Breadcrumb Trail Links

News

Canada falling behind Mexico as America’s No. 1 partner

Published Jul 15, 2024 • Last updated 33 minutes ago • 5 minute read

You can save this article by registering for free here. Or sign-in if you have an account.

The Ambassador Bridge at the Canada-USA border crossing in Windsor, Ont. One quarter of the value of merchandise that passes between the United States and Canada crosses this bridge. Photo by Rob Gurdebeke /The Canadian PressArticle content

The Ambassador Bridge at the Canada-USA border crossing in Windsor, Ont. One quarter of the value of merchandise that passes between the United States and Canada crosses this bridge. Photo by Rob Gurdebeke /The Canadian PressArticle content

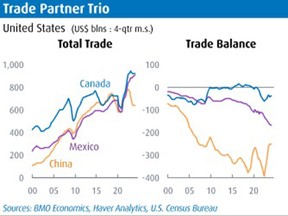

Canada and the United States have traditionally enjoyed the largest trading partnership in the world, but these days that relationship is being tested, says a new report from BMO Capital Markets.

After the disruptions of the pandemic, globalization took a back seat to “reshoring, near-shoring and friend-shoring” as countries, particularly the United States, looked to lock down supply chains.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors.Sign In or Create an Account

or

Article content

Both Canada and Mexico have benefitted from this trend, but mostly Mexico, say BMO economists Michael Gregory and Shelly Kaushik.

Trade between Canada and the United States totalled $920 billion in the year ending in the first quarter of 2024, or an average of $2.5 billion in trade crossing the border every day.

Two-way trade between the United States and Mexico totalled $905 billion, and is on track to surpass Canada sometime this year, they said.

BMO Capital Markets

BMO Capital Markets

This isn’t the first time.

According to U.S. Census Bureau data, two-way trade between Mexico and the U.S. hit a record high of $5.3 trillion in 2022, as the southern country usurped Canada as America’s top trading partner.

The United States’ trade deficit with Mexico, the amount by which imports exceeds the value of exports, is also much larger than with Canada.

Mexico’s $167 billion deficit compared to Canada’s $38 billion “is the largest it has ever been (partly mirroring a shrinking trade shortfall with China, which is raising eyebrows in Washington,” said the report.

Trade between Canada and the United States in goods was almost $780 billion in this past year, with services at about $140 billion. That’s a goods trade deficit of about $70 billion and a services trade surplus of $32 billion.

Posthaste

Thanks for signing up!

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

But goods trade is “very lopsided” when viewed by sector, say the economists.

America has a $92 billion trade deficit in the oil and gas sector with Canada, its largest source of petroleum and crude oil imports.

But since 2008 the United States has run a manufacturing surplus with Canada, amounting to $35 billion in the past year.

If you take oil and gas out of the picture, the U.S. has a $30 billion goods trade surplus with Canada.

Trade disputes are also brewing. The USMCA, the trade agreement between the United States, Canada and Mexico, is up for review in 2026, and at a meeting earlier this year U.S. officials raised three concerns, says the report.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

The list doesn’t end there. Other trade “irritants” between Canada and the U.S. highlighted by the economists include:

The Online streaming Act, which gives power to the Canadian Radio-Television and Telecommunications Commission (CRTC) to order large online streaming services to contribute 5 per cent of revenues to funds that promote Canadians productions. This has been challenged in court by the Motion Picture Association Canada on behalf of Netflix, Walt Disney, Warner Bros Discovery and Paramount Global. Members of Congress have also petitioned for an investigation.The Online News Act, which aims to ensure digital platforms compensate news media for their content.Rules of origin in the auto industry: the criteria used to determine whether a good has undergone sufficient production in the USMCA region to be eligible for preferential tariff treatment.

“Despite total trade with Canada resulting in an overall U.S. surplus outside of the oil and gas sector, with U.S. elections approaching and 2026’s review of the USMCA on the docket for the next Administration and Congress (regardless of who, or which party, wins), the above U.S.-Canada trade irritants and others simmering on the backburner could become increasingly problematic,” said the economists.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Sign up here to get Posthaste delivered straight to your inbox.

Financial Post

Financial Post

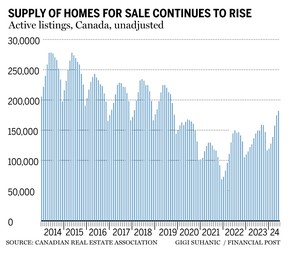

The spring housing market fizzled out so badly the Canadian Real Estate Association has slashed its forecast for the year. CREA said Friday that it now expects home sales to rise 6 per cent in 2024, down from an earlier forecast of 10.5 per cent. Its price forecast went from an almost 5 per cent gain to 2.5 per cent.

The diminished forecast comes amid a rising supply of homes on the market.

New listings were up again in June, the latest increase in five of the six past months.

“In some markets, the outstanding inventory of homes for sale has rarely been higher and, while location/type matter a lot, it’s fair to say that a gradual building of resale inventory continues,” said Robert Kavcic, senior economist at BMO Capital Markets.

“The months’ supply of homes for sale sat at 4.2 in June, or just off the highest in four years.”

Bank of Canada releases its Business Outlook Survey and Canadian Survey of Consumer Expectations2024 Summer Meeting of Canada’s Premiers, hosted by Nova Scotia Premier Tim Houston.Today’s Data: Canada manufacturing sales for MayEarnings: BlackRock Inc, Goldman Sachs Group Inc, PrairieSky Royalty Ltd., Corus Entertainment Inc.

Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Article content

Financial Post

Financial Post

Recommended from Editorial

How Alberta is on track to become a nation-beater again

The world’s really rich are getting richer again

Mutual funds are comparatively expensive and often don’t make up for it with better returns. That’s why portfolio manager John De Goey is calling “bullshift” on the industry, and offers three questions every investor should ask their investment managers when they try to offer mutual funds to you. Get the answers

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line with your contact info and the gist of your problem and we’ll try to find some experts to help you out, while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers, led by Julie Cazzin, can give it a shot.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Share this article in your social network

Source link : https://financialpost.com/news/canada-falling-behind-mexico-us-top-trading-partner

Author :

Publish date : 2024-07-15 08:00:06

Copyright for syndicated content belongs to the linked Source.