LSE:SEPL Earnings and Revenue Growth as at Aug 2024

Simply Wall St Value Rating: тШЕтШЕтШЕтШЕтШЖтШЖ

Overview: Senior plc designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy markets globally; it has a market cap of approximately ┬г675.37 million.

Operations: Senior plc generates revenue primarily from its Aerospace segment (┬г651.10 million) and Flexonics segment (┬г333 million), with a minor adjustment for central costs (-┬г1.50 million).

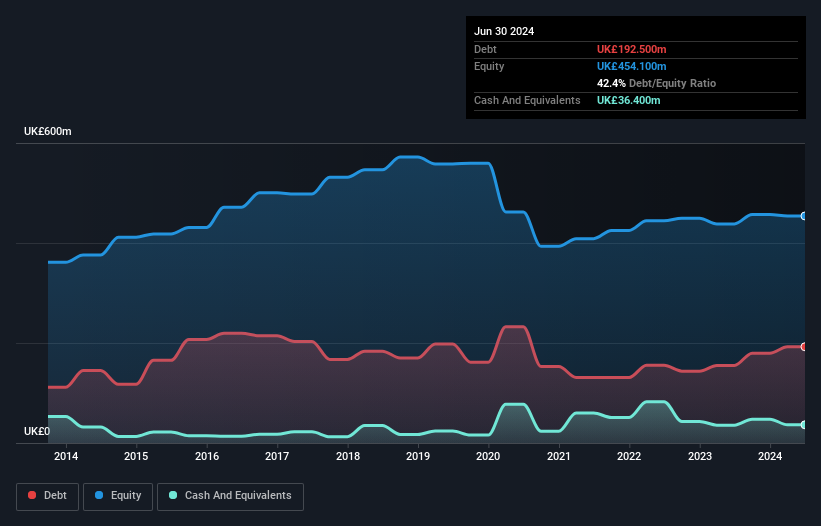

Senior plc, a notable player in the Aerospace & Defense sector, has shown impressive earnings growth of 40.1% over the past year, significantly outpacing the industry average of 14.8%. Trading at 67.8% below its estimated fair value, it represents an attractive investment opportunity. The companyтАЩs net debt to equity ratio stands at a satisfactory 34.4%, though interest payments are not well covered by EBIT (2.8x). Senior recently secured contracts with Deutsche Aircraft and Rolls-Royce and announced a dividend increase of 25%.

LSE:SNR Debt to Equity as at Aug 2024

Summing It All UpCurious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:CHRT LSE:SEPL and LSE:SNR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66bcc2002ae04694a59368619e8236e2&url=https%3A%2F%2Ffinance.yahoo.com%2Fnews%2Fundiscovered-gems-united-kingdom-stocks-140443351.html&c=9736321882380439363&mkt=en-us

Author :

Publish date : 2024-08-13 23:03:00

Copyright for syndicated content belongs to the linked Source.