Title: GILTI and Its Impact on the US Virgin Islands: A Closer Look at Pasquines

In recent years, the Global Intangible Low-Taxed Income (GILTI) provision of the U.S. tax code has emerged as a focal point of concern and debate among jurisdictions vying for economic growth and stability. For the US Virgin Islands (USVI), a territory already grappling with unique economic challenges, GILTI presents both opportunities and hurdles. As businesses operating in the islands navigate the complexities of this tax framework, the consequences ripple through local economies, raising critical questions about sustainability, investment, and the future of the territory’s financial landscape. In this article, we explore the intricacies of GILTI, its implications for the US Virgin Islands, and the broader consequences for the territory’s residents and industries.

GILTI’s Implications for Economic Stability in the US Virgin Islands

The implementation of the Global Intangible Low-Taxed Income (GILTI) provision has ushered in significant economic repercussions for the US Virgin Islands. With many corporations utilizing the islands as a strategic base for tax purposes, the GILTI regulations have prompted a reevaluation of their financial strategies. As companies face higher effective tax rates on their foreign income, the potential outflow of businesses from these territories has raised concerns about sustained economic growth and stability. This exodus could lead to diminished investments, decreased job opportunities, and a slowdown in the local economy.

Moreover, the implications of GILTI extend beyond transient corporate interests, revealing critical societal challenges. Key sectors, such as tourism and manufacturing, may suffer collateral damage as businesses reassess their commitments under the new tax landscape. To mitigate potential declines, local policymakers could explore incentives or adjustments that bolster traditional industries. Some potential actions include:

- Tax Credits: Offering credits for businesses maintaining operations in the region.

- Investment Infrastructures: Enhancing public amenities to attract further investment.

- Collaborative Initiatives: Partnering with private entities to innovate and diversify the economy.

Navigating the Challenges of GILTI: Strategies for Local Businesses

The introduction of Global Intangible Low-Taxed Income (GILTI) regulations has ushered in a new era of complexity for local businesses in the US Virgin Islands. To effectively navigate these waters, it’s critical for business owners to implement strategic adjustments that will mitigate the impact of GILTI on their operations. Understanding the nuances of GILTI compliance is essential; businesses should prioritize the following strategies:

- Conducting Regular Tax Assessments: Periodically review tax obligations to identify potential GILTI exposure and opportunities for minimizing tax liabilities.

- Utilizing Tax Incentives: Leverage local tax incentives designed to promote economic growth while aligning with GILTI considerations.

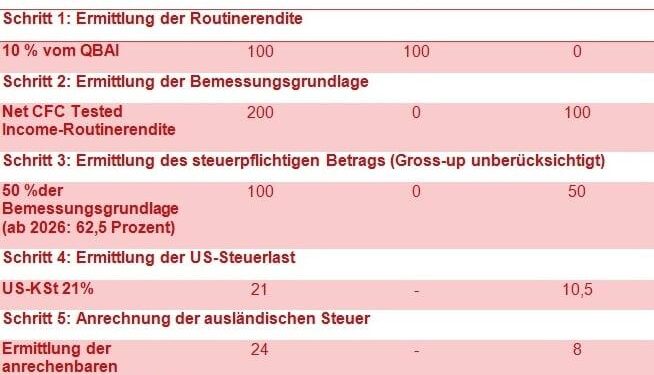

- Maximizing Foreign Tax Credits: Ensure proper accounting of foreign taxes paid to optimize benefits under GILTI rules.

Moreover, collaboration with tax professionals who possess expertise in international tax law is imperative. Establishing a strong partnership can provide valuable insights and enable businesses to develop tailored solutions that address their specific circumstances. Key considerations include:

- Reevaluating Corporate Structures: Analyze and restructure corporate entities to minimize GILTI implications.

- Enhanced Record-Keeping: Maintain meticulous records to substantiate claims and support deductions.

- Staying Informed: Regularly update knowledge about changes in GILTI regulations and international tax laws.

Policy Recommendations to Mitigate GILTI’s Impact on the US Virgin Islands Economy

To address the adverse effects of GILTI on the economy of the U.S. Virgin Islands, a set of policy initiatives should be considered. Increasing local investment incentives is crucial. By offering tax credits and favorable financing options, the government can attract a wider range of businesses, thus diversifying the economic base. Support for entrepreneurship should also be emphasized, particularly for local startups, through grants and training programs aimed at enhancing business acumen and operational capacity. This could help mitigate the negative impacts of external corporate structures that GILTI encourages.

Additionally, collaboration with federal agencies can create tailored solutions to adapt GILTI provisions to the unique circumstances of the islands. Implementing a long-term economic development plan that prioritizes sustainability and resilience is essential in this regard. This plan should focus on tourism, renewable energy, and technology sectors. Acknowledging the potential for export growth, especially in niche markets, should be a vital component. These strategies, combined with a strong workforce development program, will enable the USVI to build a robust economy responsive to external challenges posed by international tax reforms.

In Conclusion

In conclusion, the Global Intangible Low-Taxed Income (GILTI) provision has significant implications for the economy of the U.S. Virgin Islands, reshaping the landscape of international business and tax policy within the territory. While designed to curb profit shifting to low-tax jurisdictions, GILTI has also prompted debates surrounding its effects on local businesses and the broader community. As the U.S. government continues to evaluate and refine its tax policies, the Virgin Islands must navigate the challenges posed by GILTI while striving to foster an environment conducive to growth and investment. Moving forward, stakeholders in the territory will need to engage in constructive dialogue to ensure that the interests of both local businesses and global corporations are effectively balanced, securing a sustainable economic future amid evolving regulatory frameworks.