Good morning. Here’s what happened overnight and what you need to know today.

Get Standup in your inbox

Signed up to Standup

Standup is a free morning newsletter featuring the news that matters from around the world.

Update and view your newsletter preferences in your account.

1.

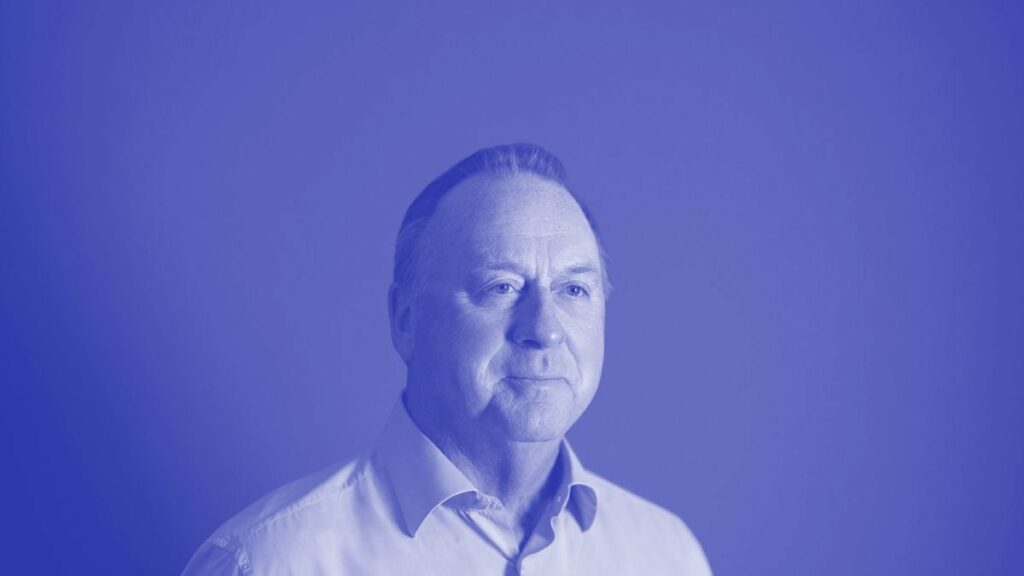

Tax scandal: Chris Ellison, Mineral Resources’ managing director and founder, admitted to involvement in alleged tax evasion involving offshore companies registered in the British Virgin Islands, The Australian Financial Review reported. The admission came after the paper revealed the billionaire had run the scheme for years before self-reporting undeclared revenue totalling millions of dollars to the Australian Taxation Office, on the condition the ATO would cut any penalty payments by 80%. Ellison, one of Australia’s richest people and owner of an 11.5% stake in the $9 billion MinRes, and MinRes chair James McClements on Sunday confirmed the existence of the scheme. Ellison, who repaid the tax owed after self-reporting to the ATO, described his actions as a “serious lapse of judgment”. McClements said the company had hired external lawyers to investigate the matter and advise the board, which he said still had “full confidence” in Ellison’s leadership. (Capital Brief)(AFR)

2.

Crypto options: The US Securities and Exchange Commission (SEC) granted accelerated approval for 11 exchange-traded funds to list and trade options tied to spot bitcoin prices on the New York Stock Exchange. The approval expands investment avenues for institutional traders. The approved funds include Fidelity Wise Origin Bitcoin Fund, ARK21Shares Bitcoin ETF, and iShares Bitcoin Trust ETF, among others. Options allow investors to hedge or amplify their exposure to bitcoin by setting a predetermined price for future transactions. Last month, the SEC also approved BlackRock’s bitcoin ETF for trading on Nasdaq, amid growing institutional acceptance of bitcoin derivatives. (Reuters)

3.

Trader trap: Odin Partners, a recruitment firm operating in London, Singapore and Hong Kong, is accused of using fake IDs to dupe Wall Street traders. Bloomberg reported cold callers from the firm dangled the prospect of jobs at global banks like Goldman Sachs, Morgan Stanley, Deutsche Bank, Nomura and BNP Paribas in exchange for details about their salaries, their teams and their desks’ P&L. Odin staff used fake identities and fabricated job offers to obtain the confidential data, which was then shared with clients, the publication said. Several former Odin staffers reportedly admitted taking part in the practice, called rusing, and said they were instructed by senior managers at the recruitment firm, including co-founder James Hext. Odin denies the allegations. (Bloomberg)

4.

Voter checks: Elon Musk pledged to give away US$1 million ($1.49 million) each day until the November election to a randomly chosen registered voter in Pennsylvania who signs his petition supporting the First and Second Amendments. The initiative, launched by Musk’s America PAC, aims to rally support for Donald Trump in the upcoming presidential election. The first US$1 million was awarded to a man named John Dreher at a Pennsylvania rally. The offer will extend to other swing states in the final weeks leading up to the election. The legality of the move is under scrutiny, as US election law prohibits offering incentives for voting or registering to vote. America PAC, heavily funded by Musk’s US$75 million donation, has faced difficulties meeting its voter registration targets, and critics argue that Musk is using his wealth to buy political influence. (WSJ)(Reuters)

5.

Banking move: ASX-listed fund manager GQG Partners, a top-five shareholder in BBVA, sold its entire stake due to the Spanish bank’s pursuit of a hostile €10 billion ($16.21 billion) bid for Banco Sabadell, the Financial Times reported. GQG believes the Sabadell acquisition will distract from BBVA’s core focus on emerging markets and was too time-consuming. Despite winning support from its shareholders for the deal, BBVA is facing resistance from Sabadell’s board and Spain’s government, which opposes the merger. The deal is still awaiting approval from Spain’s financial and antitrust regulators, with a decision expected in 2025. GQG also has a top-10 position in Germany’s Commerzbank, which is the subject of a potential bid from Italian rival UniCredit. (Financial Times)

6.

Indonesia’s leader: Prabowo Subianto was sworn in as Indonesia’s eighth president, marking his rise from an ex-general accused of rights abuses during Indonesia’s military dictatorship to the nation’s highest office. In an hour-long speech in parliament, the former defence minister vowed to tackle corruption, boost economic growth and achieve food and energy self-sufficiency within five years. The 73-year-old, once self-exiled after being accused of human rights abuses as a general under Suharto, now leads 280 million Indonesians after securing a decisive election win. His vice president, Gibran Rakabuming Raka, the eldest son of outgoing leader Joko Widodo, joined him in a ceremony attended by Australian deputy Prime Minister Richard Marles and dignitaries from China, the US and other nations. (Capital Brief)

7.

Power grip: Labor secured its seventh consecutive term in the ACT election but will again form a minority government after a strong performance by independents. Despite suffering a swing vote of more than 3%, Labor retained ten seats, needing three more for a majority. The Greens picked up at least two seats, while Fiona Carrick and Tom Emerson became the first independents to win in the territory since 2001. Liberal leader Elizabeth Lee conceded defeat by 9:30 pm on Saturday following a challenging campaign, which included controversies such as Lee being filmed giving the middle finger to a local journalist and internal party scandals involving disendorsed MLA Elizabeth Kikkert and controversial social media activity by candidate Darren Roberts. (Capital Brief)

8.

Debt warning: The focus of this week’s annual International Monetary Fund and World Bank meetings in Washington will be on the need for governments to tackle soaring debt levels, which are projected to reach US$100 trillion ($149 trillion) this year, driven by borrowing from the US and China. Finance ministers, central bank governors, and leaders from think tanks and charitable organisations will convene in the US capital to discuss the global economy and its capacity to improve living standards. A barrage of projections and studies are expected to be released, including the IMF’s Fiscal Monitor on Wednesday. Several central banks are also expected to make key interest rate decisions during the week, including Canada, Russia, Hungary and Uzbekistan. (Bloomberg)

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=6715ee9a75cb446594f9b3f4bb05fff5&url=https%3A%2F%2Fwww.capitalbrief.com%2Fnewsletter%2Fminres-boss-chris-ellison-admits-tax-evasion-0534b993-c026-4af4-b921-8457b58bce19%2F&c=10908535165954011350&mkt=en-us

Author :

Publish date : 2024-10-20 08:12:00

Copyright for syndicated content belongs to the linked Source.