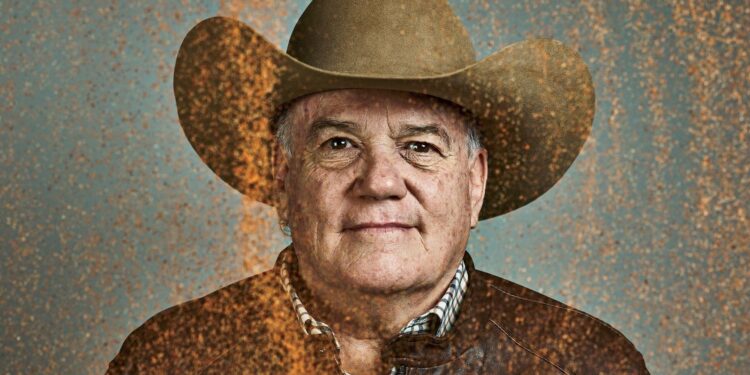

Ethan Pines for Forbes

“The American Dream motivated me,” explains Horacio Fernández, the 66-year-old founder and CEO of TajĂn. “You build the business with your work, with your mind, with your innovation. In Mexico, it’s difficult.”

Fernández created the seasoning blend 40 years ago in his kitchen, taking cues from what his grandmother used, with the goal of selling genuine Mexican flavors in the U.S. market. It was an audacious plan in an era when some American supermarkets didn’t even stock jalapeños—and Chi-Chi’s, founded in Minneapolis, was among the country’s most popular “Mexican” restaurants. He succeeded by creating a Mexican product aimed squarely at Americans while simultaneously helping preserve (through commercialization) a heritage pepper key to Mexico’s national identity: chile de árbol de Jalisco, featured in TajĂn’s logo. Some 40 million pounds of TajĂn is now sold in America annually, much of it at Walmart, according to the cowboy hat– wearing Fernández, who rarely gives interviews. The U.S. is the engine behind the brand’s cultlike following, making up 60% of its business.

Top Shelf: TajĂn is “category-defining, like Kleenex,” says Matt Leeds, who founded Forward Consumer Partners after having led the deal for McCormick to buy Cholula hot sauce in 2020.

avid Tonelson/Alamy

Forbes pegs annual revenue for Industrias TajĂn at $300 million—with gross margins of as high as 70% and net margins of 30%. We estimate the business to be worth $1.5 billion. Fernández, who started the company in 1985, and his brother Aldo, who joined 11 years later, own nearly all of it. Sergio Arias, a banker who became CFO in 1996, has 3%. Since 2020, TajĂn has grown sales at a compound rate of 15%, some three times faster than the overall $7 billion U.S. spices category.

Fernández says TajĂn, which has been licensed by brands ranging from Taco Bell to Hellman’s mayonnaise, has been wooed by NestlĂ©, ConAgra, Unilever and Kraft. Yet he hasn’t been tempted to sell. “It’s not about the money,” says Fernández, who has spent some of his wealth on a school celeÂbrating traditional Mexican ceramics as well as a colonial-era hacienda, built in Jalisco in 1564, purchased in 2021 for events.

TajĂn is “category-defining, like Kleenex,” says Matt Leeds, who founded Forward Consumer Partners after having led the deal for McCormick to buy Cholula hot sauce in 2020 at private- equity shop L Catterton. Leeds says TajĂn checks all the boxes—“addictive and craveable” while being “very versatile.”

“The brand is underexposed,” he adds. “There are not many companies this scaled, this profiÂtable, with strong brands, their own manufactuÂring and independently held.”

When McCormick—the $6 billion (sales) seasoning behemoth behind Frank’s Red Hot and Old Bay—acquired Cholula, it spent 10 times revenue for a total of $800 million. Since then, deals in spice brands have ranged a bit lower—from four to eight times sales. Last year, Siete Family Foods, the corn-free chip maker that expanded into seasonings and hot sauce, was acquired by PepsiCo for $1.2 billion, or more than four times sales.

“As a brand, what [TajĂn is] doing is meaningful. It’s powerful,” says Siete’s cofounder and CEO, Miguel Garza, who grew up in Laredo, Texas. “It felt for so long like this is a Latino thing. But now I go to my Whole Foods in Austin and they have TajĂn—and it’s sitting right next to the fruit.”

TajĂn grew through grit. Fernández was raised in Guadalajara, one of seven kids of a wealthy gasoline entrepreneur, but he wanted to strike out on his own. Without help from his father, he started more than 20 small businesses, hawking everything from leather goods to candy. Each one failed, but Fernández kept looking for the idea that would take off. While selling beans and rice, he attended a food trade show in Chicago. There, in 1980, he had an epiphany: He would bring chilis to the masses.

It took a whole year for TajĂn to sell its first 200 cases. Fernández dreamed of breaking into America from the beginning, but he spent the first eight years growing sales in Mexico—at a snail’s pace. By 1993, when TajĂn finally made it to U.S. grocery stores and supermarkets, its annual revenue was less than $10,000.

Even though sales were tiny, Fernández didn’t have any debt—not even a company credit card. He funded the business entirely from profits. In 2002, emboldened by his American dream, Fernández moved to Houston with his wife and five children. It was a huge risk. Sales were just $130,000 the year prior.

He personally drove cases of TajĂn around Texas in his pickup truck, offering tastes to Hispanic grocers and convenience stores. Fiesta, a Houston-based supermarket with 48 stores, was an early adopter, as was Texas favorite H-E-B. Then in 2004 he landed Walmart. Sales doubled every two years, but it wasn’t enough. As retailers like Trader Joe’s copied TajĂn, Fernández needed to grow bigger, quicker. “We had a lot of competition,” he says.

His plant was hitting capacity—produÂcing around 7.5 million pounds of TajĂn annually—but Walmart wanted more. So he spent

$50 million, from his own savings and a small loan, to build a plant that was eight times larger. It opened in 2020, and sales at Walmart have since soared; they now make up 50% of TajĂn’s revenue. There’s still plenty of room to grow: Only 7% of American households bought TajĂn last year. That means there are still a lot of tables TajĂn can hit for the first time.

Spice Force: Horacio Fernández built a $50 million factory in Mexico to increase production of TajĂn so the brand can expand to U.S. schools and brick-and-mortar stores.

Photo by Ethan Pines for Forbes

One idea is to hook ’em young by selling to American public schools. Individual TajĂn seasoning packets, launched in 2015, have caught on: Kids like to sprinkle the powder on boring broccoli and carrots. TajĂn now has 552 school districts under contract and delivered more than 55 million low-sodium sachets last year. It hopes to double that by 2030.

Next up? Brick-and-mortar retail stores. Of course, the flagship shop for this very Mexican brand will be in America. Fernández is even investing in regional U.S. peppers after acquiring New Mexico’s famed hatch green chile brand Paulita’s in 2022. After all, it took him eight years in Mexico to reach more than $10,000 in sales; he now does that in less than an hour in America. No wonder he’s all in on the USA.

— Additional reporting by Maria Gracia Santillana Linares.

MORE FROM FORBESForbesHow Clase Azul Built A Billion-Dollar Tequila Business Beyond The Top ShelfBy Chloe SorvinoForbesInside The Food Industry’s Biggest Buyback Of 2024By Chloe SorvinoForbesMeet The Billionaire Family Behind King’s HawaiianBy Chloe SorvinoForbesInside The Chaos At Boar’s HeadBy Chloe Sorvino

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=67b5dfd2db3841e99c519b74454afe67&url=https%3A%2F%2Fwww.forbes.com%2Fsites%2Fchloesorvino%2F2025%2F02%2F18%2Ftajin-founder-horacio-fernandez-interview-billionaire-spice-family%2F&c=11849195940576612244&mkt=en-us

Author :

Publish date : 2025-02-18 21:00:00

Copyright for syndicated content belongs to the linked Source.