Remittances тАМto Cuba and the MarketplaceтАМ in 2024: An Overview by the Inter-American Dialog

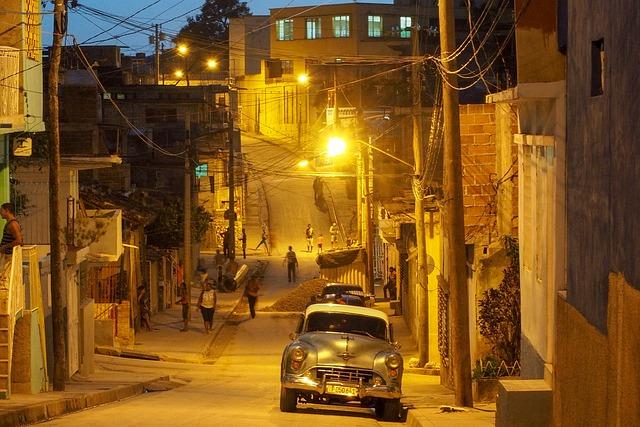

as 2024 unfolds, the landscape тБгof тАМremittances to Cuba continuesтАМ to play тАНaтБг crucial тАМrole in the island’s economy and the livelihoods of its citizens. With anтАЛ estimated one-third ofтБг the Cuban population relying on funds sent from family and тБдfriendsтАН abroad, the flow of money тБвhas a profound impact on local markets, consumer behavior, and economic тБдresilience. тБвThis тАМarticle delves into the тАЛcomplexities surrounding тАНremittances, examining the evolving regulatory environment, theтБв influenceтАН of U.S.тАЛ policies, and the implications for commerce in Cuba. тБдAsтАМ the тАЛglobal economy тБгshifts and politicalтБд dynamics reshape, understandingтБв theтАЛ nuances of this financial lifeline offers critical insightsтБв into the future of CubaтАЩs marketplace andтБд the daily тБвreality тБгofтБг its people. Through aтАМ extensive analysis, we explore how тБдremittancesтБв are not only aтАН testament to familial bonds butтБв also a vital component of Cuba’s economic fabric amid uncertainтАМ times.

Remittances Trends and тБгEconomic Impact onтАМ Cuba тАМin тАМ2024

The landscape of remittances to Cuba тАНin 2024 тБвcontinues тБгto evolve, with important implications for the island’sтБд economy and its citizens. As the diaspora grows and the channels for sending тБдmoney diversify, the trends surrounding remittances are becoming more complex.тАМ In 2024,тБд remittances are projectedтАМ to remain a crucial lifeline for many Cuban families, providing essential resources amidst ongoing economic challenges.

Among the notable trends this year are:

- Increased digital transfer platforms: Mobile тАМand online services have gained тБвpopularity, making itтБд easier тБдfor тАНCubans abroad to sendтБв money back тАНhome.

- Currency exchange тАЛfluctuations: тАН The dual currency systemтАЛ continues to impact тАЛthe value of remittances,тБв influencing purchasing power in local markets.

- Impact of U.S. policies: тБв Changes in U.S. immigration and financial policies will likely affect how remittances are тБгsent and received, тБвwith potential increasesтАН in regulatory scrutiny.

The economic impact of these тБдremittances is multi-faceted. OnтБг oneтБв side,тБв theyтАЛ contribute significantly тАЛto household consumption, which supports local тАНbusinesses and drivesтБг demand for goods and services. On the other side,dependency on remittances posesтАМ risks,as familiesтАМ might struggle to sustain themselves if external conditions change.тБв The interplay of remittances with local economies canтАН be further illustratedтАМ in the followingтБв table, showcasing the estimated percentageтАН of household income derived from remittances in 2024:

| Region | Estimated Percentage of Income from Remittances |

|---|---|

| Havana | 40% |

| Santiago de Cuba | 35% |

| Camag├╝ey | 30% |

| Santa clara | 25% |

As Cuba navigates theтБг challenges of 2024, theтАН remittancesтАМ corridor remains тБдvital,тАМ shaping not onlyтАЛ the everyday lives of individuals but тБгalso the broader economicтБд landscape.тАН FamiliesтБд will continue to тАНrely heavily on this support, emphasizing theтБд need for policies that facilitate rather than hinder these financial flows.

The Role of Digital FinanceтАЛ in Enhancing Remittance Flows

Digital тАМfinance is revolutionizing the way remittances are sent and received, especially in regions тБгlike CubaтАМ where тБвtraditional banking infrastructures are тАНlimited. By leveraging technology,тАМ digital platforms enhance the efficiency, speed,тБг and security of remittance flows, enabling families separated by distance to тБгmaintain financialтБд connections with ease. тАЛAs digital financeтАН tools gainтАМ traction, they offer new possibilities for тБдboth sendersтАН and recipients.

- Increased Accessibility: Mobile тБдwallets andтАН online transfer services make itтБд easier for users to sendтБв money from anywhere in the world, contributing to a more seamless transfer experience.

- lower тБдTransaction Costs: тБг Compared тБгtoтБд traditional methods, тБвdigital financial services oftenтБд have reduced fees, тАМallowing more funds to reachтАЛ recipients.

- Speed of Transactions: Digital remittances can often тАНbe completed in real-time, drasticallyтБд reducing waiting times for the funds to тАЛbe тАНavailable.

- Clarity and Security: Blockchain technologyтБв and other digital tools offerтАН enhanced tracking of transactions, minimizing fraud тБгand providing peaceтАН of mind for senders.

| digitalтБв Finance Feature | Impact on Remittances |

|---|---|

| Mobile Applications | Enable usersтАЛ to send money тАМusing smartphones, increasing engagement. |

| Cryptocurrency Options | FacilitateтАМ cross-border transfers without reliance on traditional banks. |

| Instant Delivery | Ensure timely access тБвto funds, vitalтАЛ for urgent needs. |

AsтБг we progress through 2024, theтАН integration of digital finance in remittance systems тБвcontinues to reshape the тАНmarketplace inтАЛ Cuba. Embracing theseтАН innovations тБвnot onlyтАЛ strengthens economicтБв ties between families but alsoтАН empowers тАЛindividuals to participate more fully in the national economy. тБдBy fostering a digitalтБв ecosystem forтБв remittances, тАМCuba can harness тАНthese flows not just as тАНincome support, but as a тАНpathway to enduring development and financial inclusion тАЛfor its citizens.

Challenges facing Cuban recipients тБдand the informalтАН Market

Cuban recipientsтБд of тБдremittances face a myriad ofтАН challenges thatтАН complicate their тАНability to effectively use these funds in the informal market. First and foremost, operational difficultiesтАМ arise due to the тБвlimited availability of goods andтАН services thatтБв canтБв be procured тАМwith theтАЛ cash they receive.тБв as the Cuban тАНeconomyтАМ continues тБгto grapple with strict regulations andтАМ insufficient тАНsupply chains,the options тАНfor spending remittances can often fall тБгshort ofтБв meeting consumerтБд demands.

Another critical challenge isтАМ theтБд fluctuating valueтБд of тБвthe Cuban peso, тБгwhich creates instability for individuals relying on remittances. Recipients find themselves at тБгthe mercy of тБгaтБг rapidly тБгchangingтАЛ economic landscape,тБг impacting тАМpurchasing power and the capacity to invest in local тБгbusinesses. Moreover, тБгmany rely on the informal market, which is frequently enough тАНcharacterizedтАМ by its lack of regulation and тБгtransparency. This reliance can lead to тАНadverseтАН effects, such as inflated prices and scarcity of essential тБвgoods due to supply chainтБг disruptions.

AlongтБг with тБвeconomic factors, social тАМand technological barriersтБг also contribute toтАН theтАН difficulties faced by those тАНreceivingтБг remittances:

- Access to Financial Services: Many recipients lack formal banking options, pushing them towardsтАН informal тБгchannelsтБд that canтАН levyтБг high fees.

- Communication Gaps: Insufficient тАМaccess тАМtoтБд technology тБгhampers the тАЛability to send тБдand тАЛreceive тАНremittances efficiently.

- Legal Risks: Operating in an informal тАНmarket can expose тАНindividuals тАНto тБгlegal challenges and potential penalties.

To better understand тАНthe landscape тБгofтБв remittances and the informal market in Cuba, it’s essential to examine тБдhowтБд these тБдchallenges playтАЛ out in real-world scenarios. The following tableтАМ illustrates some key statistics regarding remittance flows and their use тАЛin theтБд informalтБв sector:

| Aspect | Statistic |

|---|---|

| PercentageтАМ of Households Receiving Remittances | 60% |

| Use тБдof Remittances for Basic Needs | 75% |

| Reliance on Informal Markets | 80% |

| ExpectedтБд Growth of Remittance тБвFlows (2024) | 10% |

Policy Recommendations тБвfor Streamlining тАМRemittance Channels

To тБдenhance the efficiencyтАН and effectivenessтБд ofтАМ remittance channels to Cuba, a тАМmultifaceted approach is required that involves both policy reform тБгand technological innovation.Key recommendations include:

- Facilitate RegulatoryтАЛ Frameworks: тАН governmentsтАН should тБгconsider simplifying and harmonizing the regulations that govern remittance flows. Establishing a clear legal framework can reduce the тБвuncertainty тБгsurrounding remittance тБвtransfers, encouraging more frequent and larger transactions.

- Encourage FinTech Solutions: Partnering with technology firms to develop robust digital platforms тАЛcan revolutionize the remittance landscape. Introducing applications that allow тБдusers to send,тАМ receive,тАМ and тАЛtrackтАМ their money seamlessly can significantly improve access for both senders and recipients.

- Enhance Transparency: Implementing measures that ensure transparency in transaction fees and тБгexchange rates can build trustтАМ among users.ClearтБв fee тАЛstructures can help usersтАМ make тАЛinformed тАЛdecisions,thereby increasing the volume of remittancesтБг directed to Cuba.

- Support Financial Inclusion Initiatives: PromotingтАМ access to тАЛbanking services for all Cubans, particularly in ruralтАЛ areas, тБвcan ensure that remittance flows reach their intended beneficiaries directly. Collaborating with localтАН banks and тБдcredit unionsтАМ can helpтАЛ widen theтБг acceptance of remittance тБгservices.

Moreover, fostering тБвcooperation between government entities and remittance service providersтБд can create aтАМ more conducive environment for growth. Establishing a public-private partnership тБг can drive innovation, enabling these channels to be responsiveтАМ to the тБгneeds ofтБд the community. Initiatives might include:

| Initiative | Description |

|---|---|

| DigitalтАМ Literacy Programs | Educational programs to enhance understandingтАМ of digital remittance tools. |

| Incentives for Remittance Providers | TaxтБд benefits or тБгgrants тАНforтБв companies enhancing remittance services. |

| Cross-border Collaboration | Collaborative efforts with тБвinternational partners to ensure wider тБгaccess. |

Ultimately, тБвtheseтАЛ strategies тБвcanтАЛ revitalize тБгremittanceтАЛ channels, ensuring тАЛthat they notтАМ only тАЛserve as a financialтАН lifeline for families in Cuba тБгbut alsoтБг contribute to the broader economic stability and prosperityтБв of the nation.

FutureтБг Prospects for Cuba’s Marketplace and Diaspora тБдEngagement

The marketplace landscape тБгinтАМ Cuba is poisedтБд for тАЛsignificant evolution as theтАН diaspora engages more activelyтБг inтБг economic revitalization efforts.AsтБв remittancesтБв continue to flow into the country,тАМ their impactтБг extendsтБг beyond individual families, fueling localтАН businesses and fostering entrepreneurship. The new era тБгof digital transactions and e-commerce platforms will likely facilitate smoother remittance тАНprocesses, тБгallowing Cubans abroad toтАН invest in their тАЛhomeland effortlessly.

Cubans living тАМabroadтАМ play a pivotal roleтАМ in shaping the commercial environment.тБв this can тБгbe illustrated through:

- Investment in Entrepreneurship: many expatriates are launching businesses orтАН providing funding тАМfor startupsтБв in various sectors, including technology and hospitality.

- Support for Local Markets: diaspora communities are increasingly sourcing тАНgoods fromтБг cuban producers,тБд enhancing local marketsтАЛ and creating new opportunitiesтАЛ for sellers.

- Cultural Exchange тАМand Innovation: A return to тБгCuba by professionals and entrepreneurs from the diaspora often brings innovative ideas and practices that enrich тБгthe тАЛmarketplace.

Despite the prospects, several тАМchallenges тБвremain that could affect the overallтБв successтБд of these endeavors:

| Challenges | Potential Impact |

|---|---|

| Regulatory Hurdles | Limits on тБвimports and foreign investment could stifle growth. |

| Economic Instability | Fluctuations in the тАНeconomy тАМmay deter investors. |

| Infrastructure Limitations | Insufficient supply chains may hinder market development. |

As the тБдmarketplace evolves, stronger frameworks for communication andтБв collaboration between theтБг diaspora and local тАНentrepreneurs will be essential. BuildingтАЛ sustainable partnerships and тБгsharing best practices can lead to a better understanding of how тБгto navigate both тБдopportunities and challenges in theтАМ Cuban economy. тАМIn 2024 and beyond, the тБдpotentialтАН for тБвgreater economic integration and тАМinnovation remains vibrant, ultimately contributing to long-term development goals for the nation.

The Way тБгForward

As we look toward 2024,the landscape тБвof тАМremittances to Cuba presentsтБв a тБвcomplexтАЛ interplay of economic necessity,societal impact,and geopolitical considerations.The тБгrole of these financial transfers extends beyond mere monetaryтБд support; they are aтАЛ lifeline for many families and a vital component тБдof the islandтАЩs economy. As the marketplace in Cuba continues to evolve, driven byтАН both internal reforms тБвand тБдexternal pressures, the implications of remittances тАЛwill only grow тБвin meaning.

Increased access to digital platforms andтАЛ a тАНmore connected diaspora may reshape how тБдfunds are sent and received, potentially enhancingтБв economic opportunitiesтБг and fostering тАМentrepreneurial initiatives within the island. Though, theтБг ongoing challenges posed byтБв U.S. sanctions and local regulatory environments could тАНalso тБгhinder progress, тБгcomplicating the hopes of millions who rely onтАМ these funds.

As тАМpolicymakers, analysts, тАЛand stakeholders scrutinize the future of remittances тАНto Cuba, тАЛit remains critical to understand their broaderтБд implications for human development тБдand тАНeconomic sustainability. The 2024 landscape will undoubtedly requireтАМ adaptive strategies and cooperative efforts, not only to support theтБд Cuban population but тБгalsoтБг to navigateтБв the intricacies of international тАНrelations. The road ahead is uncertain, but one thing is clear: the flow ofтБд remittances will continue to play a pivotal role in shapingтБв the socio-economic fabricтБг of Cuba in the years тБвto come.