(Bloomberg) — A court decision in the Amazon rainforest city of Sinop that shielded a corn and soybean producer’s land from seizure by creditors is reverberating through Faria Lima Avenue, the Brazilian equivalent to Wall Street.

Most Read from Bloomberg

The ruling is raising concerns among lenders that it may be harder than anticipated to take control of acreage pledged as backing for agribusiness receivables certificates, or CRAs, a class of relatively new fixed-income securities used to finance grain and oilseed growers. As bountiful harvests and anemic crop prices drive a surge in Brazilian farm defaults, creditors are facing the prospect of costly, drawn-out legal fights to take possession of the collateral.

The impact could be significant. As recently as July 31, Brazilian investors held roughly 145 billion reais ($24 billion) in CRAs, according to data provider Uqbar. The notes often offer farmers better terms than traditional bank loans, while retail investors covet their tax-exempt status. CRAs are typically backed by real estate and other assets in a structure that allows creditors to hold ownership of collateral until the debt is fully repaid.

However, that assumption was turned on its head when a Sinop court denied demands from creditors that corn and soybean grower Agropecuaria Tres Irmaos Bergamasco Ltda. surrender real estate pledged as backing for 36 million reais in CRAs. The company successfully argued that because the land is essential to its recovery efforts, it should be shielded from seizure for the duration of bankruptcy protection.

The initial 180-day period of bankruptcy protection has since expired, prompting creditors including funds managed by Galapagos Capital and SFI Investimentos to put the land up for auction. But Tres Irmaos still has the option of petitioning the court for another six months of protection, which could block any sale.

Other cash-strapped farming companies including North Agro Agropecuaria Ltda. are pursuing the same strategy. Neither Tres Irmaos nor North Agro replied to requests for comment.

“If it will take more time for creditors to seize land than what was expected and if they will have more legal costs to deal with, they will include those additional costs in the price of credit,” said Alfredo Marrucho, head of research at Uqbar, a consultancy that specializes in securitization data. “They will also seek in the future to use other types of collateral that are more easy to access.”

Story continues

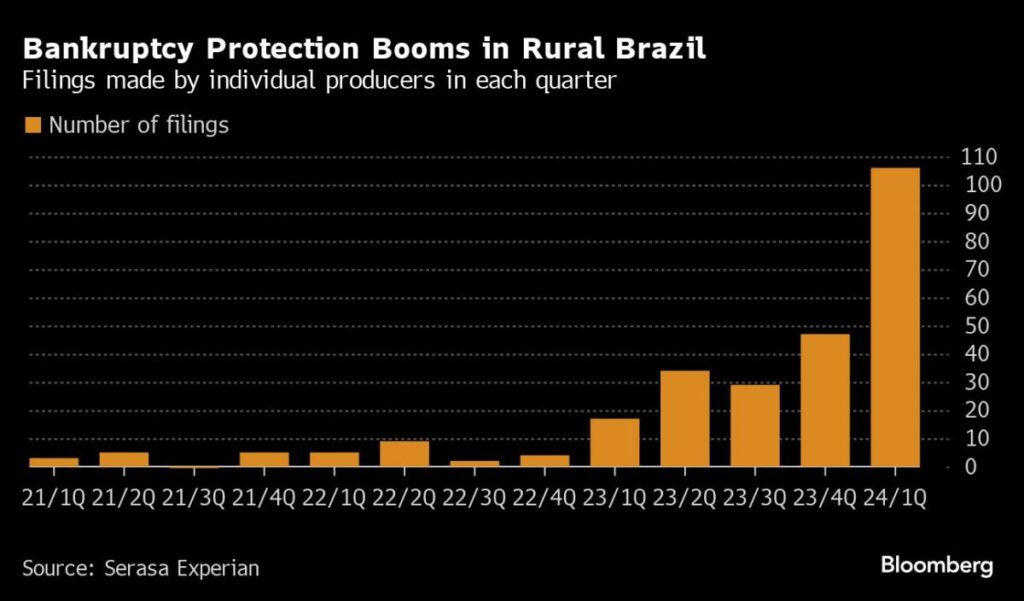

More than 100 individual rural producers sought bankruptcy protection during the first quarter, more than double the final three months of 2023 and a sixfold increase from a year earlier, according to Serasa Experian.

Even more are on the way as “climatic factors” and robust harvests in Argentina and the US harry Brazilian growers, said Allison Sousa, an attorney and restructuring specialist at ERS Consultoria & Advocacia.

Those failures have battered CRA investors. Galapagos Recebiveis do Agronegocio and SFI Investimentos do Agronegocio have fallen 35% and 69%, respectively, in the past year, according to data compiled by Bloomberg. Galapagos declined to comment for this story. SFI didn’t immediately respond to an inquiry.

Before the advent of CRAs late in the last decade, the Brazilian agricultural sector traditionally borrowed from banks, which were more accustomed to renegotiating loans and extending maturities. Farmers also were funded by traders and crop-input companies through barter transactions. Those bankers, traders and seed companies rarely seized collateral.

But because accounting rules require CRAs to be marked to market on a daily basis, any hiccups in repayment can trigger immediate paper losses, panicking holders of publicly traded funds.

“Events like that are important for the market to gain maturity and adjust,” said Daniela Gamboa, head of credit at SulAmerica Investimentos, the fund management arm of one of Brazil’s biggest insurance companies. The CRA market still has room to grow “where the industry is so important for the economy.”

–With assistance from Clarice Couto.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66cc93bbea6041f99290d0d38919750e&url=https%3A%2F%2Ffinance.yahoo.com%2Fnews%2Fcreditors-struggle-seize-land-brazil-140000659.html&c=9011656979087383130&mkt=en-us

Author :

Publish date : 2024-08-26 03:01:00

Copyright for syndicated content belongs to the linked Source.