(Bloomberg) — Brazil analysts raised their 2026 year-end interest rate forecasts as central bankers say they have all policy options on the table to tame above-target inflation.

Most Read from Bloomberg

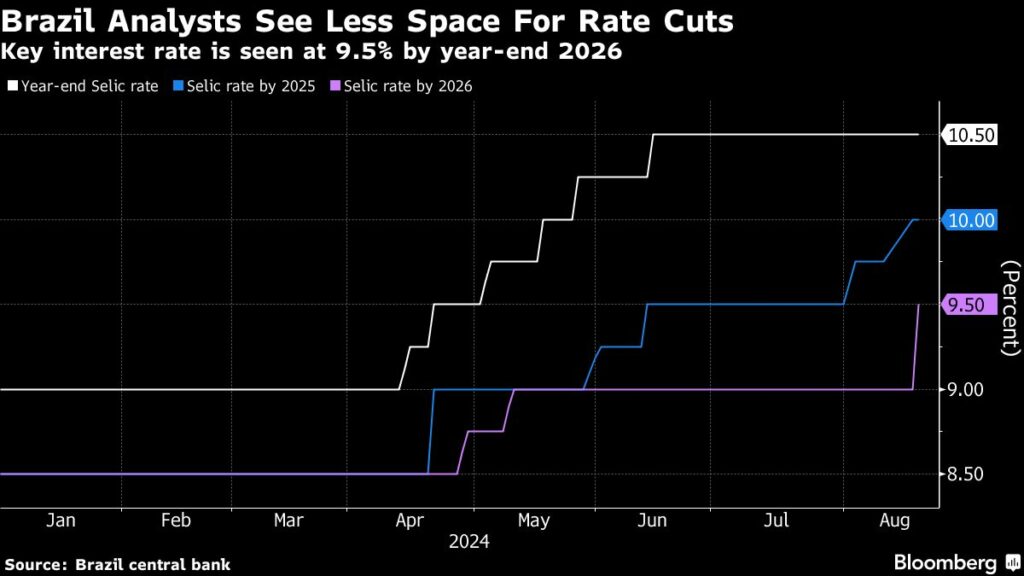

The benchmark Selic will hit 9.5% in December, 2026, up from the prior estimate of 9%, according to a weekly central bank survey published Monday. Analysts held their estimates unchanged for end-2024, at 10.5%, and for end-2025, at 10%.

Central bank Governor Roberto Campos Neto said on Saturday a tight labor market is making Brazil’s fight against consumer prices slower than expected and that the local disinflation process is “stalling.” Policymakers have held borrowing costs steady at 10.5% since June, when they paused a nearly year-long easing cycle. Traders bet the bank will lift rates as soon as next month.

Rising services costs, above-target consumer price estimates and a weaker currency are adding upward pressure to inflation, central bankers wrote in the minutes to their last policy meeting published Aug. 6, adding that the outlook requires “even greater caution.”

President Luiz Inacio Lula da Silva could soon name a replacement for Campos Neto, whose mandate ends in December. Central Bank Monetary Policy Director Gabriel Galipolo, who is seen by many as Lula’s pick to head the monetary authority, said at an event later Monday that the central bank remains data-dependent for its September rate decision and that all options are on the table.

Brazil’s economy is showing resilience, with rising income, a tight labor market and growth estimates that have been systematically revised up, Galipolo said. At the same time, inflation expectations remain unanchored, he said.

Analysts see consumer price increases at 4.25% this December, up from the prior estimate of 4.22%, according to the survey. Inflation estimates for 2026 and 2027, both of which are seen as a gauge of the central bank’s credibility among investors, remain above the 3% target.

In a 12-month horizon, similar to the bank’s current inflation regime, consumer prices are seen rising 3.83%.

(Updates with comments from Gabriel Galipolo starting in fifth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66cca1fc224c48f0a0ae8f5b4a1d7dc3&url=https%3A%2F%2Fwww.yahoo.com%2Fnews%2Fbrazil-analysts-see-less-space-115528710.html&c=5314888926805831579&mkt=en-us

Author :

Publish date : 2024-08-26 00:55:00

Copyright for syndicated content belongs to the linked Source.