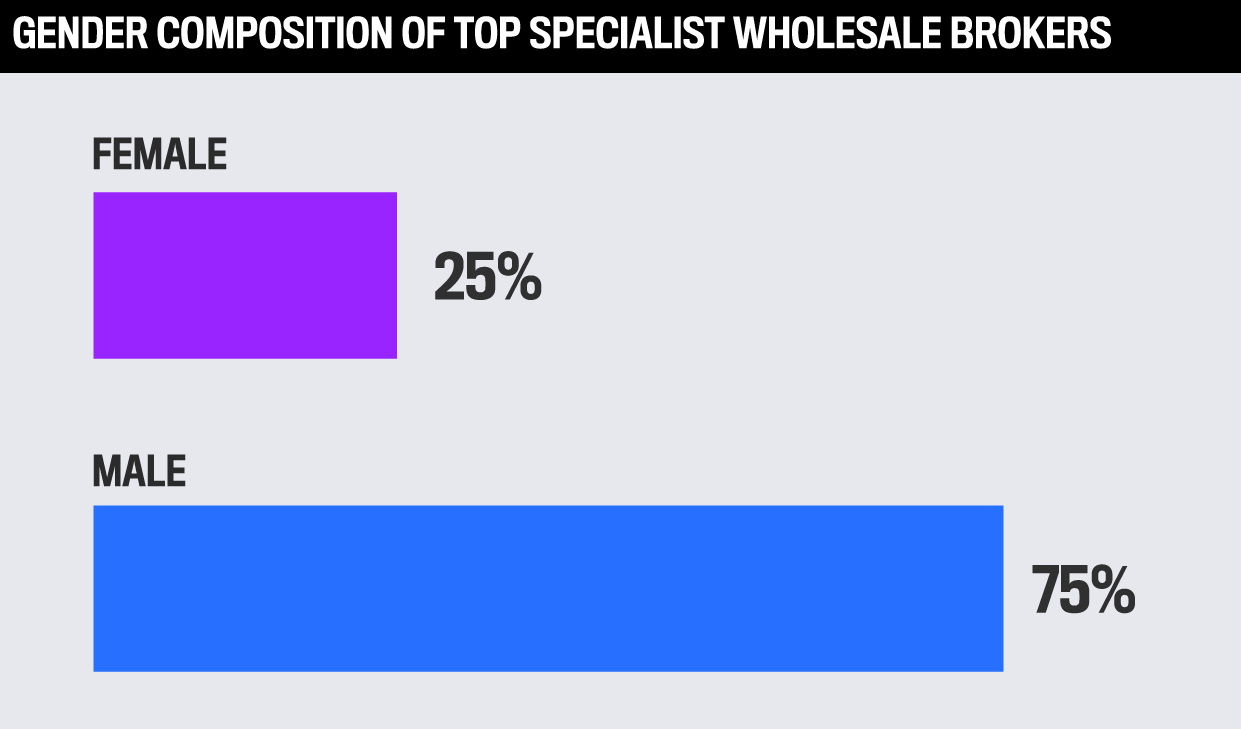

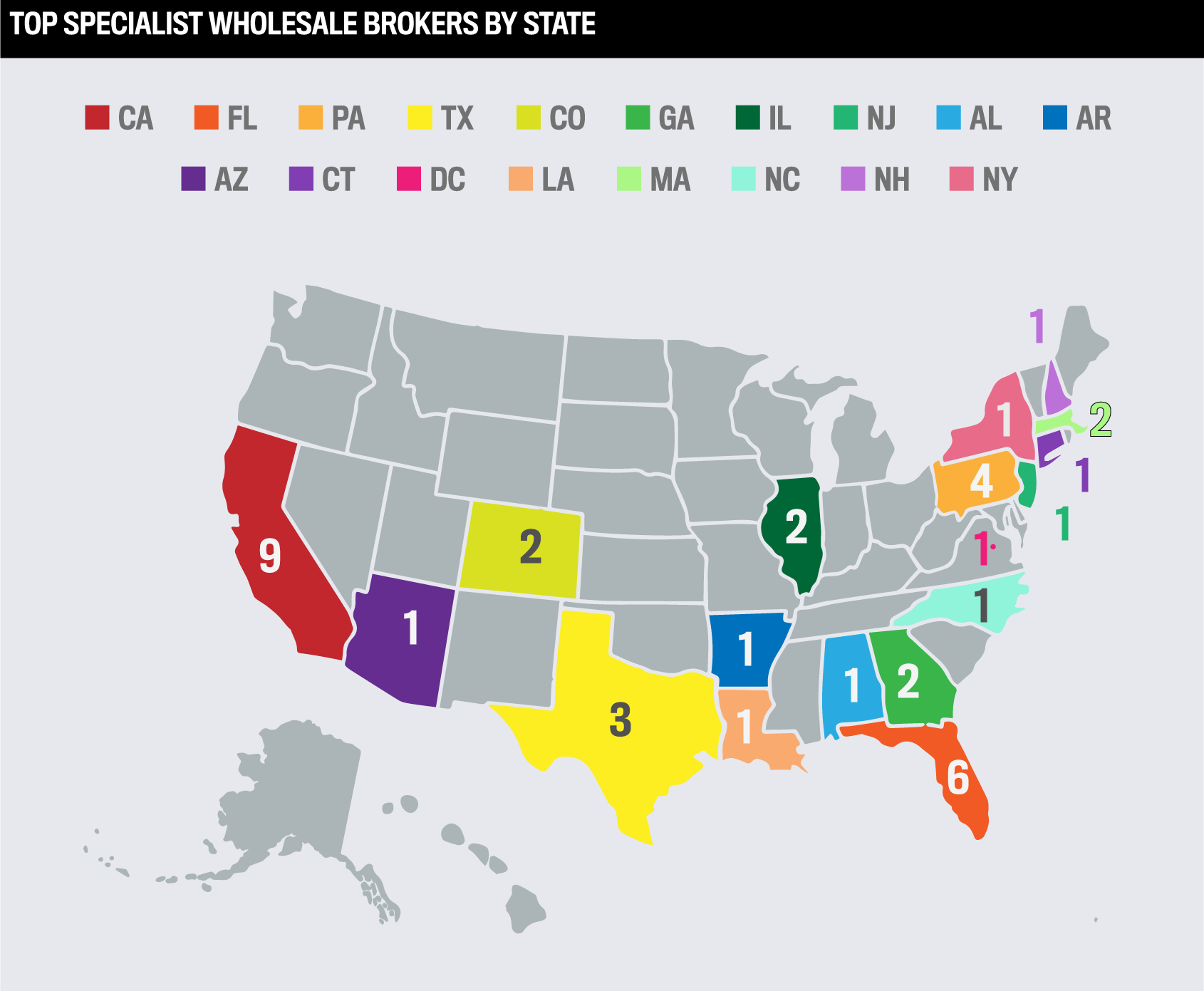

Insurance Business America’s research team invited insurance professionals to nominate the top specialist brokers in the country over the past 12 months, factoring in their contributions to the financial success of clients and business partners in 2024.

Industry respondents highlighted key areas where the Top Specialist Wholesale Brokers excel, such as:

The Top Specialist Wholesale Brokers’ value propositions are linked to measurable financial success, indicating strategic importance such as:

Staying abreast of trends and continuous learning are also cited as important by:

A construction expert and industry leader overseeing WestPac’s brokerage and underwriting teams while maintaining his own book of business, Jared Boring serves as a resource to independent agents, especially with complex E&S risks such as wraps, project-specific policies, and builder’s risk.

In addition, Boring plays a vital role in advocating for the construction industry, managing carrier relationships, and driving WestPac forward amid market challenges.

As the firm’s top producer, he increased his revenue by 19 percent from 2023 to 2024, and correspondingly, WestPac’s year-over-year revenue increased by 15.5 percent.

“Our company feels that it’s all about anticipating a customer’s need, understanding the exposures, as well as the policy language, and then how all of those things interact with the insurance operations,” he says. “Oftentimes, when we’re submitting an account or working with our carrier partners, we’ll ask for coverages that the retail agent may not necessarily have requested or asked us for.”

Specializing in casualty, specifically heavy civil/infrastructure contractors and complex risks, Goldie is highly trusted in a niche where relationship capital is built by years of performance.

Promoted to Northern California casualty practice leader due to her success, she doubled the accounts serviced in her specialty in 2024 and added 55 new clients.

Being hyper-aware of what’s happening in the market is her calling card.

“I know what type of results my colleagues are getting in terms of pricing and I’m not afraid to utilize that to my client’s benefit. I want to make sure that my clients are getting the best numbers in front of them. Explaining how you get the numbers but also having an honest relationship with underwriters is super important to me. My underwriters know, when I give them a number, it’s not because I made it up out of nowhere, I have a reason,” Goldie says.

She appreciates that she often ends up in a middle position, but rather than shy away, embraces this.

“Our job is to understand what the needs are and insure them appropriately,” she says. “You have to understand that as a wholesaler, you are the mediator. Nobody’s going to walk away happy, but it’s about how you keep both sides feeling that their needs have been met.”

Specializing in property and builder’s risk for over 16 years and navigating complex relationships between carriers, Davis is often brought in for his ability to assemble the necessary capacity, especially in high-pressure situations.

He says, “Almost every single project that comes in the door is individual and unique. You have to start from square one and we found the only way to get our clients the best coverage is by really focusing on it and doing it as much as possible.”

“I’ve seen colleagues or competitors that are arguably a lot smarter than I am but haven’t been able to figure out that it isn’t about you, per se. It’s about how you empower the people around you”

Michael DavisBrown & Riding

A major strength that Davis has is a vast track record he can call on.

“Having experience you can draw on from other similar types of projects is certainly helpful, and the only way to do that is to really build a team that is focusing on this full time,” he says.

Christopher Votta – Regional Practice Leader, Wholesure

Specializing in professional liability, Votta consistently helps agents win deals with his knowledge of products and markets. Agents send their toughest risks knowing Votta will find the correct coverages.

Highly dedicated to his agents and their success, Votta provides top-tier customer service and constantly champions his agents to insureds who have problems securing coverage.

“I’ve always made my bones in this industry by speed of service. I make sure that absolutely no one can respond quicker than I can”

Christopher VottaWholesure

His biggest challenge over the last 12 months has been to deal with pricing.

He says, “It’s related to carriers that are outliers that want to charge or still get rates for certain reasons, which are definitely valid. It could be an insurtech that runs a scan and finds a reason why they’re bumping the rate, even though revenues are the same as last year and controls haven’t changed. The thing is we’re still able to find other carriers out there that are pricing and expiring or less.”

And he adds, “The challenge for us has been explaining that to the customer and making sure they understand the reason why we remarketed.”

John Grise – Executive Vice President, Amwins

Known for helping retail partners understand the difference and nuance of language in non-ISO-based coverage lines, in professional and management liability, Grise stresses the need to not commoditize buying behavior.

“It’s really digging into what that client needs specifically, whether it might be a coverage that is a manuscript or something that is customized or tailored specifically to that client. Obviously, being in the E&S space and the wholesale arena, we have a great level of flexibility to migrate over to a non-admitted product where we can be truly prescriptive and have bespoke coverage for each client,” he says.

“I look beyond my own book and put myself out there as a resource for carriers, for other brokers as well as clients”

John GriseAmwins

Awareness is what Grise regards as essential to excellence as he has:

averaged 32 percent growth for each of the last three years

added over 1,400 new clients in 2024

He adds, “The key component is understanding what’s out there, what’s available, and then understanding where individual pain points and needs are and being able to fulfill those in the best way possible.”

Clay Fuchs, VP, Casualty – QuoteWell

Growing up in the oil patch in West Texas is the foundation of Fuchs’s passion for working with independent agencies serving local communities.

Fuchs helps to address general business and strategy needs in geographies economically dominated by energy, all while delivering cutting-edge risk transfer design and solutions for insureds.

“We’re not just focused on getting the client the best coverage and pricing. It’s how we’re doing it”

Clay FuchsQuoteWell

“I pride myself on putting full and complete submissions out as a starting point. When we send in a submission, our underwriters know it’s going to be full and complete,” he says. “With our agents, we must be transparent in our conclusions with the terms and conditions and pricing. It’s not enough just to present a proposal; we have to do it in a timely manner and explain why it’s the best option.”

Stephanie Buchanan, Broker, Assistant Vice President – Wholesure

Specializing in property/casualty, Buchanan has tripled the size of her book of business since 2020.

“Number one for me is the responsiveness and customer service that we give to our retailers”

Stephanie BuchananWholesure

“I instill in my whole team the need to really be responsive and make sure we’re keeping our retail agents in the loop,” she says. “We send marketing summaries to say where we’ve gone, so they know we’ve shopped it everywhere we possibly can, to the best of our abilities, to get them not only the best price but the best coverages for what they need.”

Grant Chiles, Executive Vice President – Amwins

In her role, Chiles customizes bespoke coverage placement solutions for large owners and developers, general contractors, municipalities, and homebuilders.

As the leader of the firm’s Builders’ Risk property practice group, he has averaged growth of 79 percent over the past three years and added over 280 clients in 2024. Chiles has an in-depth understanding of the construction space and his leadership is instrumental in helping clients understand evolving risks.

“We’re specialists in this space and have our thumb on the pulse of the market at any given point in time, which is key in the transitioning marketplace”

Grant ChilesAmwins

“No deal that we work on is going to be the same. It’s going to be located in a different spot, it could be different types of construction, or there could be wind or flood exposure,” he says.

The standout ability that Grise offers is being able to grasp what is required.

“It’s about being able to understand the needs from the client and dictating that to the market and the underwriters, to tailor specified coverage for what those needs are. A lot of pieces make each deal different, so it’s about understanding those and tailoring a solution.”

Solving problems

“When the rubber meets the road, the price of insurance has gotten exponentially more expensive for energy companies over the last 10 to 15 years. Every year, it just seems to go up, and it’s not because these insurance companies are making money hand over fist. It’s because they’re facing significant losses,” says Fuchs.

To combat this whenever he gets a submission, Fuchs studies the MSA and determines what coverage is really needed. This is enhanced by QuoteWell being tech-based and venture capital-backed.

Fuchs makes an effort to find out if any coverage is needed beyond the MSA.

“I tell you, 95 percent of the time the answer is no and then from there, it’s also about pushing back on unreasonable requests. Sometimes, we’re getting requests for two $5 million each occurrence limits on the GL, and that’s not really a thing that a lot of our insurance carriers are interested in doing,” he says.

Harnessing the company’s tech capabilities, Fuchs is able to go back and explain why that isn’t the best way forward.

“I tell them, ‘We see this kind of request all the time and you should have the client work to push back, plus here’s an alternative that you should be able to offer up and see if they’ll bite on it’. And nine times out of 10, we usually see it.”

It’s that approach that differentiates Fuchs and QuoteWell.

He says, “We’re working to try to redefine the way that E&S insurance is placed, and I’m working to redefine the way that E&S insurance is placed within the energy industry. We’re trying to bring back customer service into the space as this hard market over the last five to 10 years has really altered what customer service and what a reasonable timeframe is to get things done. We’re using technology to redefine all of that.”

Buchanan has made a name by taking on unusual risks. She cites the examples of an axe-throwing ring and an electric vehicle charging station.

“Usually, the agents are in a pinch, they need us, and we step in. I call ourselves ‘little detectives’ as we have to dig deep and see where we can go. We really try to treat all of our agents like best friends and value those relationships and keep building them, so we’re constantly giving that top-of-the-line responsiveness and service to them on the daily,” he says.

Being able to rely on relationships to help her deliver was evidenced in a hard-to-place risk for a large scaffolding contractor in 2024.

“I shopped it to literally everywhere I could, and I was just getting declined across the board. And my agent said, ‘Okay, well, we have this quote, and it’s crazy high from another wholesaler and we’re going to have to go with it’.”

However, Buchanan had a trusted connection that she felt might just work and took the deal to them.

“They turned it around for me and I almost fell off my chair that they quoted it for maybe $30,000 less than the competing quote. That was a really nice and a last-minute Hail Mary that I had an idea for, as I got that account in a pinch and on the effective day,” she says.

This type of effort and proactive action has seen Buchanan double and almost triple her revenue for certain months in the past year.

“I’m going to hopefully do the same again this year because of the influx of business that we have, because so many policies are being non-renewed in the admitted markets with our retailers. They’re coming to us way for many more things.”

For Boring, anticipating customers’ needs, understanding exposures and policy language allows him to think outside of the box. He does this with a strong sense of being based in Colorado.

“I believe we’re the only local independent wholesaler left in our state. We generally tend to work with local independent agents and they’re looking to partner with someone who is invested in their community just as much as they are,” he says.

Being nimble and providing solutions are two qualities Boring places a premium on.

“This year, we were able to successfully bring in two new markets to Colorado to write residential contractors that previously had steered clear from our state. We were able to help them gain a comfort level. We crafted some forms, shared our experiences on loss trends and we’re able to give recommendations on certain risks or exposures to avoid,” he says.

Allied with that is clear and swift communication.

“We want to be able to write every single account that we look at. However, sometimes that isn’t possible. Our view is that a quick ‘no’ is better than a drawn out ‘maybe’. Even if we’re not able to write that account, we’re still trying to go above and beyond by providing that communication and level of service,” he says.

Taking a long-term view and being upfront serves Goldie well. This is showcased in how she approaches the significant impact of auto in her construction remit.

“We understand carriers’ appetites for fleet sizes and place deals with people that we know aren’t going to walk away when the fleet gets a little bit higher,” she says. “Auto is a huge driver in the excess space, and we do what we can to combat that, but the reality is people have to drive to the job site, so we’re always going to have auto in the mix for our construction risks.”

Preparing the next generation is a passion for Goldie. She is proudly part of Amwins’ Provisional Broker program, which involves advising up-and-coming brokers.

“We often talk about the barbell that exists between the young and the older people who are going to retire. I spend a lot of time internally talking to people who are taking over books of business, and how distinctly different that is from building a book from zero,” she says.

Davis has focused his attention on helping his team weather changing market conditions as 2024 saw almost double-digit rate decreases hit almost instantaneously in January.

“We saw the tables turn pretty quickly, from a hardening position for most projects and most renewals for property to softening builders’ risk, especially wood frame builders, at a faster rate than everybody anticipated,” he says.

This substantial softening and easing created an influx of capacity and an attractive area of investment for capital into the market and also lead to rate reductions of what had been seen in prior years.

This posed an issue for Davis, who hired the majority of this team from college over the past seven years.

“These individuals hadn’t actually been in a market environment with softening rates. While they’re very good brokers, they just hadn’t been in an environment where they could push for rate reductions and expansion of terms for clients,” he explains. “That took a little bit of refocusing and shifting, and something that I didn’t quite anticipate. These individuals just hadn’t been in this type of environment before.”

Being a true specialist means Davis can rely on various parts of the market and assemble the best way forward.

“We work on property and builders’ risk, assembling capacity can be anywhere from quota sharing, layering or a combination of both, using the reinsurance market, the direct market, the E&S market, London market, and Bermuda market,” he reveals. “It becomes a game of Tetris in terms of assembling that capacity and finding the most efficient way to put it together.”

He displayed those skills to perfection on a $5-billion stadium project for an NFL team.

“I had about 48 hours to reshuffle the entire quota share panel of 32 carriers in order to get the capacity together in the right place. I was supposed to be on vacation at the time and I was doing it on a napkin in a ski lodge, figuring out the calculations of where to put everybody and weave it together. Being able to problem solve on the fly is critical,” he says.

True experts

“You have to understand the risk and the exposure to the risk because you’re going to get applications from your agents that aren’t the most complete,” says Votta.

His method is to split his market into tiers.

“Tier 1 means a good couple of fast service underwriters, but also excellent broad terms and conditions. Tier 2 is that middle ground and Tier 3 is more hard to place. So, if I have some financially distressed risks that I need to place, I have to put that probably somewhere in Tier 2. But there may be an aggressive Tier 1, and I have one underwriter in mind that looks at those risks in a different way.”

Another attribute Votta brings to the table is overcoming the vast amount of information available and understanding what moves the needle. He compiles the “right parts of the right documents” and gives them to his agents.

“It’s me telling them, ‘I’ve found this product or niche and here’s new exposures that have come up with changing litigation or these new requirements are coming down the pipe for these contractors to have this type of coverage,” he says.

The idea is so that Votta allows his agents to be the best possible scenario.

“I pass what I feel are excellent explanations of coverage and options to the agent, as your agent doesn’t want to confuse your insured. They also want you on the call with the insured and a lot of what I’ve done to overcome those obstacles is talking it through with the insured,” he says.

“Once you explain it in layman’s terms and you go through it in a little more detail, but not too much to confuse them, 99 percent of the time, you’re going to make the sale easier for your agent, and you’re going to get that bind order probably within a few days.”

Construction expert Chiles believes being a true specialist has enabled him to build a reputation and become such a valued partner to clients.

“We’re the only wholesale team that only specializes in builder’s risk. Most brokers are property brokers first, and then handle it as an offshoot of their current team structure,” he says.

This unique position means Chiles and his team can leverage relationships to boost their offering.

“Being the only ones who do what we do, we work with some of the most sophisticated clients, whether on the retail side or the building and development side, that recognize our expertise is needed to fulfill their requirements to get the best deal done and satisfy their lending and equity partner requirements.”

Another factor that drives performance is how Chiles continuously monitors the market and it’s what enables him to stay ahead of the game.

He says, “We went from a very hard market to a transitioning soft market by the end of Q3 and Q4 in 2024 and then into Q1 of 2025. For me, it’s being able to stay on top of market trends to make sure that we were still getting the best deal available. Our market is a very nimble mover and being specialists in this space, our job is to find the best coverage at the cheapest price that the market will bear.”

Echoing these sentiments is Amwins colleague Grise, who says, “We see a softening of the market, and have been for a past couple of years, whether or not that’s in the public or private D&O and cyber. The challenge really is making sure we navigate that market and the various capacities out there in a way to bring value to our clients.”

Grise is wary of never being completely price led as this could have knock-on effects.

“It’s making sure that downward pressure pricing doesn’t come with restrictive terms. Some of the things that we’ve been doing as a practice group is using that amount of capacity and competitive nature in the marketplace to create customized forms that are exclusive to Amwins in our practice group.”

A product being developed is a specific cyber program that’s going to be supported by various facilities, with the mindset of best-in-class coverage form and competitive pricing.

“We think it’ll put us in a position to stay ahead of some of the trends that we might see in the next 12 to 18 months, specifically in cyber where we’re starting to see some carriers who’ve taken losses and continue to take losses scale back on things like systemic risk, dependent business interruption exposures, and things of that nature that come from the Internet of Things and the connectivity of the world across various businesses,” adds Grise.

Albert Reed

Manager, Personal Insurance

Burns & Wilcox

Alexander Bargmann

Chief Executive Officer

Pathpoint

Andrew Hartman

Broker

CRC Group

Angelo Ganguzza

Vice President and General Manager, Brokerage Operations

Green Tree Risk Partners

Beth Linton

Vice President

Environmental Underwriting Solutions

Brett Hoffmann

President

CRC Group

Casey Sherwin

Senior Vice President

Amwins

Cyndi Johnston

First Vice President: Producer/Broker

USG Insurance Services

David Perkins

EVP, Practice Leader

US Risk

David Zemlin

Vice President

Insurance Office of America (IOA)

Elizabeth Pullen

First Vice President: Producer/Broker

USG Insurance Services

Kim Hansard

Senior VP, Director of Energy Practice

Towerstone

Krystal Boggs

Executive Vice President

RT Specialty

Mary Roy

Senior Underwriting Team Leader

CRC Group

Michael Barr

Senior Vice President

RT Specialty

Nick Kohal

Executive Vice President

American Risk Management Resources Network

Sean McLaughlin

Environmental Broker

CRC Group

Shawn Flanagan

Senior Vice President

Specialty Wholesale Insurance Solutions

Tyler O’Connor

Senior Vice President and Professional Liability Broker

CRC Group

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=67bf18e6553b4e61b7f17f52ec6aa5f7&url=https%3A%2F%2Fwww.insurancebusinessmag.com%2Fus%2Fbest-insurance%2Fthe-top-specialist-wholesale-brokers-in-the-usa-522551.aspx&c=16759410261168333753&mkt=en-us

Author :

Publish date : 2025-02-26 00:00:00

Copyright for syndicated content belongs to the linked Source.