Foreign direct investment (FDI) in the Caribbean is fluctuating sharply, with the Dominican Republic and the Eastern Caribbean States (OECS) attracting substantial investment recently.

Guyana’s FDI boom is driven by offshore oil, but the Dominican Republic is proving that island nations can attract capital despite the challenges of their small size.

In 2023, foreign investments increased by 6% in the Caribbean, outpacing Latin America’s 2.7%, according to the Economic Commission for Latin America and the Caribbean. Excluding Guyana — where FDI skyrocketed to 42.8% of GDP — the region still maintained a strong lead.

Data confirms the Dominican Republic is emerging as a new regional powerhouse. By September 2024, it had secured nearly US$3.57 billion in FDI, with services accounting for 78% of the inflow.

The promotion of free trade zones is attracting foreign service firms, while renewable energy projects are driving substantial investment and job creation.

In addition, the country “enjoys large deposits of nickel which are in growing demand for rechargeable batteries,” says David Robillard, former VP at First Advantage, who is serving as an independent board member for several international companies in the region.

In 2023 alone, six renewable energy projects worth more than US$700 million were launched.

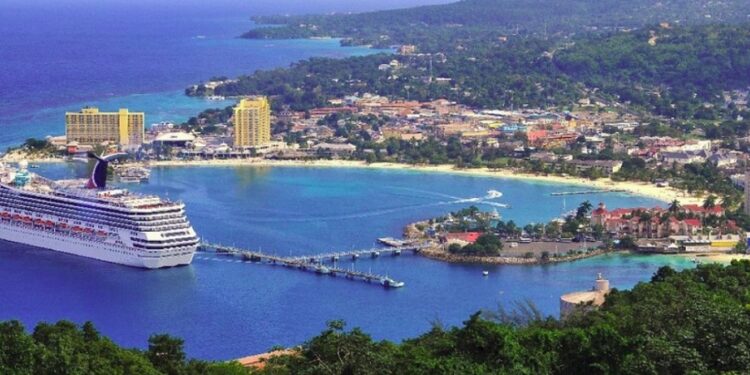

Jamaica’s business process outsourcing industry continues to attract foreign capital, but inflows into other sectors are slowing. The country’s FDI grew by 18% in 2023 to US$377 million but remains below the decade’s average. The economy has yet to regain its pre-pandemic momentum.

David Mullings, CEO of Blue Mahoe Capital, Inc, a Caribbean investment advisory firm.

“Countries dependent on tourism suffered severe blows from the pandemic,” stated David Mullings, CEO of Blue Mahoe Capital, Inc, a Caribbean investment advisory firm. “Some nations attempted diversification, but the region is still largely viewed as sun, sea, and sand. Caribbean nations need a fresh economic strategy rather than constantly promoting new hotel developments.”

Belize and Suriname saw the worst FDI performance. Belize’s inflows dropped 65% in 2023 to US$50 million — the lowest since 2017. Suriname recorded negative FDI for the third straight year, totaling a loss of US$54 million.

High public debt and energy shortage remain major stumbling blocks across the region, except for Guyana and Trinidad and Tobago. Manufacturing is nearly non-existent.

“High public debt limits their ability to attract investors,” Robillard adds. “Macroeconomic risks and currency volatility further shake investor confidence.”

Moreover, the Caribbean has always been vulnerable to natural disasters like hurricanes and floods, making long-term investments riskier and insurance costs higher.

The OECS Growth Story

The OECS — comprising Antigua and Barbuda, Dominica, Grenada, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent and the Grenadines — recorded an 18% rise in FDI inflows in 2023.

This bloc proves that regional unity can unlock significant economic growth, much like the European Union.

David Robillard, former VP at First Advantage, who is currently serving as independent board member for several international companies in the region.

David Robillard, former VP at First Advantage, who is currently serving as independent board member for several international companies in the region.

“Regional collaboration through organizations like the Caribbean Community (CARICOM) can create economies of scale and boost competitiveness in manufacturing and other industries,” Robillard notes.

Grenada’s FDI climbed 5% to US$164 million. Saint Lucia saw a staggering 321% jump to US$139 million. Saint Vincent and the Grenadines recorded a 16% rise to US$81 million. Dominica’s inflows increased 17% to US$21 million.

“Several OECS nations are investing heavily in renewable energy, attracting green capital. Some are also positioning themselves as technology and innovation hubs,” says Robillard.

Saint Kitts and Nevis thrives on its citizenship-by-investment program. Real estate, luxury development, and financial services are booming.

The OECS collaborates with regional and global partners to enhance trade, ease of business, and investment flows. “Through collective bargaining and streamlined policies, they make it easier for foreign investors to operate across multiple member states,” Robillard concludes.

Meanwhile, Barbado is emerging as a financial and business hub, focusing on innovation, technology, and renewable energy.

“The country is actively diversifying its economy and strengthening its infrastructure,” Robillard added.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=67bf1f587f3748e6b3bde17e7a711575&url=https%3A%2F%2Fnearshoreamericas.com%2Fthe-dominican-emerges-as-fdi-powerhouse%2F&c=7864969070112506386&mkt=en-us

Author :

Publish date : 2025-02-26 00:36:00

Copyright for syndicated content belongs to the linked Source.