In a significant move to bolster economic stability in South America, the United States government is contemplating a substantial $20 billion currency swap with Argentina. This potential financial intervention aims to provide crucial support amid ongoing economic challenges, including soaring inflation and a depreciating peso. As Argentina grapples with a precarious fiscal situation, Washington’s proposed initiative is seen as a decisive step not only to aid its southern neighbor but also to reinforce regional economic ties. The discussions around the currency swap reflect a broader U.S. strategy to engage with Latin American economies as they navigate the complexities of recovery and growth. This article delves into the implications of this proposed swap, the motivations behind it, and the potential impact on both countries and the wider region.

US Weighs $20 Billion Currency Swap to Bolster Argentina’s Economy

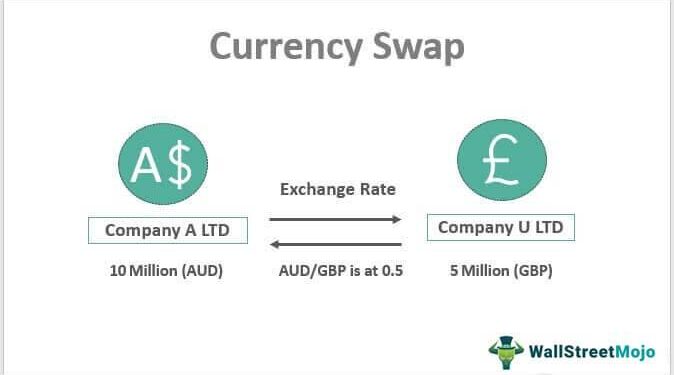

The U.S. government is reportedly in discussions regarding a significant financial initiative aimed at stabilizing Argentina’s beleaguered economy. A potential currency swap arrangement, valued at $20 billion, could provide much-needed liquidity to the Argentine peso amidst soaring inflation and economic uncertainty. Such a move would not only strengthen bilateral relations but also signal a commitment by the U.S. to support its Latin American partners in their economic recovery efforts.

This proposal comes at a critical juncture, as Argentina faces mounting economic challenges, including substantial foreign debt, a declining currency, and rising poverty levels. Key components of this potential currency swap could include:

- Immediate liquidity support: Enabling the Argentine government to meet short-term obligations.

- Stabilizing the exchange rate: Reducing volatility in the foreign exchange market.

- Facilitating trade: Encouraging increased export activity and foreign investments.

Economists suggest that the impact of such a financial strategy could extend beyond immediate relief, fostering long-term economic stability if managed correctly. By instilling confidence both locally and internationally, this initiative might pave the way for further investments and stronger trade ties between the two nations.

Critical Implications of US Support for Argentine Financial Stability

The proposed $20 billion currency swap between the U.S. and Argentina represents a significant commitment to stabilizing the latter’s struggling economy. This financial maneuver is not just a lifeline for Argentina but carries critical implications for regional geopolitics and U.S. foreign policy. By stepping in to support Argentina, the U.S. aims to curb the influence of alternative powers, particularly China, which has been expanding its foothold in Latin America through investment and trade. The strategic implications of this deal could foster stronger ties between the two nations, reinforcing a partnership that might extend beyond mere economic assistance to encompass broader diplomatic and security interests.

Furthermore, the success of this currency swap might set a precedent for future U.S. interventions in Latin America, influencing how the region perceives American intentions and capabilities. A stabilized Argentina could lead to economic growth, which in turn may foster a more favorable environment for U.S. businesses and investments. However, if the currency swap fails to produce the desired effects, it could exacerbate existing economic disparities and negatively impact U.S. credibility in the region. The dual nature of this assistance-economic aid intertwined with strategic positioning-highlights the complexities of international relations in today’s rapidly changing global landscape.

| Potential Effects of Currency Swap | Positive Outcomes | Negative Outcomes |

|---|---|---|

| Economic Stability | Increased Investment | Rising Inflation |

| Geopolitical Influence | Stronger Bilateral Ties | Erosion of Trust |

| Public Perception | Support for U.S. Policies | Backlash Against Foreign Intervention |

Recommended Strategies for Argentina to Optimize Currency Swap Benefits

To maximize the benefits of a potential $20 billion currency swap with the United States, Argentina should consider implementing a series of strategic measures aimed at bolstering economic stability and investor confidence. Firstly, the government can improve transparency by regularly updating stakeholders on the use of funds obtained through the swap. This can include establishing a dedicated task force that monitors and reports on various economic metrics, such as inflation rates and currency stabilization efforts. Secondly, enhancing bilateral trade relations with the U.S. could help maintain a balanced economic growth trajectory. Initiatives may include organizing trade missions and seeking mutual agreements that encourage American investment in sectors critical to Argentina’s infrastructure and agriculture.

Furthermore, Argentina can leverage the currency swap to prioritize debt management and repayment strategies. By utilizing a portion of the funds to refinance existing debt at lower interest rates, the country could significantly ease fiscal pressure. To facilitate this process, the government should engage actively with international financial institutions to negotiate the terms of existing debts. A structured approach could be as follows:

| Action | Expected Outcome |

|---|---|

| Increase transparency in fund allocation | Boosted investor confidence |

| Strengthen bilateral trade | Expanded market access |

| Refinance high-interest debt | Improved fiscal stability |

This multifaceted approach could position Argentina to not only stabilize its economy but also create a sustainable environment for future growth and collaboration with international partners.

In Conclusion

In conclusion, the U.S. government’s potential move to establish a $20 billion currency swap with Argentina marks a significant step in bolstering economic stability in the region. This initiative not only underscores the strategic importance of Argentina within South America’s economic landscape but also reflects an evolving U.S. foreign policy approach aimed at fostering resilience in key partner nations. As discussions progress, both nations will be monitoring the implications of this financial agreement amid ongoing economic challenges. Stakeholders will be watching closely to see how this partnership develops and its potential impact on Argentina’s economic recovery and Latin America’s broader financial stability.