(Bloomberg) — Chile’s central bank said its interest rate can fall toward a neutral level given lower risks to inflation, according to the minutes of its most recent policy decision.

Most Read from Bloomberg

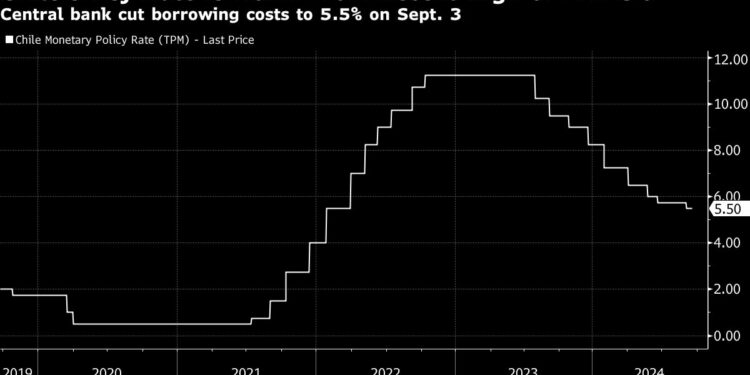

Board members weighed a reduction of either 50 or 25 basis points this month, they wrote in the minutes to their Sept. 3 decision, when they lowered borrowing costs by a quarter-point to 5.5%. That drop was coherent with their outlook and also future cuts, policymakers wrote in the document published Monday.

Recent data showed “lower demand was being counterbalanced by the pressure on prices from energy costs, among other factors,” they said. “This, together with inflation expectations aligned with the 3% target, reduced the risks of greater inflationary persistence in the medium term.”

Central bankers led by Rosanna Costa are guiding Chile through a near-term inflation shock as well as a choppy economy. Electricity tariffs are undergoing a series of increases that will keep consumer prices pressured into early next year. Still, the monetary authority is cutting borrowing costs to provide more support to uneven domestic demand and a weak labor market.

This month, Chile’s central bank indicated that it sees the neutral rate, which neither stimulates nor restricts the economy, in a range between 3.5% and 4.5%.

Annual inflation ticked up to 4.7% in August, the fastest pace in nearly a year and well above the 3% target, according to the national statistics agency.

Analysts surveyed by the central bank in September forecast policymakers will deliver a quarter-point rate cut at both their October and December meetings.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66f1965e45f64bd3aa3e0e92401d8dc2&url=https%3A%2F%2Fwww.yahoo.com%2Fnews%2Fchile-central-bank-sees-interest-125920168.html&c=780536090768822771&mkt=en-us

Author :

Publish date : 2024-09-23 01:59:00

Copyright for syndicated content belongs to the linked Source.