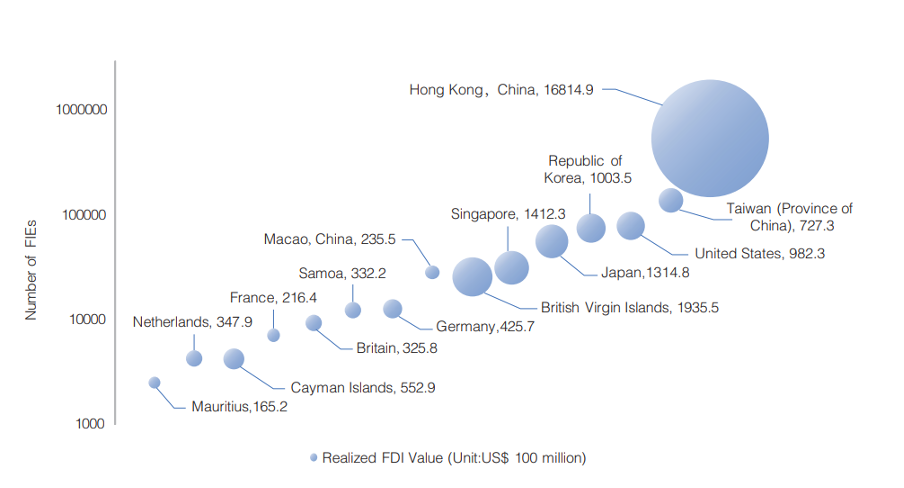

In terms of specific countries or regions, Hong Kong┬аmaintain its position as the top source of FDI in both 2022 and 2023, reflecting its ongoing significance in the investment ecosystem.

The┬аBritish Virgin Islands┬аemerged as a rising star, moving up one spot to second place, which indicates a strengthening role in financial inflows. Similarly,┬аJapan┬аclimbed two positions to third, showcasing an increased interest in investing in China. These shifts highlight the growing confidence of these regions in the Chinese market.

Conversely, some contributors experienced declines.┬аSingapore┬аdropped three positions to fifth, suggesting a decrease in its relative investment activity, while┬аGermany┬аfell four spots to 11th, indicating a significant reduction in its investment contributions. Additionally,┬аMacao┬аsaw a notable decline, dropping four positions to 15th, which may reflect changing investment dynamics in the region.

Mixed trends were evident among other countries as well. The┬аUnited Kingdom┬аand┬аUnited Arab Emirates┬аimproved their rankings, reflecting a resurgence in their investment activities, while the┬аUnited States┬аexperienced a slight decline, which may be influenced by broader geopolitical factors.

Top 15 FDI Sources of China as of 2023

Source: ChinaтАЩs Ministry of Commerce FDI Statistics 2024

Top FDI destinations within China

In 2023, ChinaтАЩs FDI was heavily concentrated in the eastern region, which accounted for 87.6 percent of new FIEs and 87.1 percent of actual utilized foreign capital. This concentration reflects the regionтАЩs economic advantages, including advanced infrastructure, established industrial bases, and proximity to major international markets.

The eastern provinces, particularly economic powerhouses like Guangdong, Shanghai, and Zhejiang, benefit from better access to resources, skilled labor, and government support, making them attractive to foreign investors.

In contrast, the central and western regions accounted for a smaller share of FDI, with 5.6 percent and 6.8 percent of new enterprises, respectively. The central regionтАЩs developing infrastructure and growing industries are starting to draw more attention, while the western region, despite its rich natural resources and potential for growth, still faces challenges such as less developed infrastructure and fewer direct links to global markets.

FDI Flows to Eastern, Central and Western Parts of China in 2023

Region

Number of new FIEs

Share (%)

Realized FDI value (US$100 million)

Share (%)

Total

53,766

100.0

1,632.5

100.0

Eastern

47,089

87.6

1,422.4

87.1

Central

3,019

5.6

103.7

6.4

Western

3,658

6.8

106.4

6.5

Source: ChinaтАЩs Ministry of Commerce FDI Statistics 2024

Eastern part: Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, Hainan.

Central part: Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, Hunan.

Western part: Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Xizang, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang.

Province-by-province breakdown

In 2023, the top 10 provinces in China attracting FDI were Guangdong, Shanghai, Jiangsu, Zhejiang, Shandong, Beijing, Fujian, Sichuan, Hainan, and Tianjin. Together, these provinces accounted for 87.4 percent of all new FIEs and 86.2 percent of the actual utilized foreign capital.

Guangdong led the charge, hosting the highest number of new enterprises due to its well-established industrial base, strategic location near Hong Kong, and its role as a key hub in global supply chains. Shanghai and Jiangsu also attracted significant FDI, driven by their advanced infrastructure, vibrant economic zones, and business-friendly policies.

Zhejiang, Shandong, and Beijing further highlight the importance of economic diversity and regional strengths. Zhejiang, with its strong manufacturing and export-oriented economy, and Shandong, known for its heavy industries and agriculture, provided unique opportunities for foreign investors.

Beijing, as the political and cultural capital, offered advantages in sectors like technology, finance, and professional services.

FDI in ChinaтАЩs super city clusters

The┬аYangtze River Economic Belt┬аwas the leading performer, contributing┬а34 percent┬аof new FIEs and a substantial┬а50.9 percent┬аof the realized FDI value. This region includes major cities like Shanghai, Wuhan, and Nanjing, characterized by a dynamic economy and extensive transportation networks. The Yangtze River serves as a crucial trade artery, facilitating the movement of goods and services. Its focus on innovation, manufacturing, and logistics has made it a magnet for foreign investors looking to access ChinaтАЩs vast market.

The┬аBeijing-Tianjin-Hebei┬аregion accounted for┬а5.3 percent┬аof newly established FIEs and┬а13 percent┬аof the realized FDI value. This region is notable for its strong economic infrastructure and proximity to Beijing, the capital of China. The presence of many multinational corporations and a skilled workforce make it an attractive destination for foreign investment, particularly in technology, finance, and services.

The┬аNortheast region┬аaccounted for┬а1.8 percent┬аof new FIEs and┬а2.6 percent┬аof the realized FDI value. Historically known as ChinaтАЩs industrial heartland, this region includes Heilongjiang, Jilin, and Liaoning. Although it has faced economic challenges in recent years, efforts are underway to revitalize its industries and attract new investments. The government is focusing on modernizing infrastructure and promoting high-tech industries to enhance the regionтАЩs competitiveness and appeal to foreign investors.

FDI distribution by industries and sectors

By industry

In 2023, FDI in China demonstrated a strong sectoral concentration, with the tertiary industry dominating the landscape. Newly established FIEs in the tertiary sector accounted for a remarkable 90.3 percent of the total, while the secondary and primary industries contributed 9.1 percent and 0.6 percent, respectively.

This pattern was mirrored in actual FDI utilization, with the tertiary industry attracting 64.4 percent of the total FDI, the secondary industry 35.2 percent, and the primary industry a mere 0.4 percent.

This distribution highlights the increasing importance of service-oriented industries in ChinaтАЩs economic evolution.

FDI by Industry in 2023

Industry

Number of new FIEs

Share (%)

Realized FDI value (US$100 million)

Share (%)

Total

53,766

100.0

1,632.5

100.0

Primary Industry

319

0.6

6.7

0.4

Secondary Industry

4,879

9.1

575.2

35.2

Tertiary Industry

48,568

90.3

1,050.7

64.4

Source: ChinaтАЩs Ministry of Commerce FDI Statistics 2024

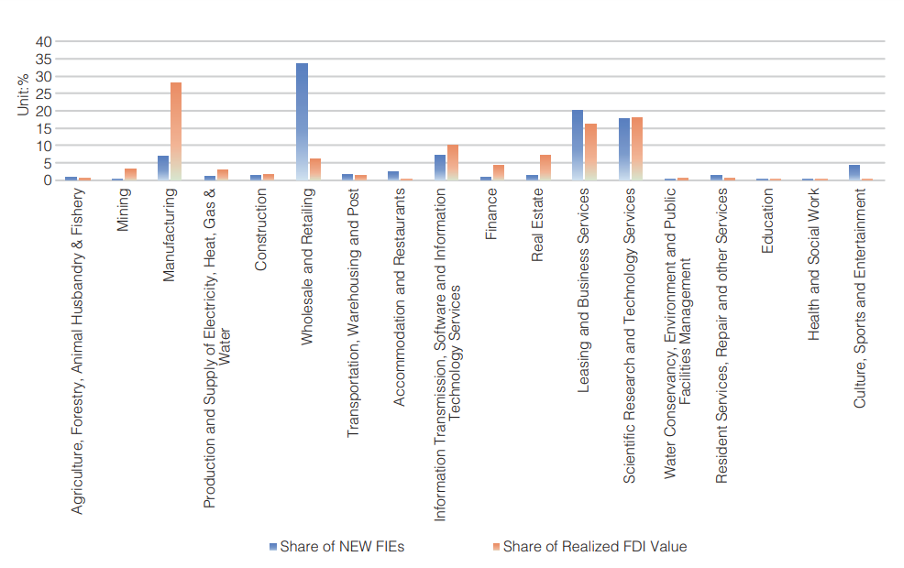

By sector

Key sectors attracting FDI in 2023 included:

Manufacturing;

Leasing and business services;

Scientific research and technology services;

Information transmission;

Software and IT services;

Wholesale and retail;

Real estate; and

Finance

Notably, high-tech industries were a major focus, with 13,758 new FIEs and realized FDI value of US$61 million in this sector. Among them, high-tech services alone drew US$42.9 million, underscoring ChinaтАЩs strategic emphasis on innovation-driven growth and the transition from traditional manufacturing to high-value services.

Indeed, the focus on high-tech industries reflects ChinaтАЩs push for high-quality industrial development. High-tech manufacturing attracted US$181 billion, emphasizing the countryтАЩs drive towards advanced sectors like pharmaceuticals, electronic information, and automotive manufacturing.

Simultaneously, there was a notable surge in productive service industries, including financial services and R&D, aligning with ChinaтАЩs broader goals of modernizing its economy and fostering sustainable, innovation-led growth.

This trend is reinforced by policies under the 14th Five-Year Plan, which aim to open up sectors like telecommunications and culture, paving the way for a more service-oriented economy.

FDI by Sectors in 2023

Source: ChinaтАЩs Ministry of Commerce FDI Statistics 2024

Top 5 Sectors with Largest FDI from Key Investing Partners

┬а

ASEAN

EU

BRI Partner Countries

BRICS

Top 5 sectors

Manufacturing

Leasing and Business Services

Real Estate

Scientific Research and Technical Services

Wholesale and Retailing

Manufacturing

Scientific Research and Technology Services

Leasing and Business Services

Mining

Finance

Manufacturing

Leasing and Business Services

Scientific Research and Technical Services

Real Estate

Wholesale and Retailing

Manufacturing

Wholesale and Retailing

Scientific Research and Technical Services

Transportation, Warehousing and Postal Services

Leasing and Business Services

Share of the regionтАЩs New FIEs in China (%)

80.8

53.4

86.9

90.5

┬а

Share of the regionтАЩs realized FDI in China (%)

80.4

95.2

86.7

┬а

99.1

Source: ChinaтАЩs Ministry of Commerce FDI Statistics 2024

ChinaтАЩs FDI trends and outlook in 2024

According to recent statistics from the Ministry of Commerce, China attracted a total of RMB 640.6 billion in foreign investment from January to September 2024, despite a year-on-year decrease of 30.4 percent in actual capital utilization. During this period, the country established 42,108 new foreign-invested enterprises, reflecting an 11.4 percent increase compared to the previous year. This growth in new enterprises suggests a continued interest among foreign investors in entering the Chinese market.

Find Business Support

When breaking down foreign investment by industry, the service sector emerged as the most significant recipient, utilizing RMB 446.13 billion (US$62.78 billion), while the manufacturing sector attracted US$179.24 billion (US$25.22 billion). Notably, high-tech manufacturing showed resilience, with foreign capital usage reaching RMB 77.12 (US$10.82 billion), accounting for 12 percent of the national totalтАФa 1.5 percentage point increase from the same period in the previous year.

Specific industries within the manufacturing sector demonstrated remarkable growth in foreign capital utilization. The medical equipment and instrument manufacturing industry saw an impressive 57.3 percent increase, while the professional technical services and computer and office equipment manufacturing industries experienced growth rates of 35.3 percent and 29.2 percent, respectively. These trends indicate a strong demand for innovative technologies and specialized services, aligning with ChinaтАЩs goals to advance its technological capabilities and support high-value sectors.

In terms of foreign investment sources, countries such as Germany and Singapore reported significant growth in their investments in China, increasing by 19.3 percent and 11.6 percent, respectively, which includes figures from free port investments. This highlights a favorable shift in the investment landscape as foreign investors continue to seek opportunities in the Chinese market despite the overall decline in total capital utilization.

As China navigates through a complex global economic environment, these developments in FDI reflect a mixed but promising outlook for 2024, characterized by a growing number of foreign enterprises and targeted investments in high-tech and service sectors. This positioning underscores ChinaтАЩs ongoing efforts to attract foreign capital while simultaneously advancing its industrial and technological transformation.

What is China doing to attract more foreign investment?

The Chinese government has taken decisive steps in its policy landscape aimed at fostering a more attractive foreign investment environment and strengthening its regulatory framework. These developments, highlighting the countryтАЩs strategic initiatives to encourage international capital inflow while addressing critical security concerns, include:

Expansion of foreign investment access: ChinaтАЩs State Council has approved the 2024 Negative List for Foreign Investment Access, marking a significant shift in the countryтАЩs approach to foreign investment. Restrictions on foreign ownership in the manufacturing sector have been completely lifted, while access to telecommunications, education, and healthcare services has been further opened. In a strategic move, China has also launched a pilot program allowing 100 percent foreign ownership of data centers and value-added telecom services in major cities like Beijing, Shanghai, Hainan, and Shenzhen, creating new opportunities in the tech sector for multinational companies. This pilot has already attracted interest from over 10 foreign corporations, including Tesla and Apple. Additionally, foreign investment limits are being eased in advanced healthcare fields, permitting foreign ownership in cell and gene therapy as well as wholly foreign-owned hospitals in select cities.

Enhanced foreign investment guidelines: The State Council unveiled a comprehensive set of guidelines designed to improve the overall foreign investment climate. These guidelines focus on creating more favorable conditions for foreign businesses, aiming to attract increased foreign capital and enhance the countryтАЩs economic competitiveness.

Extension of tax incentives: The Ministry of Finance, in collaboration with the State Administration of Taxation, announced the extension of existing tax holidays for foreign investors until the end of 2027. This initiative aims to incentivize long-term commitments from foreign enterprises, demonstrating ChinaтАЩs intention to maintain a welcoming environment for international investments.

Promotion of foreign Investment in R&D: The State Council introduced measures to encourage the establishment of foreign-invested R&D centers. This initiative underscores ChinaтАЩs commitment to fostering innovation and technological advancement, positioning the country as a competitive hub for global research and development activities.

Facilitation of cross-border data flow: China has introduced several regulatory updates to streamline cross-border data transfers and clarify cybersecurity compliance. Key changes include new data export regulations from the cybersecurity regulator, which raise thresholds for personal information volumes before compliance procedures are triggered and provide clearer guidelines for handling тАЬimportantтАЭ data. Specific areas, such as the Tianjin Free Trade Zone and Lingang New Area in Shanghai, have established data тАЬNegative ListsтАЭ and trial data lists to simplify export procedures and reduce regulatory burdens for companies in sectors like automotive, biopharmaceuticals, and mutual funds. Additionally, new rules for companies handling тАЬcoreтАЭ and тАЬimportantтАЭ data in industrial and IT sectors specify the scope and procedures for mandatory data security assessments. Further regulations strengthen data protection requirements, expanding responsibilities for personal information handling, data transfer, and network security across internet platforms. These measures aim to ease cybersecurity compliance while reinforcing data protection standards for businesses.

Relaxing rules on foreign strategic investment in listed companies: On November 4, 2024, China announced revised regulations for foreign strategic investments in publicly listed companies to attract high-quality foreign capital amid economic and geopolitical challenges. Effective December 2, the new rules lower entry barriers by reducing the minimum shareholding threshold for foreign investors from 10 percent to as low as 5 percent and easing eligibility criteria from US$100 million to US$50 million in overseas assets or US$500 million to US$300 million in assets under management. Additionally, the share lock-up period has been reduced from three years to one, enhancing liquidity, and foreign investors can now use tender offers and shares in unlisted overseas companies for strategic investments. These changes reflect ChinaтАЩs commitment to a more open investment environment to drive economic growth and innovation.

Explore vital economic, geographic, and regulatory insights for business investors, managers, or expats to navigate ChinaтАЩs business landscape. Our Online Business Guides offer explainer articles, news, useful tools, and videos from on-the-ground advisors who contribute to the Doing Business in China knowledge.

Start exploring

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China BriefingтАЩs content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at [email protected] or visit our website at www.dezshira.com.

┬а

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=672b84c4468f4e69b9eb44bab0cc36ef&url=https%3A%2F%2Fwww.china-briefing.com%2Fnews%2Fchinas-fdi-trends-2024-key-sources-destinations-and-sectors%2F&c=5027446565743621485&mkt=en-us

Author :

Publish date : 2024-11-06 00:28:00

Copyright for syndicated content belongs to the linked Source.