Guyana Gains French Support Amid U.S. Pressure on Venezuela – Crude Oil Prices Today

In a significant geopolitical development, Guyana has secured the backing of France amid escalating tensions surrounding Venezuela’s political turmoil and its implications for oil markets. As the United States intensifies its efforts to isolate the Venezuelan regime through sanctions and diplomatic maneuvers, Guyana’s burgeoning oil industry finds itself at the center of a complex interplay of regional alliances and energy interests. This newfound support from France not only bolsters Guyana’s strategic position but also reflects a broader shift in international dynamics within South America, highlighting the intricate relationship between geopolitics and energy resources. As crude oil prices fluctuate in response to these unfolding events, both local and global markets will be watching closely to gauge the impacts of this alliance on the volatile landscape of South American oil production and exportation.

Guyana Strengthens Alliances with French Support as U.S. Intensifies Pressure on Venezuela

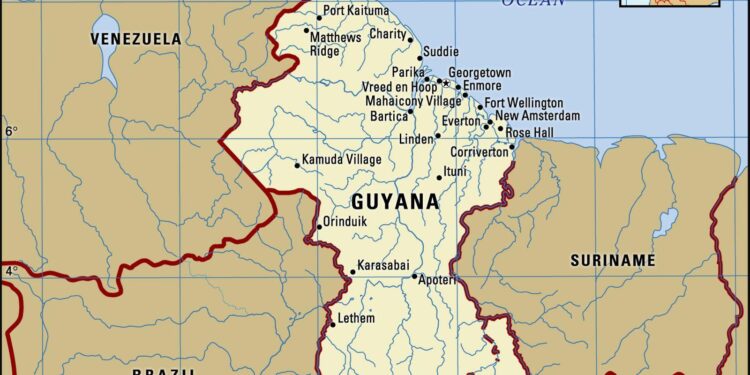

In a strategic move to fortify its geopolitical standing, Guyana has recently enhanced its partnerships with France, aligning itself with European interests amid intensifying U.S. pressure on Venezuela. This collaboration is particularly significant as Guyana embarks on the development of its vast offshore oil reserves, which are crucial to the nation’s economic future. The French government has expressed strong support for Guyana’s efforts in maintaining sovereignty and stability in the face of Venezuelan claims to part of its territory. This burgeoning alliance not only underscores the importance of international support for Guyana but also positions France as a key player in South American geopolitics.

Moreover, the growing collaboration is expected to include various sectors, ranging from energy to security, with a focus on ensuring that the regional stability is maintained against potential Venezuelan aggression. Observers note that this partnership could be a tactical counterbalance to the influence of the U.S. in the region, as both nations work together on initiatives aimed at promoting economic growth and investment. The pact is particularly timely, considering the volatility of crude oil prices, which directly impacts both Guyana’s emerging economy and the broader energy market. The table below highlights key aspects of the Guyana-France partnership:

| Focus Area | Details |

|---|---|

| Energy Development | Joint ventures in offshore oil exploration |

| Economic Support | Investment in infrastructure and technology |

| Security Cooperation | Defense collaborations to secure territorial integrity |

Navigating Crude Oil Market Uncertainties: Strategic Recommendations for Investors Amid Geopolitical Tensions

The current dynamics in the crude oil market have been significantly influenced by geopolitical tensions, particularly the evolving relationship between Guyana and France amid increasing U.S. pressure on Venezuela. This scenario has led to volatility in oil prices, prompting investors to reassess their strategies. Firms should consider diversifying their portfolios to mitigate risks associated with sudden market shifts. Key strategies may include:

- Investing in renewable energy assets to align with global transitions.

- Exploring futures contracts as a hedge against price fluctuations.

- Monitoring geopolitical developments closely to make informed decisions.

Furthermore, as Guyana solidifies its alliance with France to secure favorable terms for oil exploration and production, investors should remain cognizant of the potential for increased production in the region. This can create both opportunities and challenges for established oil markets. Considerations for investment might include:

- Analyzing Guyana’s production capabilities and projected output growth.

- Evaluating the impact of U.S. policies on Venezuelan oil exports and how that reshapes supply chains.

- Staying updated on international relations as they directly affect oil pricing dynamics.

| Factor | Impact on Oil Prices |

|---|---|

| Guyana’s Production Growth | Potential increase in global supply, lowering prices |

| U.S. Sanctions on Venezuela | Potential decrease in global supply, raising prices |

| International Relations | Market uncertainty and volatility |

The Way Forward

In conclusion, Guyana’s burgeoning collaboration with France underscores a significant geopolitical shift in the region, particularly in light of escalating U.S. pressure on Venezuela. As Guyana charts its own path amidst the complexities of international relations and valuable crude oil resources, the support from a major European power like France provides not only economic advantages but also a counterbalance to external pressures. This development not only highlights the intricate dynamics of energy politics in Latin America but also portends potential shifts in alliances and strategies moving forward. As the situation evolves, industry stakeholders and geopolitical analysts alike will be closely monitoring both Guyana’s domestic policies and its foreign relations to gauge their impact on global oil markets. Stay tuned to OilPrice.com for ongoing updates and in-depth analysis on this pivotal narrative.