Street scene in Santa Ana, El Salvador. (Photo: iStock)

El Salvador’s Comeback Constrained by Increased Risks

By the El Salvador country team,

IMF Western Hemisphere Department

February 16, 2022

El Salvador’s increase in public debt will constrain medium-term growth prospects given the risks associated with high and growing financing needs.

In an interview with Country Focus, the IMF El Salvador team, led by Alina Carare, talks about the country’s rebound and challenges, and the decision to make Bitcoin legal tender.

How is the economy rebounding from the pandemic?

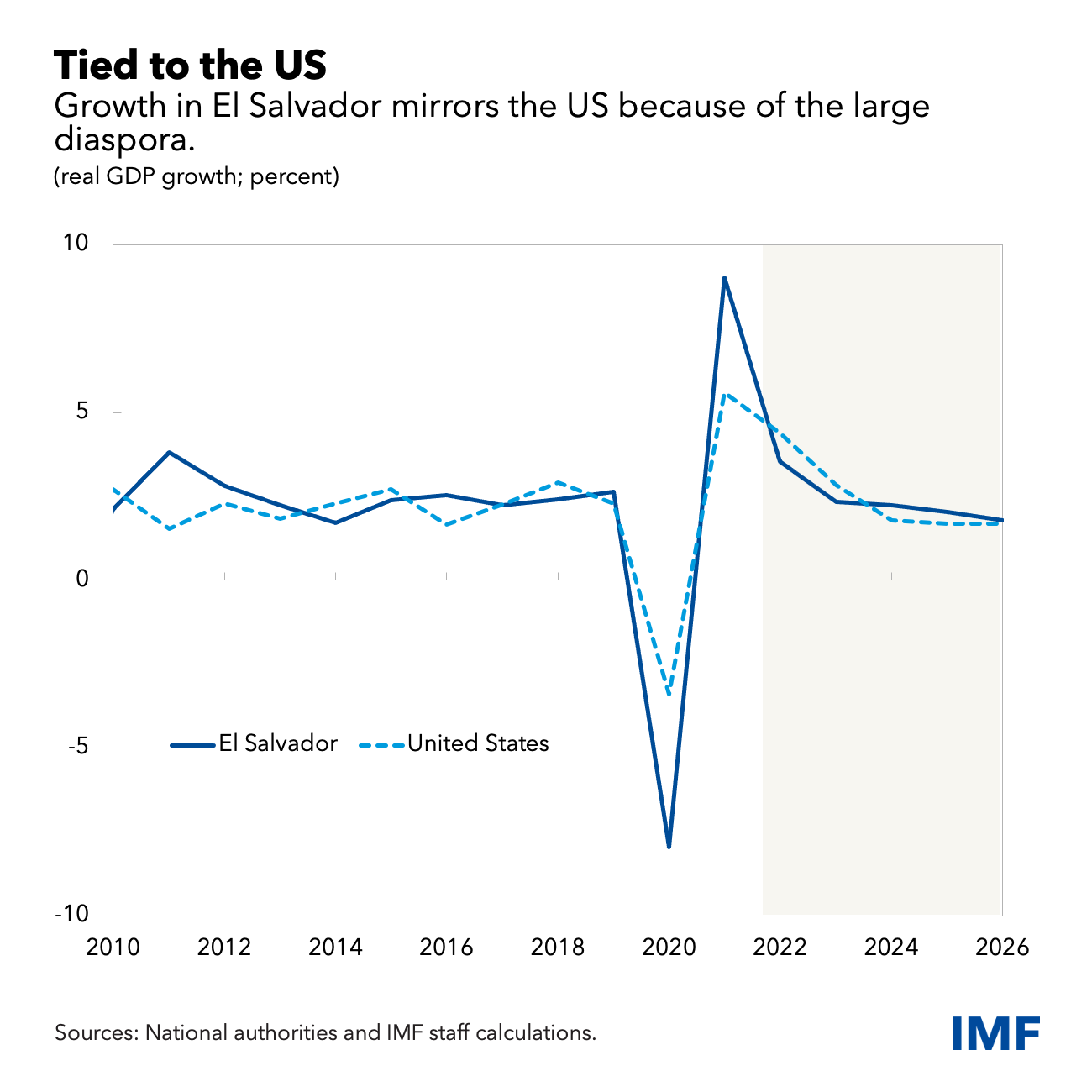

After a sharp decline in 2020, we expect the economy to grow by around 10 percent of GDP in 2021, and 3.2 percent in 2022. This has a lot to do with the pick-up in external demand, and El Salvador’s response to the pandemic. Though it is one of the most densely populated countries in Latin America, El Salvador had one of the lowest reported rates of COVID-19 infections and fatalities in the region and has a relatively high vaccination rate.Â

US real GDP growth is also an important growth driver because of the large Salvadoran diaspora. About one-fifth of the population is living in the US. They contribute to the Salvadoran economy by sending remittances to support their families—more than 25 percent of GDP in 2021.Â

Â

Â

What are the top challenges and priorities going forward for El Salvador?

We expect medium-term growth rates in El Salvador to decline to around 2 percent as policy stimulus in the US wanes. This is below the historical average, and it is because of high public borrowing costs. Persistent budget deficits and continuous expansionary fiscal policies—despite the strong economy—have resulted in a rapidly growing public debt-to-GDP ratio. Unless decisive policy actions are taken, public debt will continue to grow, demanding more resources from the budget as borrowing costs increase. This situation is unsustainable—it crowds out private investment, and limits resources for social and infrastructure spending, all impediments to growth. To increase growth rates in the long term, more private investment is needed. Healthier public finances would help.

Because of this, we recommend a permanent reduction in the fiscal deficit (the difference between government revenue and spending), to be implemented over a 3-year period. This was agreed by the authorities and is in line with efforts made by other countries. It would put the debt-to-GDP ratio on a firm downward trend, creating the required fiscal space to implement the authorities’ ambitious social and inclusive growth agenda.

Measures to support the vulnerable together with improvements to governance frameworks and efforts to minimize risks from Bitcoin are critical to ensuring higher growth and macroeconomic stability. Failure to take prompt action would only complicate policy choices in the future and increase risks.

We have proposed policy options to restore the confidence of the market and ensure sufficient resources to service the country’s debt and finance its large development needs.

What are the risks of using Bitcoin as legal tender? How can these risks be addressed?

Digital means of payment such as Chivo (government e-wallet) have an important role to play in promoting financial inclusion, especially if used in US dollars. But as noted by our Executive Board, there are large risks associated with using Bitcoin as legal tender, especially given the high volatility of its price. We don’t recommend it. In the short-term, the costs and risks largely outweigh the benefits. These include risks to:

Financial stability: Banks and other financial institutions could be exposed to massive fluctuations in crypto-asset prices. Banks will need to introduce new prudential rules, such as capital and liquidity requirements to fully hedge Bitcoin exposures or ban deposits in Bitcoins. Additionally, as the payments ecosystem is highly concentrated in Chivo, we recommend strengthening its regulation and supervision.

Financial integrity: Crypto assets could open the door to illicit money, terrorism financing, and tax evasion, because of the anonymity they provide. Despite efforts to identify Chivo users, there are financial integrity risks. Theft or cybercriminals could jeopardize the stability of the system affecting relationships with foreign countries and correspondent banks. Because anti-money laundering and combating the financing of terrorism requirements are not uniformly implemented, a lot is left to the discretion of Bitcoin-service providers. International standards for virtual assets providers are needed. For these reasons, we recommend more intense and uniform regulation for all entities.

Consumer protection: Households and businesses who hold Bitcoin balances and save in Bitcoin could lose wealth through large swings in value, and in a digital environment, cybercrime and theft is always a risk. With a quarter of the population already living in poverty, it is important that the use of Chivo does not lead to further destitution. For these reasons we recommend: (i) strengthening legal requirements for e-wallets, particularly Chivo, to fully safeguard users’ funds (in both Bitcoins and US dollars); (ii) setting legal limits on Bitcoin transactions and holdings; and (iii) boosting the consumer protection framework with stricter transparency requirements, higher institutional involvement, and clearer disclosure of Bitcoin use and the risks it carries due to price volatility.

Contingent fiscal liabilities: The adoption of Bitcoin as legal tender is fully funded by public money, through a trust fund. If the price of Bitcoin was to plummet, the resources in the trust could be rapidly depleted. For the government to continue guaranteeing the convertibility between the Bitcoin and the US dollar, it would need to fund the trust through additional resources or the issuance of debt.Â

The El Salvador Country Team:

Â

Alina Carare is Deputy Division Chief in the Western Hemisphere Department Â

Jaime Ponce is a Senior Financial Expert in the Monetary and Capital Markets Department

Javier Kapsoli is a Senior Economist in the Western Hemisphere Department Â

Juan Francisco YĂ©pez is an Economist in the Western Hemisphere Department Â

Justin Lesniak is a Research Assistant in the Western Hemisphere Department

Laura Doherty is a Senior Economist in the Fiscal Affairs Department

Lorena Rivero del Paso is a Technical Assistance Advisor in the Fiscal Affairs Department

Yorbol Yakhshilikov is an Economist in the Western Hemisphere Department Â

Â

Source link : https://www.imf.org/en/News/Articles/2022/02/15/cf-el-salvadors-comeback-constrained-by-increased-risks

Author :

Publish date : 2022-02-16 03:00:00

Copyright for syndicated content belongs to the linked Source.