(Bloomberg) — The new power broker in Brazil’s central bank, Gabriel Galipolo, has made a radical transformation to anti-inflation crusader over the past few weeks. In so doing, Galipolo, who’s been tapped to take the top job at the bank, has upended the outlook for monetary policy in Latin America’s largest economy.

Most Read from Bloomberg

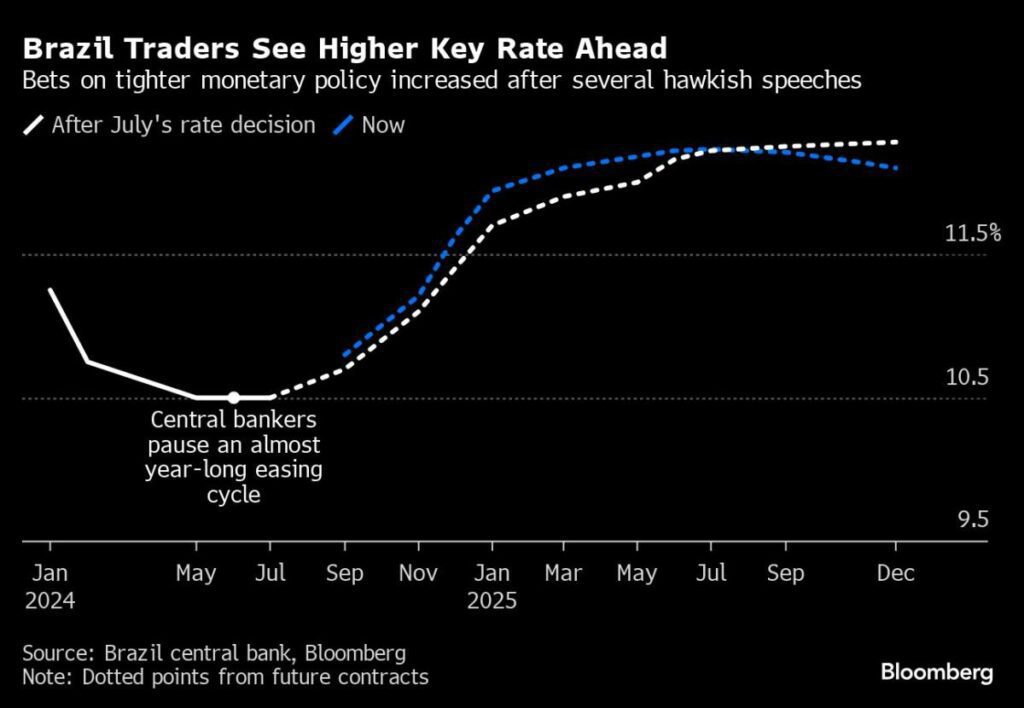

Whether Galipolo changed his mind or is just seeking more credibility, his newfound hawkishness has caught investors by surprise, sparking a surge in wagers that the bank will start hiking interest rates on Wednesday, just hours after the Federal Reserve begins to lower rates to shore up the economy.

It’s a remarkable turnaround for the 42-year-old central bank director who just a few months ago was seen as an emissary of President Luiz Inacio Lula da Silva, one who would eventually be in charge of delivering the rate cuts sought by the leftist leader since the beginning of his mandate. Galipolo’s tone started to change about five weeks ago, when he began to promise to do “whatever it takes” to bring inflation down. On Aug. 12, he made it clear that a rate hike was on the table.

“His tough stance surprised us,” said Caio Megale, chief economist at XP Investimentos, who now forecasts a tightening cycle of 125 basis points starting this week. “We changed our rate call because of those statements.”

The central bank declined to comment on this story.

Galipolo joined Brazil’s central bank in 2023 as monetary policy director. He had previously worked as undersecretary to Finance Minister Fernando Haddad who, like the nation’s leftist president, has repeatedly called for lower interest rates. Lula appointed him as the bank’s next chief on Aug. 28, and he’s due to take office early next year after being confirmed by the Senate.

His initial proclivity for a more dovish monetary policy was clear in May, when the central bank’s board disagreed on whether to deliver a seventh consecutive rate cut of 50 basis points or a more cautious 25 point reduction. Galipolo and all board members appointed by Lula voted for keeping the pace of easing despite rising inflation expectations and public spending.

Even after being defeated by a majority led by Governor Roberto Campos Neto, the explicit position of the new board members sparked fears that the institution would inevitably become more lenient with inflation once Lula appointed a new governor and a majority of its directors by the end of the year.

Right after the negative market reaction that followed the episode — which sent the real tumbling as much as 1.7% on the after the decision — Galipolo started working for consensus, saying he had also considered voting for a smaller cut. In June, policymakers unanimously decided to call off the easing cycle as the weaker currency and still robust economic growth fueled price increases and inflation expectations.

Unafraid of Blood

In August, still trying to shake off the perception of being dovish, Galipolo likened a central banker who fears rate hikes to a medical student who’s scared of blood. But what finally convinced economists that he is serious about tightening monetary policy was his assertion that policymakers are “uncomfortable” with the bank’s own models showing future inflation “clearly” above target.

The monetary authority forecasts annual inflation at 3.2% in the first quarter of 2026, above the 3% goal. While policymakers have usually minimized that difference, saying estimates were “around target,” Galipolo has recently taken a harsher approach.

In several speeches last month, he has made it clear that the bank’s tolerance range of inflation — plus or minus 1.5 percentage points — is “in no way” meant to allow policymakers to try less hard. Many analysts took his comments as an acknowledgment by the central bank that just holding rates steady won’t be enough to tame prices.

“Galipolo is much more of a hawk now than a few months ago,” said Mirella Hirakawa, research coordinator at Buysidebrazil, an economic consultancy based in Sao Paulo. “There’s been a learning curve in his communication, with a very relevant watershed moment after May’s split vote.”

In private, some economists wonder if Galipolo’s stance will morph once again, or if he will succumb to calls for easing while in charge of the monetary authority. Lula could redouble pressure on his chosen governor as tighter monetary policy delivers a bigger blow to the economy.

While Galipolo has said he doesn’t like being labeled, his change of tone has sparked social media memes showing him as the new hawk on the board, eyed with envy by fellow director Diogo Guillen, who has often favored higher rates, and even Campos Neto.

‘Credibility Is Costly’

Leadership transitions at central banks across the world tend to lead to tighter monetary policy, according to a 2017 research paper authored by former Economic Policy Director Carlos Viana, among others. Although that’s not the only way to achieve credibility, a hawkish stance can be beneficial for a new central bank chief by making inflation expectations fall.

While bets on higher borrowing costs have been completely priced in, inflation expectations remain above target through 2027, a sobering reality that signal many investors remain skeptical that he will be able to fulfill the bank’s mandate.

Brazil’s government now expects economic growth above 3% this year, and Lula is forging ahead with plans to bolster consumption by raising public spending. The government has already backed off its pledge of reaching a primary fiscal surplus next year, opting instead for a balanced budget.

Investors will be all-ears when Galipolo presents his testimony before the Senate on Oct. 8. Traders and some economists already see borrowing costs north of 12% by early next year.

“Earning credibility is costly, and Galipolo is in that process,” said Hirakawa, from Buysidebrazil. “He has to prove that he will be guided by the bank’s mission, which is to tame inflation, and not by a development agenda.”

–With assistance from Martha Beck.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66e97855504b40a3a29017050198ad0f&url=https%3A%2F%2Fwww.yahoo.com%2Fnews%2Fbrazil-braces-hawkish-central-bank-113000767.html&c=1387334062348294678&mkt=en-us

Author :

Publish date : 2024-09-17 00:30:00

Copyright for syndicated content belongs to the linked Source.