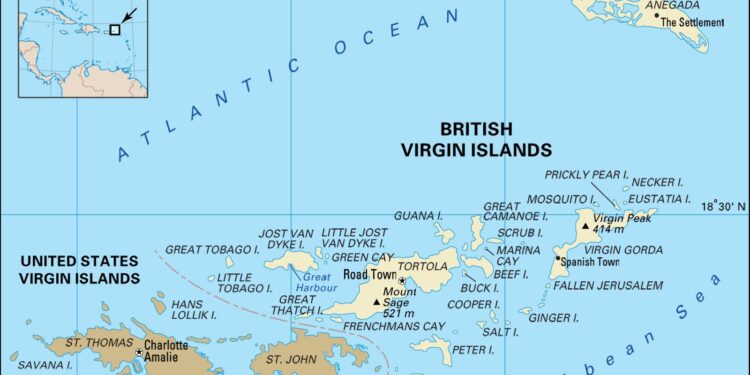

Chinese Firm Granted Asset Seizure Rights in Nigeria by British Virgin Islands Court

In a pivotal legal growth, the High Court of the British Virgin Islands has authorized a Chinese corporation to confiscate assets valued at $25 million from a Nigerian entity. This ruling highlights the intricate nature of global financial disputes and emphasizes the increasing scrutiny surrounding international asset management. As this case progresses, it prompts critical discussions regarding its effects on foreign investments in Nigeria and the enforcement of international court decisions. Both financial and legal professionals are observing this situation closely, as it may establish a benchmark for future cases.

Court Decision Opens Doors for Chinese Firm to Seize Assets in Nigeria

The recent verdict from the British Virgin Islands court empowers a Chinese company with the right to seize $25 million worth of assets situated in Nigeria. This groundbreaking decision sheds light on the challenges associated with international finance and enforcing foreign judicial rulings. Several key elements influenced this ruling:

- Jurisdictional Power: The court affirmed its jurisdiction over these assets based on prior agreements established between both parties involved.

- Legal Precedent: This ruling could set an critically important precedent for future claims made by foreign entities aiming to enforce judgments internationally.

- Asset Recovery Protocols: The court delineated specific steps that must be followed by the Chinese firm to carry out asset seizure within Nigerian territory.

The ramifications of this decision extend beyond just those directly involved; they may considerably influence international business transactions concerning Nigerian assets. Stakeholders within finance and investment sectors should recognize how this ruling could reshape asset protection strategies and recovery processes.A thorough evaluation of relevant financial details is essential,as demonstrated below:

| Type of Asset | Estimated Worth ($) | Status Update | |

|---|---|---|---|

| Real Estate Holdings | $15,000,000 | Pursuing Seizure Process | |

| Savings Accounts | $7,500,000 | Status Under Review | |

| Securities Investments | $2,500,000 | Status Frozen |

Impact of Ruling on Global Business Relations and Legal Frameworks

This recent judgment from the British Virgin Islands court favoring a Chinese firm’s claim over $25 million in Nigerian assets carries considerable implications for global business relations. It has potential repercussions that might affect how foreign investors interact with national jurisdictions—possibly creating an habitat where similar claims become more commonplace. As businesses increasingly operate across borders, recognizing such judgments underscores how local laws intersect with international commercial agreements—resulting in complex compliance requirements and legal considerations.

This situation also raises significant concerns aboutsafeguarding sovereignty and investment security </strongfor nations engaged in global trade activities. Countries may feel compelled to enhance their legal frameworks to shield local resources from being seized under foreign jurisdictions effectively. Important considerations include:

- Aiming for stronger bilateral investment treaties that ensure reciprocal legal protections.

- Fostering arbitration systems prioritizing local jurisdiction during disputes.

- Encouraging transparency along with equitable practices withininternational contracts .

This landmark ruling may prompt governments worldwide to reevaluate their diplomatic stances alongside economic policies aimed at protecting against rising trends related to cross-border asset seizures while promoting stability conducive towards attracting foreign investments.

Strategic Actions for Nigeria To Protect Assets From Foreign Seizures

Nigeria must adopt an integrated approach focused on safeguarding national resources against external claims through various strategic actions including:

- Tightening Legal Structures: Establishing robust laws designed specifically aimed at protecting domestic properties including provisions ensuring sovereign immunity limiting outside interference.

- Engaging Diplomatically : Actively collaborating with global stakeholders establishing pathways facilitating dispute resolution prioritizing interests unique towards Nigerians .

- Creating Asset Protection Strategies : Formulating trust arrangements foundations securing vital resources shielding them away from external creditors.

- Building Judicial Partnerships : Working alongside other nations developing mutual assistance treaties addressing issues surrounding enforcement protection measures .

A comprehensive review assessingexisting holdings  and identifying vulnerabilities is crucial moving forward . Government authorities should consider :

Type Of Asset  Current Risk Exposure   Recommended Measures   Naturally Occurring Resources   Implement protective legislation Diverse Foreign Investments  Review current contracts Civic Contracts  Conduct regular evaluations audits

Conclusion: Navigating New Legal Landscapes Amidst International Challenges

The recent verdict allowing a Chinese corporation access rights over $25 million worth Nigerian properties signifies notable shifts occurring within realms involving both commerce law globally today . Such developments reveal complexities inherent when dealing cross-border recoveries especially amidst evolving market conditions impacting stakeholders across regions alike navigating consequences stemming forth thereafter will require careful consideration among experts analyzing potential outcomes shaping future engagements strategies accordingly .

ADVERTISEMENT - Creating Asset Protection Strategies : Formulating trust arrangements foundations securing vital resources shielding them away from external creditors.