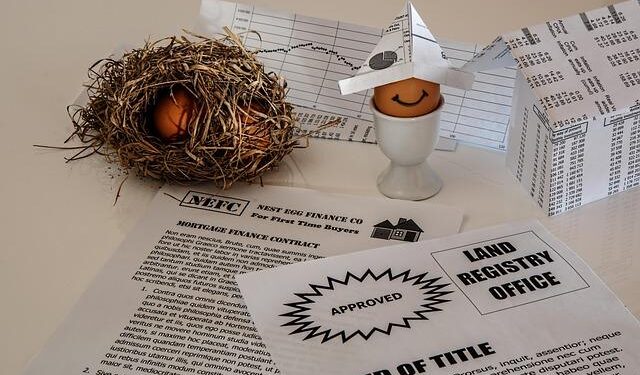

In a significant shift that could impact homebuyers and borrowers across the region, local mortgage and loan rates have seen a notable decline following the recent decision by the U.S. Federal Reserve to cut interest rates. This unexpected development offers a glimmer of optimism for prospective homebuyers in the Cayman Islands, as lower borrowing costs may boost housing demand and stimulate economic activity. Experts suggest that this rate reduction may not only ease financial burdens for consumers but also influence the dynamics of the local real estate market and lending landscape. As financial institutions adjust their offerings in response to the Fed’s move, stakeholders are closely monitoring the potential implications for future lending and investment strategies.

Impact of Federal Rate Cut on Local Mortgage and Loan Market Dynamics

The recent federal rate cut has sent ripples through the local mortgage and loan markets, leading to a notable decline in borrowing costs for consumers and businesses alike. As lenders adjust their rates in response to the central bank’s decision, potential homebuyers and those seeking personal loans can benefit from reduced interest rates. This change is significant as it can enhance housing affordability, stimulate demand in the real estate market, and encourage spending in other sectors influenced by personal loans.

Key effects observed in the local market include:

- Lower Mortgage Rates: Average mortgage rates are expected to decrease, making homeownership more accessible.

- Increased Loan Applications: Lenders report a surge in inquiries as consumers rush to capitalize on favorable rates.

- Refinancing Boom: Existing homeowners are likely to refinance their mortgages, benefiting from lower monthly payments.

- Market Competition: Local lenders may offer promotional rates or reduced fees to attract borrowers.

| Type of Loan | Old Rate | New Rate | Change |

|---|---|---|---|

| 30-Year Fixed Mortgage | 4.5% | 4.0% | -0.5% |

| Personal Loan | 10.0% | 9.5% | -0.5% |

| Home Equity Loan | 7.0% | 6.5% | -0.5% |

Understanding the Benefits of Lower Borrowing Costs for Homebuyers and Investors

The recent decrease in mortgage and loan rates, following the US Federal Reserve’s decision to cut rates, has opened up new opportunities for potential homebuyers and investors alike. Lower borrowing costs mean that buyers can potentially secure loans at more favorable terms, making homeownership more accessible than it has been in years. This shift is particularly beneficial for first-time buyers, who may have felt the pinch of rising interest rates in the past. Now, with reduced monthly payments, these individuals can enjoy improved cash flow, allowing them to allocate funds toward other essential expenses or investments.

For seasoned investors, lower borrowing costs can greatly enhance return on investment (ROI) strategies. By capitalizing on lower interest rates, investors can finance properties at a fraction of the cost, thus increasing their profit margins. They may also consider leveraging their savings on mortgage payments to expand their portfolios or invest in renovation projects that can boost property value. Key advantages include:

- Increased Purchasing Power: Access to larger loans or more favorable terms.

- Enhanced Cash Flow: Reduced monthly payments that can support other investments.

- Opportunity for Growth: Ability to invest in additional properties or renovations.

This environment not only supports prospective buyers in the market but also stimulates economic activity as housing demand rises, ultimately contributing to a robust real estate market.

Strategic Recommendations for Securing Favorable Loan Terms in a Changing Financial Landscape

As the landscape of borrowing evolves with recently lowered mortgage and loan rates, it is crucial for prospective borrowers to adopt a proactive approach. Financial institutions are now competing for customers, creating opportunities to secure more favorable terms. Key strategies include:

- Researching Multiple Lenders: Compare various mortgage products and lenders to identify the best rate available.

- Enhancing Credit Profiles: Improve credit scores through timely payments and reducing debt-to-income ratios to qualify for lower interest rates.

- Considering Fixed Rates: Locking in fixed-rate loans may offer more stability as market conditions fluctuate.

Furthermore, leveraging local market insights and expert advice can provide an added edge. Understanding the nuances of the regional financial environment and staying attuned to shifts in lending criteria will strengthen negotiating power. Advisors suggest:

- Utilizing Pre-Approval: Gaining pre-approval not only boosts confidence but also showcases the borrower’s seriousness to lenders.

- Engaging Local Experts: Consult mortgage brokers familiar with the local landscape for customized guidance.

- Monitoring Economic Indicators: Keep an eye on trends that can affect rates, such as employment statistics and inflation, to anticipate future borrowing conditions.

Final Thoughts

In summary, the recent decision by the U.S. Federal Reserve to lower interest rates has sparked a notable shift in the local mortgage and loan landscape, resulting in more favorable conditions for borrowers across the Cayman Islands. With rates decreasing, prospective homeowners and those seeking loans may find this an opportune moment to explore their financing options. As the market continues to respond to the broader economic changes, local residents are encouraged to consult with financial experts to navigate this evolving environment. As always, staying informed is crucial in making sound financial decisions that align with individual goals and circumstances. For further updates on mortgage trends and financial strategies, stay connected with Cayman Compass.