.

THE level of foreign investment reported for the Caribbean in the most recent update from the United Nations Economic Commission for Latin America and the Caribbean (ECLAC) does not augur well for the region’s future economic growth.

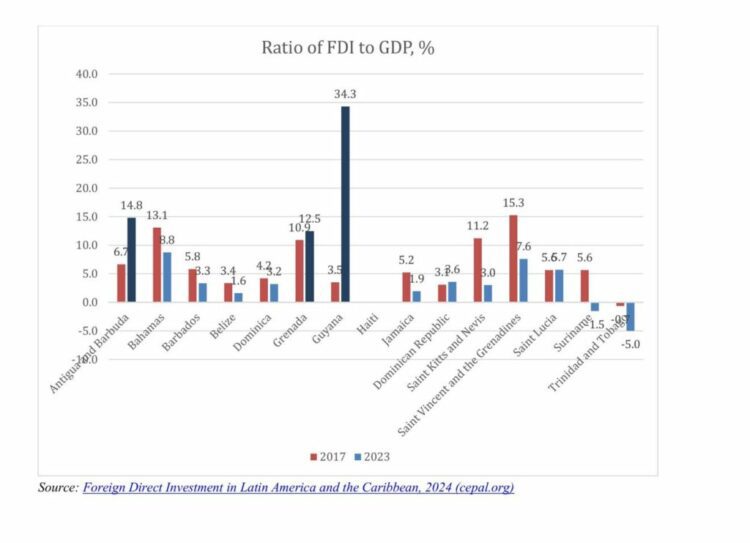

Foreign direct investment in 2023 is equivalent to less than 10 percent of gross domestic product (GDP) for all but three Caribbean economies. The exceptions are Guyana, where thanks to the rapid expansion of the oil industry, the ratio of foreign investment to GDP is as high as 34 per cent, and Antigua-Barbuda and Grenada, with 14 and 13 per cent, respectively.

These three economies are also the only ones where foreign investment in 2023 is substantially higher than it was before the COVID-19 pandemic. The Dominican Republic (DR) is the largest Caribbean economy for which data is reported; foreign investment in the DR was between three and four per cent of GDP, much the same as before COVID.

Trinidad-Tobago, the largest English-speaking economy, recorded net outflows of investment from the domestic economy, before and after the pandemic. Suriname, which recorded average foreign investment of nearly six per cent before the pandemic, also reported a net foreign outflow in 2023.

In Jamaica, The Bahamas, Barbados, Belize, Dominica, St Kitts-Nevis, and St Vincent and the Grenadines foreign investment ratios in 2023 were all significantly lower than the averages for pre-COVID years.

Foreign investment is essential to sustain and accelerate the growth of Caribbean economies. It is investment in the refurbishment, upgrade and expansion of hotel capacity which provides the basis for attracting more visitors, with the attendant benefits for restaurants and bars, sports, recreation and cultural activities, transport, security, cleaning and personal services, public utility services, etc. Foreign investments in medical and educational facilities and services, telecommunications and similar facilities also create multiplier effects that help to accelerate growth. Foreign investment in mineral extraction and manufacturing will also have multiplier effects, though their impact may not be as widespread as for the services sectors.

Foreign currency is essential for investment in economies as small as those of the Caribbean. Every investment involves the purchase of supplies and equipment that is imported, such as building materials, furnishings, computers, telecommunications equipment, vehicles and office supplies. Investment which is made in local currency has to draw on the foreign reserves of the country in order to pay for these needed imports.

A robust inflow of foreign investment is also an indicator of a country’s international competitiveness. International investors and investment bankers are always on the lookout for projects that offer a competitive rate of return, when all the circumstances and factors that affect profitability are accounted for. The things that have to be taken into account are many, and will depend on the nature of the investment. They will always include the nature and quality of the product, the market for which it is intended, and what competitors have on offer. They will also include government administrative and financial management, health and educational services, labour market skills, the quality of infrastructure and social and political stability. At the end of the day, however, we know whether a project is considered to be a competitive one if the investor goes ahead to provide financing.

On the evidence from the ECLAC report, the Caribbean has evidently not turned the corner on the anaemic economic performance of recent years. The region may have recovered from the deep contraction which countries suffered in 2020 with the onset of the COVID-19 pandemic. However, foreign investment is not yet forthcoming to increase productive capacity, earn foreign currency and accelerate the growth of Caribbean economies, except for oil-rich Guyana.

DeLisle Worrell is a former Governor of the Central Bank of Barbados.

DeLisle Worrell

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=673d544c9e0245d0b6de5627cbff428f&url=https%3A%2F%2Fwww.jamaicaobserver.com%2F2024%2F11%2F15%2Fmodest-foreign-investment-limits-caribbean-economic-outlook%2F&c=12526016217527164622&mkt=en-us

Author :

Publish date : 2024-11-15 00:23:00

Copyright for syndicated content belongs to the linked Source.