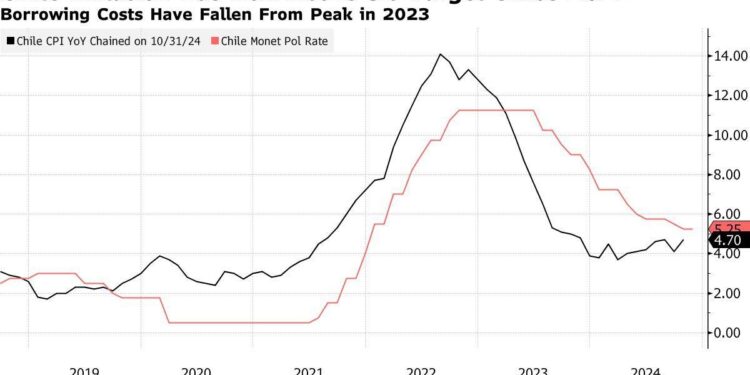

Chile’s economy is facing increasing uncertainty as inflation figures have surged beyond analysts’ expectations, casting doubt on the projected trajectory for interest rate cuts. In a report released by Reuters, data indicates that the consumer price index has risen sharply, highlighting persistent price pressures that could complicate the Chilean central bank’s monetary policy plans. As inflation remains elevated, key stakeholders-including policymakers, investors, and consumers-are grappling with potential implications for economic growth and financial stability. The unexpected inflation overshoot raises critical questions about the central bank’s ability to lower rates in a bid to stimulate the economy while managing inflationary risks effectively. This article delves into the implications of the latest inflation data and its potential impact on Chile’s monetary policy landscape.

Chile’s Inflation Surge Defies Forecasts, Prompting Economic Uncertainty

Chile’s recent inflation figures have taken a surprising turn, significantly exceeding the expectations of economists and analysts alike. In light of this trend, the Consumer Price Index (CPI) showed an annual increase that has raised alarms about the central bank’s capacity to enact further interest rate cuts. With inflation now at a level not seen in recent memory, the outlook for Chile’s economic stability has become increasingly precarious. As businesses and consumers reevaluate their financial decisions, there is a growing sentiment of caution among stakeholders.

The unexpected inflation surge can be attributed to several factors, including:

- Rising energy costs

- Supply chain disruptions

- Increased demand in various sectors

The Chilean central bank is now faced with a dilemma: to maintain higher interest rates in an effort to control inflation or risk stifling economic growth. Stakeholders are closely monitoring the situation, as sudden policy shifts could have far-reaching implications. A comprehensive analysis of the inflation trends is critical, prompting discussions about potential measures the government may implement to stabilize the economy.

| Inflation Factors | Impact Level |

|---|---|

| Energy Prices | High |

| Supply Chain Issues | Medium |

| Consumer Demand | High |

Analyzing the Implications of Rising Prices on Monetary Policy and Consumer Behavior

The recent surge in inflation in Chile has raised significant concerns about the effectiveness of the current monetary policy framework. As prices have exceeded forecasts, central bank officials face the challenging task of navigating a complex economic landscape. Interest rates, which have traditionally been a tool for controlling inflation, may require reevaluation as rising costs impact both businesses and consumers. The hesitation to lower rates, once anticipated, is now compounded by the fear that such a move could further drive inflationary pressures.

Consumer behavior is also shifting in response to these economic conditions. With prices climbing, many households are likely to adjust their spending habits, prioritizing essential goods while cutting back on discretionary items. This change can lead to a ripple effect in the economy, influencing everything from retail sales to service industries. Key implications include:

- Increased demand for affordable alternatives: As prices rise, consumers may seek out less expensive options, affecting retailers’ pricing strategies.

- Shift in saving behavior: With inflation outpacing wages, households may prioritize saving over spending, impacting overall economic growth.

- Potential for contraction in certain sectors: Those reliant on luxury or non-essential goods could see a downturn as consumers tighten their budgets.

| Economic Indicator | Current Trend |

|---|---|

| Inflation Rate | Above Forecasts |

| Consumer Spending | Shifting to Essentials |

| Interest Rates | Uncertain Path Ahead |

Strategic Recommendations for Stakeholders Amidst Inflationary Pressures

As inflation in Chile continues to surpass expectations, stakeholders should adopt a proactive approach to navigate this economic climate. Businesses must evaluate their pricing strategies, potentially implementing tiered pricing or value-added services to maintain customer loyalty while adapting to rising costs. Investors should consider diversifying their portfolios to mitigate risks associated with volatile markets, focusing on sectors that traditionally outperform during inflationary periods, such as real estate and commodities. Moreover, stakeholder engagement through transparent communication regarding price adjustments can enhance trust and sustain customer relationships.

On the governmental front, policymakers need to prioritize monitoring inflation indicators closely and adjust fiscal policies accordingly to support economic stability. Measures could include targeted subsidies for essential goods to alleviate pressure on low-income households. Additionally, central banks must weigh the implications of potential interest rate hikes against economic growth, ensuring that monetary policy aligns with the current inflation trajectory. To assist in strategic decision-making, the following table summarizes key actions for stakeholders in the face of elevated inflation:

| Stakeholder Group | Recommended Actions |

|---|---|

| Businesses |

|

| Investors |

|

| Policymakers |

|

Final Thoughts

In conclusion, the recent surge in inflation rates in Chile, which has significantly exceeded preliminary forecasts, casts a shadow over the prospects for interest rate cuts in the near future. As policymakers grapple with the implications of this unexpected economic outlook, the focus will shift to how the Central Bank responds to these challenges. With rising prices impacting consumer purchasing power and market stability, the next steps taken by monetary authorities will be crucial in shaping the nation’s economic trajectory. As we continue to monitor the developments in Chile’s financial landscape, the interplay between inflation and interest rate policy will remain a key area of concern for both investors and consumers alike. Keep an eye on future announcements from the Central Bank as they navigate these complex economic waters.