Robert Way

Introduction & Investment Thesis

Lululemon (NASDAQ:LULU) (NEOE:LULU:CA) (TSX:LLL:CA) designs, distributes, and retails technical aesthetic apparel, footwear, and accessories, which has severely underperformed the S&P 500 and Nasdaq 100 YTD. The company reported its Q1 FY24 earnings on June 5th, where revenue and earnings grew 11% and 7.7% YoY, respectively, beating estimates. One of the things that stood out to me was that the company has been steadily gaining market share in its international markets, specifically in China Mainland, while its US growth has lagged as a function of macroeconomic pressures and innovation issues. For the full year FY24, the company expects to grow its revenue in the 11–12% range at approximately $10.75B, which is the slowest pace since FY21, while diluted earnings per share are expected to grow at the same rate as revenue growth.

I believe that the sell-off from the late 2023 peak of approximately 43% has created an attractive entry point for the stock, as growth should reaccelerate in FY25 and beyond as its Americas market stabilizes while it continues to gain market share in international markets at a steady pace while maintaining financial discipline. Therefore, assessing both the “good” and the “bad,” I believe investors can initiate a position in the stock to gain an upside of approximately 32% from its current levels, making it a “buy.”

Growing strength in international markets, however, growth in the US lags; Revenue guidance points to the slowest growth since FY21

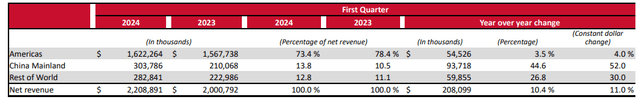

Lululemon reported its Q1 FY24 earnings, where revenue increased 11% YoY to $2.2B on a constant currency basis, exceeding expectations. Out of the $2.2B in revenue, Americas revenue contributed 73.4% of Total Revenue, growing 4% YoY, while International Revenue contributed the remaining 26.6% of Total Revenue, growing 40% YoY, with particular strength from China Mainland. At the same time, while comparable sales in the Americas remained flat YoY, the figure grew 29% in its international markets, with the men’s category growing at a faster rate of 15% compared to the women’s category, which grew at 10%.

10Q- Revenue by geographies

One of the things that stands out is that the company is focused on penetrating its international markets, which are increasingly contributing a higher share of Total Revenue. It is doing so with a go-to-market model that includes omnichannel distribution via its highly productive stores and e-commerce sites, along with a compelling product innovation line, local activations, and brand campaigns to generate awareness. During the earnings call, Calvin McDonald outlined his optimism, stating he expects International Revenue to grow to 50% of Total Revenue in the coming years as they expand their presence outside of North America.

However, comparable sales in the US were flat YoY, and the overall growth of 4% YoY was primarily driven by expanding company-operated stores. During the quarter, Lululemon opened a total of five new stores, of which two were in the US. Apart from the uncertain macroeconomic environment that has been impacting the consumer environment, the management attributed the weakness to a missed opportunity in the women’s category where they failed to optimize for the color palette, especially in leggings, along with running out of inventory for some of their smaller sizes. Despite a weaker start in the US, the management remains optimistic about its growth prospects as it looks to combine local engagement, community activations, and brand campaigns to attract new customers and drive sales through their stores and e-commerce sites. At the same time, the company is gaining market share in the men’s category at a steady pace, although the women’s category still contributes 65% of Total Revenue. Plus, I believe there are plenty of innovative ways that Lululemon can drive customer engagement to drive higher spend volume through its membership program, which currently has 20M members in North America.

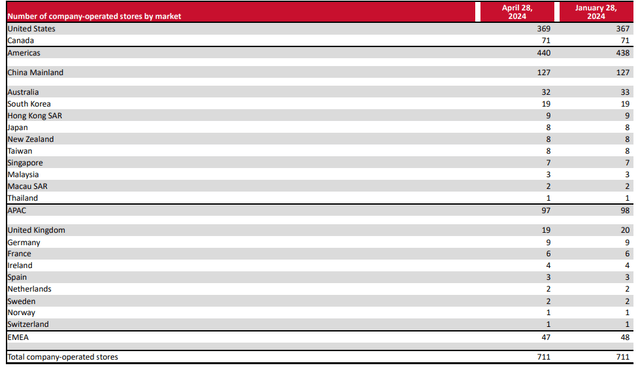

10Q- Number of stores opened by geographies

In terms of forward guidance, the management is prudent about the consumer environment in the US, where we are seeing a weakening in the labor market, which could strain consumer discretionary spending in the short term. As a result, they are guiding revenue growth in the range of 11–12% YoY to $10.7-$10.8B in FY24, which is a marked slowdown since FY21. In terms of store openings, the company expects to open 35 to 40 net-new company-operated stores, out of which 5 to 10 will be in the Americas, while the remaining ones will be in the international markets, primarily in China Mainland. I believe, given the growing number of store openings in its international markets, it should continue to see a growing contribution of revenue while the Americas, particularly the US market, stabilizes.

The management remains focused on its product innovation roadmap, especially as it increasingly gains market share in the men’s category

Meanwhile, the company remains committed to its product innovation roadmap, where it has new launches planned for women’s leggings as well as a versatile swimsuit line later this year with new technical solutions and styles. When it comes to the men’s category, they recently launched a Smooth Spacer hoodie, which provides a cooling sensation for after-workout recovery, while simultaneously launching their polo shirts with Show Zero technology. Plus, it is also seeing strength in their Pace Breaker and Zeroed franchises, which they plan to expand later this year, along with demand in men’s footwear exceeding expectations as they continue to capture more of the men’s market share.

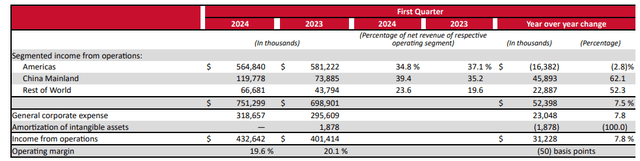

Profitability to grow in line with revenue growth in FY24

Shifting gears to profitability, the company generated $433M in GAAP operating income with a margin of 19.6%, which declined 50 basis points from the previous year. While the international operating income margin expanded, America’s operating margin shrank. At the same time, operating expenses also grew faster than overall revenue growth, at 12.7%, which shrank overall margins. Looking forward, the management is projecting an increase of 10 basis points in operating margin from the previous year, while diluted earnings per share are expected to be in the range of $14.27-$14.47., an increase of 12.5% from the previous year, as the company unlocks higher operating leverage from higher spend volume per customer, especially as it continues to drive brand activations to attract and retain customers while innovating its product lines and gaining market share internationally.

10Q- Operating income by geographies

Risks to Thesis

However, I would like to point out that in order for growth to reaccelerate beyond FY24, its Americas market needs to materially recover. While the prospects of a September rate cut are increasing as the US economy shows signs of weakness, there is a probability that the economy may tip into a short-term recession, where consumer spending will remain dampened. At the same time, it is also possible that in its international expansion plans, Lululemon faces greater competition from local brands, especially in China Mainland. Plus, it also faces competition from brands like NIKE (NKE), Deckers Outdoor (DECK) and while Nike is showing slowing growth, both Deckers Outdoor and Lululemon are projected to grow at similar paces as per consensus estimates. Therefore, given the company is planning to open 35-40 stores in FY24, out of which the majority will be in China Mainland, it might risk facing some margin pressures, if demand doesn’t match up to expectations, despite its product innovation across men’s and women’s categories.

Tying it together: Lululemon is a “buy”

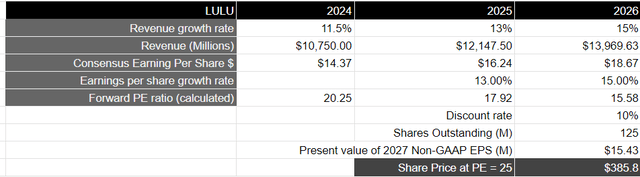

Looking forward, assuming that Lululemon achieves its FY24 revenue target and then reaccelerates in the low- to mid-teens after that, as its Americas market stabilizes while it continues to gain market share in its international markets through a combination of product innovation, brand campaigns, and channel optimizations to attract, retain, and drive higher spend volume per customer, it should generate close to $14B by FY26.

In terms of profitability, I believe its diluted earnings per share should grow at par with revenue growth as it benefits from improved unit economics from higher spend per customer across its marketing channels as it opens new stores, optimizes new ones, grows its digital footprint on its e-commerce sites, and expands usage of its membership program. This means that it will generate approximately $18.67 in diluted EPS in FY26, which will be equivalent to a present value of $15.43 when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15–18, I believe that Lululemon should be trading at least 1.5 times the multiple, given the projected growth rate of its earnings during this period of time. This will translate to a PE ratio of 25, or a price target of $385, which represents an upside of 32.5% from its current levels.

Author’s Valuation Model

My final verdict and conclusions

I believe that Lululemon stock’s drawdown of approximately 43% from its peak in late 2023 to its current level has created an attractive investment opportunity for long-term investors. Although Lululemon is going to see revenue growth slow in FY24, I believe its strategic initiatives of international expansion, while continuing to build on its product innovation and brand campaigns to reignite growth in the Americas region, should start to yield results, especially as inflation is starting to decline, giving rise to the probability of an earlier rate cut. Assuming that the US and the whole Americas region can avoid a recession, we should see growth return in FY25 and beyond, especially as the company continues to open new stores, while growing its e-commerce presence and expanding its membership program. Plus, I also like the management’s focus on financial discipline as it continues to drive its strategic initiatives. Therefore, assessing both the “good” and the “bad,” I believe that the stock is trading at an attractive point to initiate a position in order to drive long-term upside, making it a “buy.”

Source link : https://seekingalpha.com/article/4704465-lululemon-move-over-north-america-global-dominance-is-the-next-milestone

Author :

Publish date : 2024-07-17 00:12:41

Copyright for syndicated content belongs to the linked Source.