The United Kingdom’s stock market has faced recent turbulence, with the FTSE 100 and FTSE 250 indices slipping amid weak trade data from China and global economic uncertainties. Despite these challenges, there remain promising opportunities within the small-cap sector for discerning investors. In this article, we explore three undiscovered gems in the UK market that show potential for growth even in a volatile economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

Name

Debt To Equity

Revenue Growth

Earnings Growth

Health Rating

Globaltrans Investment

15.40%

2.68%

16.51%

★★★★★★

Impellam Group

31.12%

-5.43%

-6.86%

★★★★★★

London Security

0.31%

9.47%

7.41%

★★★★★★

Georgia Capital

NA

-27.80%

18.94%

★★★★★★

M&G Credit Income Investment Trust

NA

-0.35%

1.18%

★★★★★★

Fix Price Group

43.59%

12.53%

23.49%

★★★★★☆

Ros Agro

49.06%

17.05%

17.70%

★★★★★☆

Goodwin

59.96%

9.26%

13.12%

★★★★★☆

BBGI Global Infrastructure

0.02%

6.58%

9.90%

★★★★★☆

Mountview Estates

16.64%

4.50%

-0.59%

★★★★☆☆

Click here to see the full list of 81 stocks from our UK Undiscovered Gems With Strong Fundamentals screener.

Let’s dive into some prime choices out of from the screener.

Simply Wall St Value Rating: ★★★★★★

Overview: Cohort plc, with a market cap of £346.37 million, operates through its subsidiaries to offer a range of products and services in defense, security, and related markets across the United Kingdom, Germany, Portugal, Africa, North and South America, and the Asia Pacific.

Operations: Revenue streams for Cohort plc include £119.60 million from Sensors and Effectors and £82.93 million from Communications and Intelligence.

Cohort, a small cap in the Aerospace & Defense sector, has shown impressive growth with earnings up 34.9% over the past year, outpacing the industry average of 14.8%. The company’s debt to equity ratio improved from 32.5% to 29.2% over five years, and its interest payments are well covered by EBIT at 15.5x coverage. Recent highlights include a €33 million contract with NATO and a net income increase to £15.32 million from £11.36 million last year.

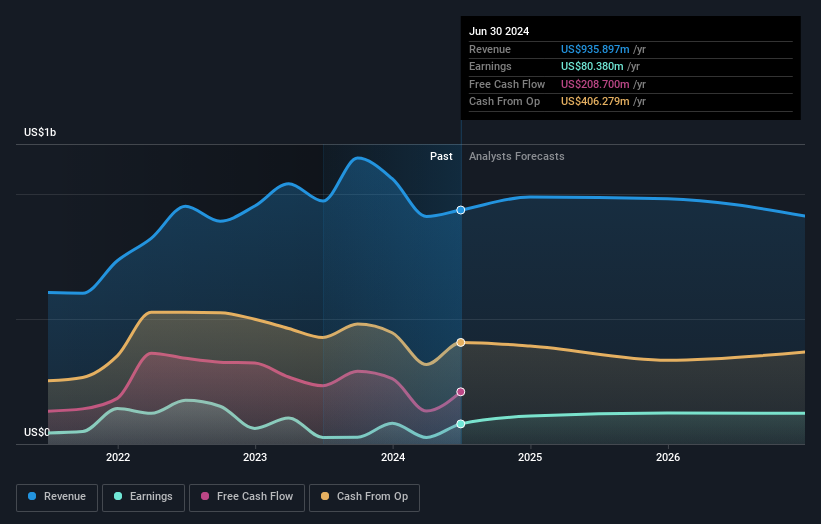

AIM:CHRT Earnings and Revenue Growth as at Aug 2024

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing activities across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.10 billion.

Operations: Seplat Energy generates revenue primarily from oil ($815.03 million) and gas ($120.87 million). The company has a market cap of £1.10 billion.

Story continues

Seplat Energy has shown impressive earnings growth of 207.6% over the past year, significantly outperforming the Oil and Gas industry, which saw a -49% change. The company’s debt to equity ratio has increased from 20.6% to 41.5% over five years, suggesting higher leverage but still within satisfactory limits at a net debt to equity ratio of 20.6%. Recent unaudited results reveal average production of 48,407 boepd for H1 2024 and net income of $39.72 million in Q2 compared to a loss last year.

LSE:SEPL Earnings and Revenue Growth as at Aug 2024

Simply Wall St Value Rating: ★★★★☆☆

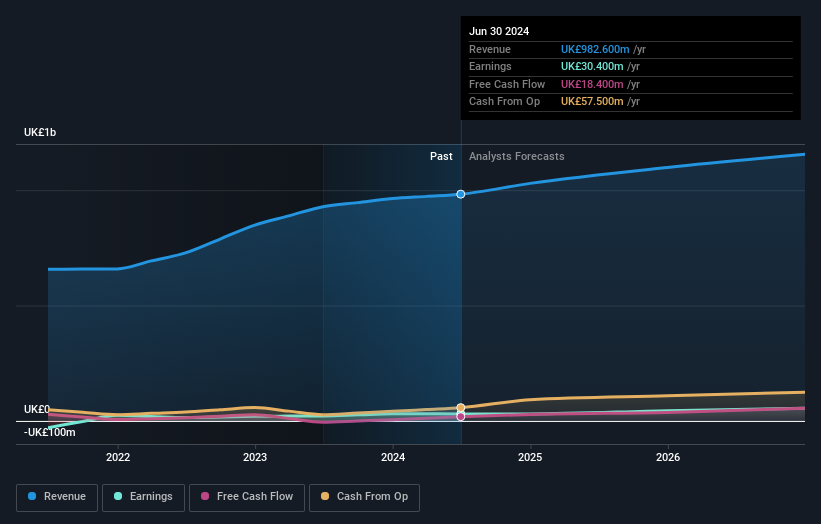

Overview: Senior plc designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy markets globally; the company has a market cap of £675.37 million.

Operations: Senior plc generates revenue primarily from its Aerospace segment (£651.10 million) and Flexonics segment (£333 million), with a minor offset from central costs (-£1.50 million).

Senior plc, a noteworthy player in the Aerospace & Defense sector, has seen its debt to equity ratio rise from 35.5% to 42.4% over the past five years. Despite this, earnings surged by 40.1% last year and are projected to grow at an annual rate of 26.52%. Trading at nearly 68% below estimated fair value, Senior boasts high-quality earnings and satisfactory net debt to equity ratio of 34.4%.

LSE:SNR Earnings and Revenue Growth as at Aug 2024

Summing It All Up

Click through to start exploring the rest of the 78 UK Undiscovered Gems With Strong Fundamentals now.

Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:CHRT LSE:SEPL and LSE:SNR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66bc69bc0d1e447fb1a0a9cca4cce03e&url=https%3A%2F%2Ffinance.yahoo.com%2Fnews%2Fundiscovered-gems-united-kingdom-august-080710765.html&c=6554882239601985225&mkt=en-us

Author :

Publish date : 2024-08-13 21:07:00

Copyright for syndicated content belongs to the linked Source.