Recent advancements have empowered individuals to monitor and enhance their sleep quality, leading to improved overall well-being.

These sensors can track an individual’s heart rate, breathing patterns, sleep duration, and body movements. The data collected is utilized to provide personalized sleep monitoring, enabling individuals to identify patterns and make adjustments for better sleep quality.

Another significant advancement in smart bed technology is the incorporation of customizable cooling and heating options. This feature enables users to set their desired sleeping temperature, ensuring optimal comfort and relaxation.

Beds are also equipped with features like adjustable firmness and pressure relief.

The realm of bed technology has witnessed notable progress in recent times, with continuous enhancements and features being introduced. These innovations have facilitated individuals in monitoring and enhancing their sleep quality, resulting in improved overall health.

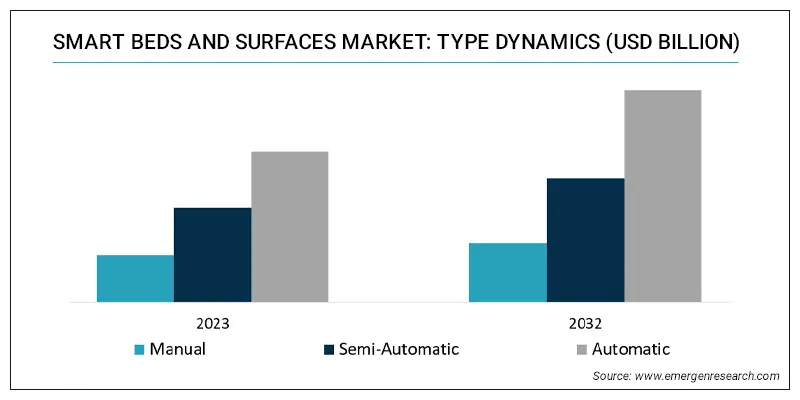

Usage Type Statistics

The increasing popularity of these tech beds is attributed to their ability to provide enhanced sleep experience and comfort. Here are some of the latest statistics on smart bed usage:

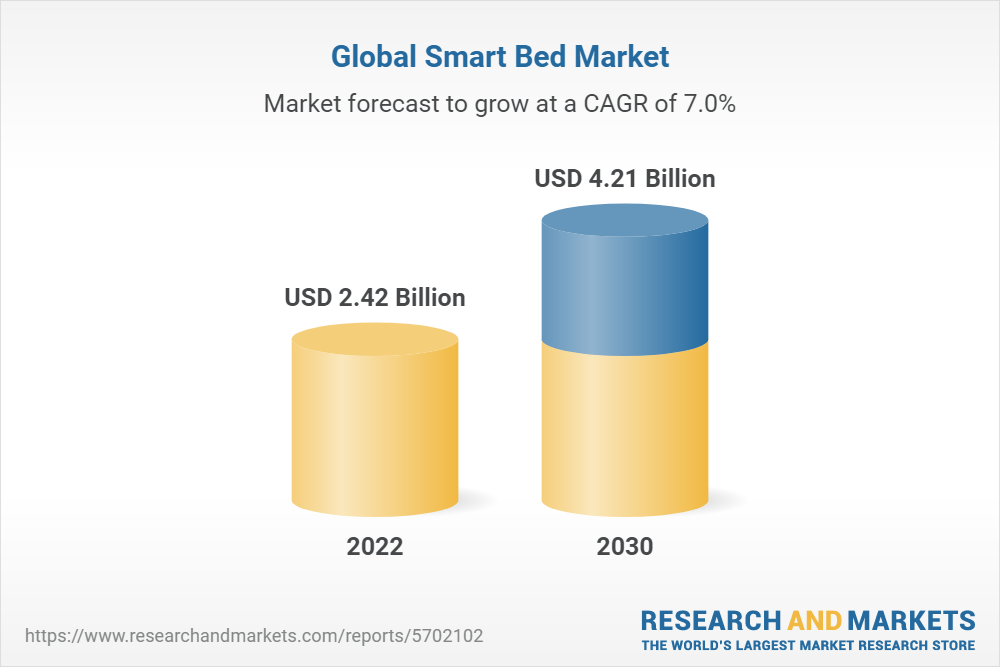

The global market size was valued at $1260.69 million in 2023 and is predicted to reach $3.64 billion by 2028, with a growth rate of 4.8% during the forecast period (2023-2028).

By 2023, the smart bed market is estimated to be valued at $2.88 billion, with an expected CAGR of 6.8% throughout the forecast period.

Hospitals are anticipated to represent 32% of total smart bed usage by 2033, with the North American market poised to lead this trend.

Key players in the smart bed market include Paramount Bed Co., Stryker Corporation, The BodiTrak, Hill Rom Holdings Inc., and Invacare Corporation.

The increased investments in sleep technology due to elevated living standards have fueled the demand for tech beds.

These beds are particularly favored by individuals with chronic pains as they can tailor the bed to offer better support and pressure relief.

Overall, the market is expected to continue its growth trajectory as individuals rediscover the importance of quality sleep and comfort.

Enhance your knowledge of the benefits offered by smart beds for improved sleep and overall well-being.

Statistics by Age Group

In recent years, tech beds have gained recognition for their advanced features and the ability to optimize sleep quality. Equipped with sensors, actuators, and cutting-edge technology, these beds can adjust elements like music, sleeping position, and temperature to enhance sleep. Let’s delve into the demographic data of smart bed users based on available statistics.

According to a report from Mordor Intelligence, the majority of smart bed users fall between the ages of 25 and 54, constituting over 70% of the global market.

Within this demographic, ages ranged from 22 to 52, with a median age of 30.88 years and a standard deviation of 6.19.

Analysis shows that 4.6% of male users and 95.4% of female users reported experiencing varying degrees of benefits from tech beds.

The data also reveals a balanced gender distribution among smart mattress consumers, indicating no significant gender bias.

Income and Education

Smart beds, being more expensive than traditional options, tend to attract customers with higher incomes.

As per Grand View Research, the global smart bed market is poised to grow at a CAGR of 3.8% from 2023 to 2030.

In 2023, around 3.2% of tech bed users were college graduates, 79.7% held a bachelor’s degree, and 17.2% pursued some form of graduate education.

Geographic Location

North America leads as the largest market for smart beds in 2023, capturing 37% to 40% of the global market share.

This is followed by Europe (30%), Asia Pacific (17%), Middle East and Africa (10%), and South America (6%).

In general, smart bed users fall in the 25-54 age bracket.

North America stands out as a key market for technologically advanced beds, followed by Europe and the Asia Pacific region.

Health Benefits

Smart beds are gaining popularity due to their advanced features that enhance sleep quality and monitor health metrics. Let’s explore some of the health benefits associated with smart beds.

Improving Sleep Quality

Smart beds excel at enhancing sleep quality by utilizing sensors to track vital sleep metrics like heart rate, breathing patterns, and movement. These insights are then used to optimize mattress settings for better sleep.

These beds also offer personalized support for various sleep positions, including adjustable firmness settings tailored to individual preferences. This customization reduces pressure points, improves spinal alignment, and reduces snoring, resulting in a more comfortable and restful sleep experience. Some smart beds even include massage features to relieve tension and promote relaxation before sleep.

(Source: terfino.com)

Monitoring Health

Tech beds offer valuable health monitoring features like built-in heart rate monitors that track heart rate variability, providing insights into overall health and stress levels.

They also monitor respiratory rate, aiding in the detection of breathing irregularities indicative of conditions like sleep apnea. By tracking these metrics, smart beds can help users identify potential health issues and take proactive measures.

Additionally, companion apps provide detailed reports on sleep and health metrics, enabling users to spot trends in their data and make informed decisions about their well-being.

In conclusion, smart beds offer a range of health benefits, including improved sleep quality and health monitoring capabilities. By leveraging advanced sensors and technology, these beds help users optimize their sleep and track health metrics, leading to enhanced overall well-being.

Trends in Pricing

The smart bed market is projected to be valued at USD 2.88 billion in 2023.

By 2028, the market is expected to reach $3.64 billion, growing at a CAGR of 4.80% during the forecast period (2023-2028).

Rising demand for sleep technology is a key driver behind this growth, propelling the need for technologically advanced beds.

While prices for some smart beds can exceed $10,000, others are available for less than $1,000, displaying significant price variability based on brand, features, and quality.

Manufacturers are striving to make smart beds more accessible while maintaining quality, leading to the introduction of budget-friendly models with fewer features. These products cater to consumers looking to experience smart beds without a hefty investment. Additionally, financing options are offered by some manufacturers to enhance accessibility to their products.

Key Manufacturers

The smart bed market is set to witness substantial growth, with a projected CAGR of 6.8% for the period 2023-2029. Here are some of the prominent players in the smart bed manufacturing industry:

Sleep Number – Sleep Number stands out as a leading smart bed manufacturer, offering beds equipped with features like sleep tracking, automatic firmness adjustment, and temperature control. These beds are popular among users seeking a personalized and comfortable sleeping experience.

Eight Sleep – Eight Sleep is another major player in the smart bed manufacturing sector, providing beds with advanced features such as temperature regulation, sleep monitoring, and personalized functionalities.

Among customers looking for a high-tech drowsing experience, Eight Sleep is a popular choice.

Tempur-Pedic – A well-established brand in the bed industry, Tempur-Pedic has ventured into the smart bed market with its Tempur-Ergo Smart Base. This base can be paired with any Tempur-Pedic mattress and offers features like adjustable head and foot positions, massage settings, and voice control through Amazon Alexa or Google Assistant.

Revenue and Market Share With estimated sales exceeding $100 million, Manufacturer 1 held a significant market share in the smart bed industry by 2023. This manufacturer has maintained its position as a key player in the market by focusing on innovation and customer-centric strategies.

Revenue and Market Share Manufacturer 2, with estimated sales of $150 million and a market share of 17.36% in 2023, is a major player in the smart mattress market. The company’s sales have been steadily increasing, with a CAGR of 6.5% from 2018 to 2023.

Revenue and Market Share Manufacturer 3, a prominent player in the smart bed market, is one of the leading manufacturers in terms of revenue and market share. The company is expected to achieve $200 million in sales in 2023, indicating significant growth from the previous year.

Challenges

Despite the increasing popularity of smart beds, the industry faces several challenges that may impede its growth. Here are some of the challenges:

One of the most significant challenges in the smart bed industry is the high cost of these products. These beds are relatively new, and the technology used in them is still evolving, resulting in high production costs that make them unaffordable for many consumers.

Another challenge is the limited compatibility of smart beds with other devices. While they are designed to work with smart home devices like speakers, thermostats, and lights, not all devices are compatible with smart beds, limiting their functionality.

Smart beds come equipped with sensors that track sleep patterns, heart rate, and other health metrics. While this data can be valuable for improving sleep quality, it raises privacy concerns as consumers may be reluctant to share their personal information with smart bed manufacturers without assurance of data protection.

Due to the industry’s early stages, there is no standardization regarding the features and functions of smart beds. This lack of standardization makes it challenging for consumers to compare different bed models and make informed decisions, while manufacturers find it difficult to differentiate their products from competitors.

Like any electronic device, smart beds are prone to technical issues ranging from minor glitches to major malfunctions that render the bed unusable. Consumers may hesitate to invest in technology-driven beds if they are uncertain about reliability and effectiveness.

In conclusion, the smart bed industry must address these challenges to make smart beds more affordable, compatible, and reliable for consumers.

Future Predictions for the Market

According to a report by Mordor Intelligence, the tech bed market size is projected to reach USD 2.88 billion in 2023.

The market is anticipated to grow to $3.64 billion by 2028, with a CAGR of 4.80% from 2023 to 2028.

By 2033, the hospital segment is expected to account for 32% of tech bed usage.

The increasing prevalence of lifestyle diseases like obesity, diabetes, and hypertension has driven the demand for technology-driven beds, aiding in improving sleep quality, reducing snoring, and relieving back pain, among other benefits.

Overall, the future looks promising for the technology-driven bed market, fueled by growing consumer and healthcare facility demand. As technology advances and beds become more accessible and affordable, the market is poised for steady growth in the years ahead.

Conclusion

Upon completion of the Smart Bed Statistics article, it can be concluded that the use of these beds has increased globally in 2023. Tech beds have delivered significant health benefits to many patients and improved sleep quality. Features like automatic adjustments, temperature control, sleep tracking apps, smart home integration, snore detection, firmness, and elevation have contributed to these benefits. The statistics presented in this article provide valuable insights for better understanding the topic.

[3px] border-t-[3px] p-4 border-[#1d598f] my-4″ style=”box-shadow: 0 0 14px rgb(9 38 66 / 8%);”>

Sources

Are smart beds effective in improving sleep?

Smart beds are designed to enhance sleep quality by providing personalized comfort and support. They utilize sensors and other technologies to adjust the mattress’s firmness, temperature, and position to meet the user’s requirements. However, the efficacy of smart beds in enhancing sleep satisfaction may differ based on individual sleep patterns and preferences.

Who are the primary customers of smart beds?

Smart beds are gaining popularity among customers who prioritize sleep quality and are willing to invest in technology for better sleep experiences. Typically, the main buyers of smart beds are middle-aged or older adults dealing with sleep disorders, chronic pains, or other health issues that impact their rest.

What is the average lifespan of a smart mattress?

The longevity of a smart bed depends on various factors, including material quality, frequency of usage, and maintenance. Typically, a high-quality smart mattress can last up to 10 years or even longer when properly cared for.

Smart Bed Statistics 2023: The Latest Trends and Insights

The data is sourced from 2023 and 2024, with forecasted information extending to 2025, 2026, 2027, and 2028.

——

REFERENCES:

This information was taken from various sources around the world, including these countries:

Australia, Canada, USA, UK, UAE, India, Pakistan, Philippines, Indonesia, Nigeria, Tanzania, Kenya, US, United Kingdom, United States of America, Malaysia, U.S., South Africa, New Zealand, Turkey, United Arab Emirates.

Afghanistan, Albania, Algeria, American Samoa, Andorra, Angola, Anguilla, Antarctica, Antigua and Barbuda, Argentina, Armenia, Aruba, Australia, Austria, Azerbaijan.

Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Belgium, Belize, Benin, Bermuda, Bhutan, Bolivia, Bosnia and Herzegovina, Botswana, Bouvet Island, Brazil, British Indian Ocean Territory, Brunei Darussalam, Bulgaria, Burkina Faso, Burundi.

Cambodia, Cameroon, Canada, Cape Verde, Cayman Islands, Central African Republic, Chad, Chile, China, Christmas Island, Cocos (Keeling Islands), Colombia, Comoros, Congo, Cook Islands, Costa Rica, Cote D’Ivoire (Ivory Coast), Croatia (Hrvatska), Cuba, Cyprus, Czech Republic.

Denmark, Djibouti, Dominica, Dominican Republic, East Timor, Ecuador, Egypt, El Salvador, Equatorial Guinea, Eritrea, Estonia, Ethiopia, Falkland Islands (Malvinas), Faroe Islands, Fiji, Finland, France, Metropolitan, French Guiana, French Polynesia, French Southern Territories.

Gabon, Gambia, Georgia, Germany, Ghana, Gibraltar, Greece, Greenland, Grenada, Guadeloupe, Guam, Guatemala, Guinea, Guinea-Bissau, Guyana, Haiti, Heard and McDonald Islands, Honduras, Hong Kong, Hungary, Iceland, India, Indonesia, Iran, Iraq, Ireland, Israel, Italy.

Jamaica, Japan, Jordan, Kazakhstan, Kenya, Kiribati, North Korea, South Korea, Kuwait, Kyrgyzstan, Laos, Latvia, Lebanon, Lesotho, Liberia, Libya, Liechtenstein, Lithuania, Luxembourg.

Macau, Macedonia, Madagascar, Malawi, Malaysia, Maldives, Mali, Malta, Marshall Islands, Martinique, Mauritania, Mauritius, Mayotte, Mexico, Micronesia, Moldova, Monaco, Mongolia, Montserrat, Morocco, Mozambique, Myanmar.

Namibia, Nauru, Nepal, Netherlands, Netherlands Antilles, New Caledonia, New Zealand (NZ), Nicaragua, Niger, Nigeria, Niue, Norfolk Island, Northern Mariana Islands, Norway.

Oman, Pakistan, Palau, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Pitcairn, Poland, Portugal, Puerto Rico, Qatar, Reunion, Romania, Russia, Rwanda, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and The Grenadines, Samoa, San Marino, Sao Tome and Principe.

Saudi Arabia, Senegal, Serbia, Seychelles, Sierra Leone, Singapore, Slovakia, Slovenia, Solomon Islands, Somalia, South Africa, South Georgia and South Sandwich Islands, Spain, Sri Lanka, St. Helena, St. Pierre and Miquelon, Sudan, Suriname, Svalbard and Jan Mayen Islands, Swaziland, Sweden, Switzerland, Syria.

Taiwan, Tajikistan, Tanzania, Thailand, Togo, Tokelau, Tonga, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Turks and Caicos Islands, Tuvalu, Uganda, Ukraine, United Arab Emirates (UAE), UK (United Kingdom), USA (United States of America, U.S.), US Minor Outlying Islands.

Uruguay, Uzbekistan, Vanuatu, Vatican City State (Holy See), Venezuela, Vietnam, Virgin Islands (British), Virgin Islands (US), Wallis and Futuna Islands, Western Sahara, Yemen, Yugoslavia, Zaire, Zambia, Zimbabwe.

Smart Bed Statistics 2023: The Latest Trends and Insights

August 20, 2024

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66cc521a60ec4993845a6a821b7d9c11&url=https%3A%2F%2Fhollywoodgazette.com%2Fsmart-bed-statistics-html%2F&c=14688395919065265504&mkt=en-us

Author :

Publish date : 2024-08-25 22:23:00

Copyright for syndicated content belongs to the linked Source.