![]()

Company Logo

Data Center Market

Data Center Market

Dublin, Aug. 12, 2024 (GLOBE NEWSWIRE) — The “Data Center Market Landscape 2024-2029” report has been added to ResearchAndMarkets.com’s offering.

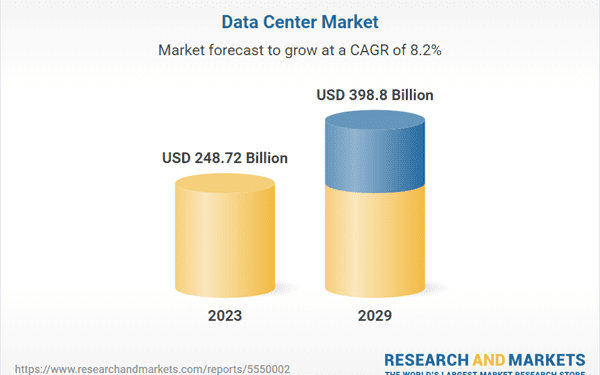

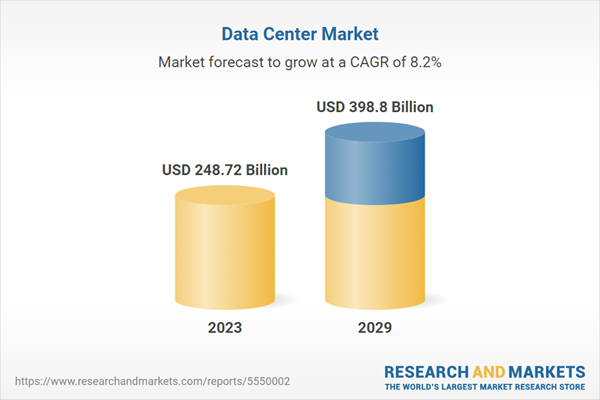

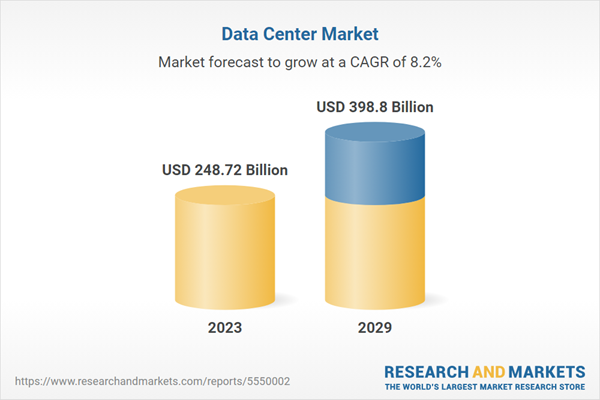

The Data Center Market was valued at USD 248.72 billion in 2023, and is expected to reach USD 398.80 billion by 2029, rising at a CAGR of 8.19%.

Regarding investment, North America leads the global data center market, with consistent growth, year on year. From 2020 to 2029, the region will oversee a significant increase in investments, with a CAGR of 6.73%. North America, particularly North Virginia, also known as the ‘Data Center Capital of the World,’ is the epitome of the data center market, boasting the highest concentration of facilities on a global scale, with several data center facilities. Locations like Ashburn in Loudoun County, Virginia, and other states like Texas, California, Arizona, Illinois, Georgia, Oregon, and New York/New Jersey are key hotspots, attracting major colocation and hyperscale operators.

While North America remains the dominant data center market player in investment and power capacity, its eastern counterpart- the APAC region, has also emerged as a key industry, experiencing substantial investment growth during the forecast period. With a CAGR of 10.25%, the APAC displays robust data center-centric development driven by countries such as India, China, Australia, and Japan. Adopting artificial intelligence (AI) and increasing investments from data center operators have contributed significantly to the region’s growth trajectory. Southeast Asian countries such as Malaysia, Indonesia, and even Singapore stand out as significant investors, with anticipated acceleration in investments from these nations in the coming years.

KEY TRENDS

Sustainability Initiatives on the Rise

The popularity of green energy is increasing worldwide and is expected to grow. It is crucial to fully adopt green energy resources as soon as possible due to the destructive impacts of climate change and global warming. In recent years, Middle Eastern countries such as the UAE, Saudi Arabia, Qatar, Turkey, Bahrain, Jordan, and Kuwait have been working to incorporate renewable energy into their energy generation. In Europe, the Nordic region is known for its sustainable practices, with wind farms and solar panels widely used to generate clean energy. North America and the Asia-Pacific region are also embracing this trend, focusing on more sustainable practices, and many companies are setting net-zero carbon emissions targets for the next two to three decades.

Rise in Rack Power Densities

The power density of equipment racks is a critical factor in data center design, planning, cooling, and power supply. In recent years, there has been a significant increase in the power density of IT equipment racks. This is due to the growing demand for high-performance computing (HPC), driven by the adoption of converged and hyper-converged solutions and virtualization. The average rack power density will increase to 10 to 12 kW in the coming years. The surge in data center deployments reflects the increasing demand, with projections indicating a 50% increase in power usage by 2025 and a five-fold growth in global data generation from 2019 to 2025. To keep up with this rapid growth, the data center market must maximize efficiency by fitting more computing power into each rack or square foot. Over the past decade, there has been a clear trajectory from modest power densities of 4-5 kW per rack to today’s densities exceeding 50 kW. Modern applications and data volumes drive rack density to unprecedented levels.

Governments Aiding Data Center Development

The growth of the data center market is observed in countries offering tax incentives. Many state and local governments provide investments and sales tax incentives to attract data center operators. In China, tax incentives such as VAT exemptions on equipment and reduced CIT rates for local investments have played a crucial role in fostering the growth of data centers. India’s Data Centre Policy, which grants infrastructure status to the sector and state-level incentives such as reduced electricity duties, aims to encourage investment in the data center market. In Germany, incentives focus on compliance with GDPR and outsourcing IT equipment, creating a conducive environment for data center investment. The UK has invested in renewable energy sources and digital information protection laws to attract data center projects.

Heightened Demand for Cloud-based Services

The demand for digital transformation in businesses has significantly increased the uptake of cloud-based services in the marketplace. The market has seen a swift escalation in adopting cloud computing applications and services, driving the development of extensive hyperscale cloud data centers. This surge in cloud computing is transforming the landscape of the data center market within the area, prompting numerous innovations and the integration of advanced infrastructure.

Significantly, the growth in the usage of cloud services is fueled by leading providers, including Google, Amazon Web Services, Microsoft, Alibaba Cloud, Oracle, Tencent Cloud, and IBM. These cloud service providers enable organizations to store information, operate software, and utilize computing resources via the Internet, reducing dependence on traditional data centers. The shift towards cloud platforms brings myriad benefits, such as enhanced flexibility, scalability, and cost-effectiveness, positioning it as a favored option across various sectors like IT, telecommunications, manufacturing, retail, logistics, healthcare, and government bodies.

SEGMENTATION ANALYSIS

Segmentation by Facility Type

Hyperscale Data Centers

Colocation Data Centers

Enterprise Data Centers

Segmentation by Infrastructure

Segmentation by IT Infrastructure

Server Infrastructure

Storage Infrastructure

Network Infrastructure

Segmentation by Electrical Infrastructure

Segmentation by Mechanical Infrastructure

Segmentation by Cooling Systems

CRAC & CRAH Units

Chiller Units

Cooling Towers, Condensers, and Dry Coolers

Economizers & Evaporative Coolers

Other Cooling Units

Segmentation by Cooling Techniques

Segmentation by General Construction

Core & Shell Development

Installation & Commissioning Services

Engineering & Building Design

Physical Security

Fire Detection & Suppression

DCIM

Segmentation by Tier Standard

Tier I & II

Tier III

Tier IV

COMPETITIVE LANDSCAPE

In the North American region, well-known construction contractors like AECOM, Arup, and Turner Construction are capitalizing on the burgeoning data center market, supported by the expansion efforts of major colocation operators such as Equinix, Digital Realty, CyrusOne, QTS Realty Trust, STACK Infrastructure, NTT DATA, Aligned Data Centers. In addition, hyperscale tech giants like Amazon Web Services (AWS), Google, Meta (Facebook), and Microsoft are aggressively expanding their footprint, particularly in regions like Northern Virginia and Texas, paving the way for further construction activities.

Latin America presents a dynamic data center market landscape with established and emerging contenders. Colocation operators such as Ascenty and ODATA (Aligned Data Centers) are spearheading the development of multiple data center facilities. ABB, Stulz, Vertiv, and several other infrastructure companies are crucial in facilitating construction activities and ensuring efficient operations across regions worldwide. The entry of new players, such as Layer 9 Data Centers and CloudHQ, has also widened the data center market’s horizons.

Western Europe has construction contractors like Atkins, Deerns, Dornan, ISG, Mercury, and several others competing for opportunities in a data center market dominated by established colocation operators such as Colt Data Centre Services (COLT DCS), Equinix, STACK Infrastructure, Digital Realty, and others. Major hyperscale operators such as Google, Microsoft, and Meta continue to invest confidently, driving up the demand for construction services. New players entering the data center market, such as Global Technical Realty and Stratus DC Management, bring dynamism to the industry, fueling competition and innovation.

IT Infrastructure Vendors

Support Infrastructure Vendors

Data Center Contractors

AECOM

Arup

Corgan

DPR Construction

Fortis Construction

Holder Construction

Jacobs

Mercury

Red Engineering

Rogers-O’Brien Construction

Syska Hennessy Group

Turner Construction

Turner & Townsend

AlfaTech

Atkins

Aurecon

Basler & Hofmann

Black & Veatch

BlueScope Construction

Brasfield & Gorrie

CallisonRTKL

Cap Ingelec

Clark Construction Group

Climatec

Clune Construction

COWI

DC PRO Engineering

Dornan

Edarat Group

Ehvert

EMCOR Group

EllisDon

EYP MCF

Gensler

Fluor Corporation

Gilbane Building Company

HDR

HITT Contracting

Hoffman Construction

ISG

JE Dunn Construction

Kirby Group Engineering

kW Engineering

Laing O’Rourke

Linesight

M+W Group (Exyte)

McLaren Construction Group

Morrison Hershfield

Mortenson

PM Group

Quark

Rosendin

Royal HaskoningDHV

Salute Mission Critical

Sheehan Nagle Hartray Architects

Skanska

Southland Industries

Sturgeon Electric Company

Structure Tone

Sweco

The Mulhern Group

The Walsh Group

The Weitz Company

TRINITY Group Construction

Urbacon

Data Center Operators

21Vianet Group (VNET)

Amazon Web Services (AWS)

Apple

AUBix

China Telecom

Colt Data Centre Services (Colt DCS)

Compass Datacenters

CyrusOne

Digital Realty

Equinix

GDS Services

Global Switch

Iron Mountain

Meta (Facebook)

Microsoft

NTT DATA

STACK Infrastructure

ST Telemedia Global Data Centres

Vantage Data Centers

3data

AdaniConneX

Africa Data Centres

AirTrunk

Aligned Data Centers

American Tower

AQ Compute

Aruba

AtlasEdge

atNorth

AT TOKYO

BDx (Big Data Exchange)

Bulk Infrastructure

CenterSquare

CDC Data Centres

Chayora

China Mobile

Chindata

CloudHQ

Cologix

COPT Data Center Solutions

CtrlS Datacenters

Data4

DataBank

DC BLOX

Digital Edge DC

Digital Parks Africa

Echelon Data Centres

EdgeConneX

Edge Centres

EdgeUno

Element Critical

ePLDT

eStruxture Data Centers

fifteenfortyseven Critical Systems Realty (1547)

Flexential

Green Mountain

Gulf Data Hub

H5 Data Centers

HostDime

IXcellerate

Hyperco

KDDI (Telehouse)

Keppel Data Centres

Khazna Data Centers

LG Uplus

maincubes SECURE DATACENTERS

Milicom (Tigo)

Nabiax

Nautilus Data Technologies

NEXTDC

Open Access Data Centres

Orange Business Services

OVHcloud

Pi Datacenters

Prime Data Centers

PowerHouse Data Centers

Princeton Digital Group (PDG)

Proximity Data Centres

Pure Data Centres Group

QTS Realty Trust

Quantum Switch Tamasuk (QST)

Raxio Data Centres

Rostelecom Data Centers

Sabey Data Centers

Scala Data Centers

Sify Technologies

Skybox Datacenters

SpaceDC

Stream Data Centers

SUNeVision (iAdvantage)

Switch

T5 Data Centers

Tenglong Holdings Group

Telecom Italia Sparkle

TierPoint

TONOMUS (ZeroPoint DC)

Turkcell

Urbacon Data Centre Solutions

Wingu Africa

YTL Data Center

Yondr

Yotta Infrastructure (Hiranandani Group)

New Entrants

Agility

Cloudoon

ClusterPower

Corscale Data Centers

Crane Data Centers

EDGNEX Data Centres by DAMAC

DHAmericas

Edged Energy

Evolution Data Centres

Form8tion Data Centers

Gatineau Data Hub (AVAIO Digital Partners)

Gaw Capital

Global Technical Realty

Kasi Cloud

Layer 9 Data Centers

Quantum Loophole

Regal Orion

Rowan Digital Infrastructure

Stratus DC Management

Surfix Data Center

YCO Cloud

KEY QUESTIONS ANSWERED

1. How big is the data center market?

2. What are the key trends in the data center industry?

3. What is the growth rate of the global data center market?

4. What is the estimated market size in terms of area in the global data center market by 2029?

Key Attributes

Report Attribute

Details

No. of Pages

329

Forecast Period

2023-2029

Estimated Market Value (USD) in 2023

$248.72 Billion

Forecasted Market Value (USD) by 2029

$398.8 Billion

Compound Annual Growth Rate

8.1%

Regions Covered

Global

For more information about this report visit https://www.researchandmarkets.com/r/otu3bi

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66ba1d669e664598b277808ced8e566d&url=https%3A%2F%2Ffinance.yahoo.com%2Fnews%2Fdata-center-market-landscape-2024-142800256.html&c=16031193176471977828&mkt=en-us

Author :

Publish date : 2024-08-11 23:28:00

Copyright for syndicated content belongs to the linked Source.