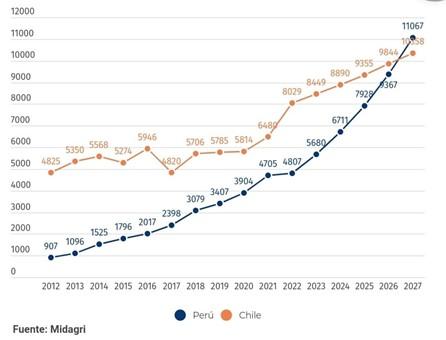

Peru Poised to Surpass Chile as South America’s Leading Fruit Exporter by 2025

In a significant shift in the agricultural landscape of South America, Peru is set to overtake Chile as the continent’s largest exporter of fruit by 2025, according to industry forecasts from FreshPlaza. This anticipated transition underscores Peru’s growth in the agricultural sector, fueled by favorable climate conditions, increased investment in technology, and a growing global demand for diverse fruit varieties. As both countries compete in the lucrative export market, experts highlight the potential economic implications for Peruvian agriculture and the challenges that lie ahead for Chilean producers. With this evolving dynamic, stakeholders across the region are closely monitoring trends that could reshape the fruit export industry and impact trade relations within South America and beyond.

Peru’s Strategic Farming Practices Set to Propel Fruit Export Growth

Peru is poised to become a titan in the global fruit export market, leveraging its unique geographical advantages and innovative agricultural techniques. As the country invests in advanced farming practices, it is expected to enhance both the quality and quantity of its produce. These practices include:

- Precision Agriculture: Employing technology to monitor crop health and optimize resource usage.

- Integrated Pest Management: Utilizing biological controls to reduce pesticide reliance and promote sustainable production.

- Soil Health Management: Employing organic fertilizers and crop rotation to enhance soil fertility.

This strategic approach has positioned Peruvian farmers to tap into lucrative international markets, with projections indicating a significant increase in the export of popular fruits such as avocados, grapes, and blueberries. The recent trade agreements and investments in infrastructure have further facilitated the expansion of exporting capabilities, making Peru an attractive player in the global fruit industry. Below is a comparison table of the projected growth rates of fruit exports:

| Year | Peru (US$ billion) | Chile (US$ billion) |

|---|---|---|

| 2023 | 2.5 | 3.0 |

| 2024 | 3.0 | 3.2 |

| 2025 | 3.7 | 3.5 |

Economic Implications of Peru’s Rise in the South American Fruit Market

The anticipated shift in leadership from Chile to Peru as South America’s dominant fruit exporter by 2025 signals profound economic implications for the region. This transformation highlights several key aspects that could reshape trade dynamics:

- Increased Foreign Direct Investment: As Peru’s fruit market expands, it is likely to attract significant foreign investment, particularly in agribusiness and logistics sectors.

- Job Creation: The rise in production and export capacities can lead to job opportunities in agriculture, transportation, and sales, contributing positively to Peru’s economy.

- Trade Partnerships: With improved export capabilities, Peru may foster new trade agreements, enhancing its relationships with international buyers and markets.

Moreover, this shift is expected to create a ripple effect throughout the region, influencing neighboring countries and their agricultural sectors. Chile, historically the forerunner, may need to reassess its strategies to maintain competitiveness. The economic landscape could alter as follows:

- Price Adjustments: Changes in export volumes may affect market prices, potentially lowering costs for consumers but impacting producer margins.

- Innovation and Technology Adoption: Increased competition may spur Chilean producers to innovate and modernize their farming techniques, impacting the overall quality and sustainability of production.

- Market Diversification: As Peru expands its reach, other countries may seize opportunities to diversify their own agricultural exports, fostering greater regional economic interdependence.

Recommendations for Chilean Farmers to Compete in an Evolving Export Landscape

As the competitive landscape of fruit export shifts with Peru poised to surpass Chile, farmers in Chile must adopt strategic approaches to maintain their market position. Innovative farming practices that integrate sustainable agriculture can improve yield quality and minimize production costs. Leveraging technology such as precision agriculture tools can enhance water management and soil health, ultimately boosting productivity. Moreover, investing in crop diversification will help mitigate risks associated with fluctuating demand and climatic changes, allowing farmers to cater to a broader market segment.

To further solidify their competitive edge, Chilean farmers should engage in strategic partnerships and collaborations. Establishing connections with international buyers and participating in global trade fairs can provide valuable insights into market trends and consumer preferences. Additionally, enhancing branding efforts, coupled with a commitment to quality assurance and certifications such as GlobalGAP, will increase product appeal on the international stage. Farmers are encouraged to explore digital marketing strategies to reach consumers directly, utilizing social media platforms to create a strong online presence and showcase the unique qualities of Chilean produce.

Closing Remarks

In conclusion, the anticipated shift in fruit export dominance from Chile to Peru by 2025 marks a significant milestone in the agricultural landscape of South America. With its diverse climate, expanding infrastructure, and commitment to innovation, Peru is poised to capitalize on the growing global demand for fresh produce. As the nation continues to enhance its export strategies and expand its agricultural capabilities, industry stakeholders will need to closely monitor this developing scenario. The changing tides of fruit exportation not only reflect economic dynamics but also underscore the increasing importance of sustainable practices in agriculture. With all eyes on Peru’s burgeoning export potential, the coming years will be crucial for both countries as they navigate this competitive market.