All these events are connected by one vast global transfer of wealth. Climate damage is paid for in nickels and dimes, by individuals in rich countries and poor ones.

Homeowners unable to pay for their home coverage, or quitting their suburbs altogether because of increased risk of flood or wildfire, are bearing the cost in the form of insurance premiums and reduced property values. In less affluent corners of the world, the expenditure is even more devastating, as money that should be invested in growth is spent instead on repairing the effects of natural disasters. Of about $687 billion in annual damages that one influential study estimates will be caused in a 2030 world under 2.7 Celsius of warming, $426 billion will be incurred in developing countries.

The profits from this despoliation, however, accrue to companies, whether privately- or state-owned.

It’s dispiriting that the improving economics of clean power, and the rising devastation caused by atmospheric carbon, haven’t prompted a more dramatic shift in the politics of this question.

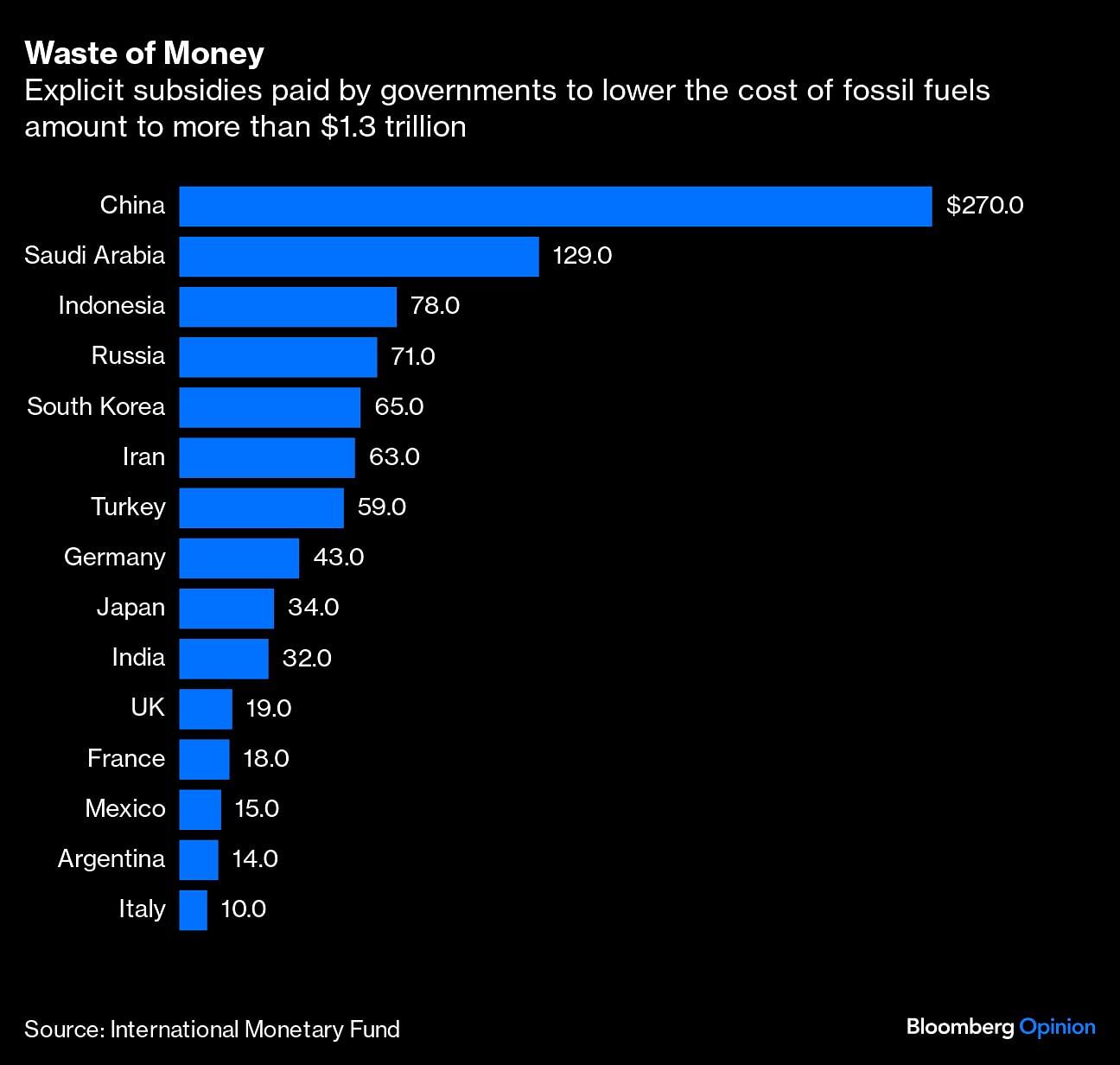

Instead, the opposite has happened in recent years. Direct subsidies paid by governments to make fossil fuels cheaper almost doubled to $1.3 trillion in 2022 from $500 billion in 2020, though they’re likely to have reduced a bit since then thanks to cheaper oil and gas prices. Combine that with the tariffs increasingly imposed on electric vehicles, batteries, and solar panels, and governments are deploying their fiscal powers to raise the cost of clean energy, while reducing the cost of carbon pollution — a desperately counterproductive state of affairs.

Signs of a turning point in humanity’s fossil fuel addiction are everywhere, from evidence that China’s emissions are peaking this year, to the ongoing failure of crude oil output to climb above levels it hit in 2018.

Still, emissions need to not just plateau, but fall dramatically over the coming decade, and then the decade after that. At this point, politics and profit are making it harder for us to hit that target.

Published 10 July 2024, 06:30 IST

Source link : https://www.deccanherald.com/opinion/the-great-climate-change-wealth-transfer-is-here-3099701

Author :

Publish date : 2024-07-09 14:00:00

Copyright for syndicated content belongs to the linked Source.