(Bloomberg) — What started as a top idea among Wall Street emerging-market strategists has turned into one of the year’s most painful trades.

Most Read from Bloomberg

Morgan Stanley, Bank of America, JPMorgan and Barclays all told clients earlier this year to pile into positions that profit from lower interest rates in Brazil — the so-called receivers. The Federal Reserve’s first rate cut since the pandemic, the thinking went, would allow policymakers globally to ease monetary policy. That was particularly true in Brazil, with real rates at a whopping 6%.

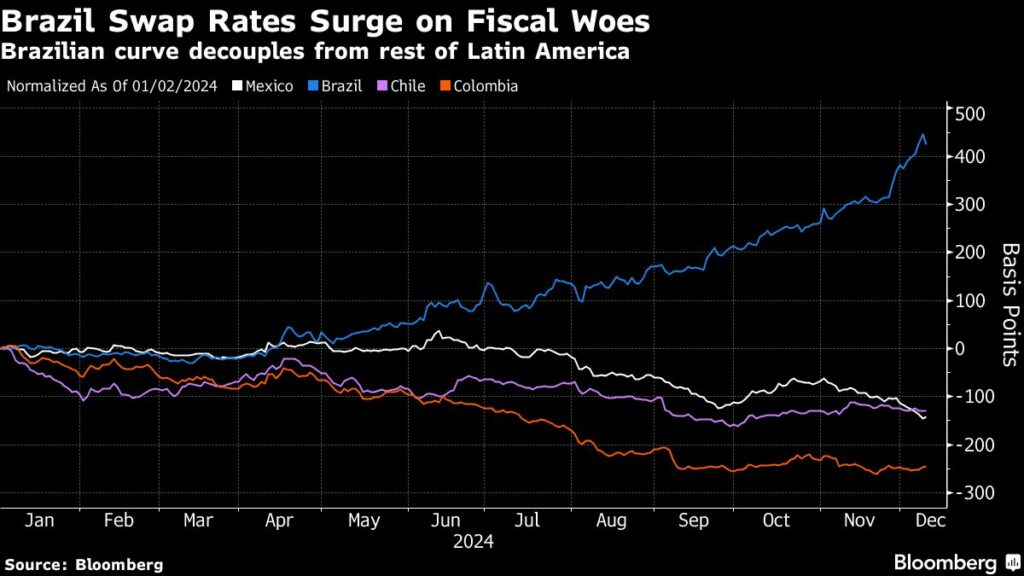

But over the past few months, what unfolded was a relentless selloff. Brazil’s swaps curve has entirely disconnected from peers, with contracts maturing in January 2026 up more than 470 basis points year-to-date. Similarly-dated contracts in Mexico and Chile are down in the span.

The slump has largely been driven by Brazilian hedge funds, who were highly skeptical of President Luiz Inacio Lula da Silva’s commitment to fixing a growing budget deficit and took the opposite tack. In just a week in June — when the central bank was, ostensibly, still easing — traders erased bets on new cuts and began pricing in rate increases.

Despite offering investors a lot of risk premium and some insulation from risks like US tariffs, Brazil “proved to be a catastrophe,” said Luis Estrada, a strategist at RBC Capital Markets in Toronto.

The last leg of the selloff took place late last month after Lula tacked on income tax exemptions to a long-awaited fiscal package. The move, investors say, watered down any expected savings, and confirmed fears that the left-wing president has no real commitment to fiscal austerity.

The announcement of the package, which was expected to provide some relief to local markets, sent rates surging and the real to a record low. His recent health woes — Lula is in the hospital after needing emergency brain surgery this week — only cloud the outlook further.

“Investors have lost patience,” said Pradeep Kumar, an emerging market portfolio manager at PGIM, who’s neutral on Brazil’s rates. “If the real yield at 6% to 8% cannot stabilize the currency, then something else is going on.”

The fiscal concerns also prompted VanEck Associates to recently cut its main strategy’s exposure to Brazilian local-currency bonds.

Traders are now pricing in a 100 basis-point rate hike later on Wednesday, double the pace from the last central bank meeting, and follow up with a similar increase in January. Foreign investors, many of whom got stopped out from those Brazil receivers, are waiting for volatility to decline.

Story Continues

“Until the fiscal is resolved, it’s really hard to get a proper investment case in Brazil,” said Pramol Dhawan, head of the emerging markets team at Pacific Investment Management Co. “How high should real rates go? I don’t think any valuation model is sensible enough to tell you.”

(Adds VanEck commentary in ninth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=675a4c305afc4583bf77df4eeaf7e6f6&url=https%3A%2F%2Ffinance.yahoo.com%2Fnews%2Ftop-em-trade-turns-catastrophe-151854542.html&c=6274243630067383057&mkt=en-us

Author :

Publish date : 2024-12-11 02:18:00

Copyright for syndicated content belongs to the linked Source.