– Rallying LNG prices have pushed natural gas prices to a premium over crude oil, with the regionтАЩs benchmark JKM quotes on average 22% higher than oil per GJ, prompting regional power generators to seek to switch away to cheaper fuels. ┬а

– Thanks to weakening fuel oil cracks, power plants across Asia might be tempted to run on fuel oil for electricity and diesel-type fuels for heating and transport, lifting demand for heavy distillates after Asian imports dipped last year below 5 million b/d.

– The average price for February-delivery cargoes of LNG into Northeast Asia rose to $14.5 per mmBtu, supported by the end of RussiaтАЩs Ukraine transit and unusually cold temperatures across Europe.

– The correlation between EuropeтАЩs TTF and AsiaтАЩs LNG prices rose notably in 2024, averaging 94% in January-September and then falling marginally to 91%, suggesting that EuropeтАЩs continued gas supply woes keep on pushing Asian prices higher.┬а┬а

Russian Oil Exports Collapse as Refineries Regain Their Mojo

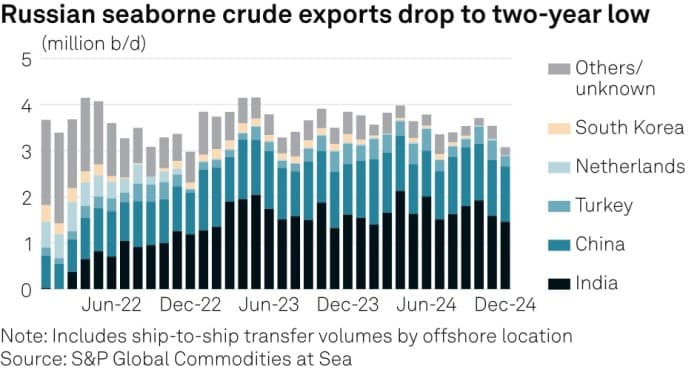

– RussiaтАЩs seaborne crude exports fell to a two-year low last month as the end of refinery maintenance and relatively little damage from Ukrainian drone attacks lifted the countryтАЩs downstream performance. ┬а

– Crude shipments by sea averaged only 3.07 million b/d, down 13% compared to the November reading of 3.53 million b/d, all the while oil product exports rose to their highest since April at 2.57 million b/d.

– India felt the sudden decline in Russian volumes as its imports dipped to a 10-month low of 1.46 million b/d, needing to replace those missing barrels by spot purchases from the Middle East.

– As the US Treasury Department rolls out its last set of Russia sanctions targeting more than 100 tankers, Russia has been moving 80% of its crude exports on ships that are not flagged, owned or operated by G7 countries.

Beijing Bets on State Oil Firms as Teapots Dwindle

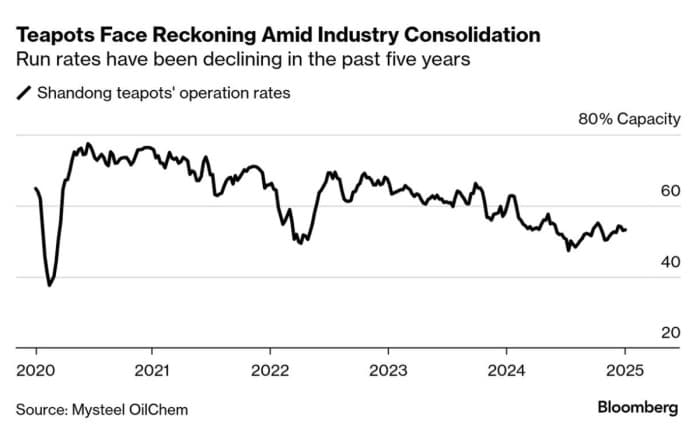

– ChinaтАЩs independent refiners (often called тАШteapotsтАЩ) will be fighting for survival in 2025 as Beijing stepped up pressure on them, prioritizing state-owned oil majors as peak oil demand looms on the horizon for the Asian powerhouse.

– The Chinese government handpicks refiners that can have crude import quotas, with teapots often relying on fuel oil as a refining feedstock, but Beijing has raised the fuel oil import tariff to 3% from 1% previously, shaving off some $2 per barrel from their profits.

– Chinese teapots have been running at 55% or less capacity and would most probably see even lower throughput rates as state-owned refinery expansions take their place, with Sinopec expecting 9 mtpa of capacity (180,000 b/d) to be shuttered in 2025 alone.

– Teapots in the Shandong region have been by far the largest buyers of Iranian barrels, recently soaring above 1.5 million b/d in total volumes, and Beijing might be tempted to sacrifice independent refiners vis-├а-vis President Trump.

MaduroтАЩs Inauguration to Test TrumpтАЩs Sanctioning Resolve

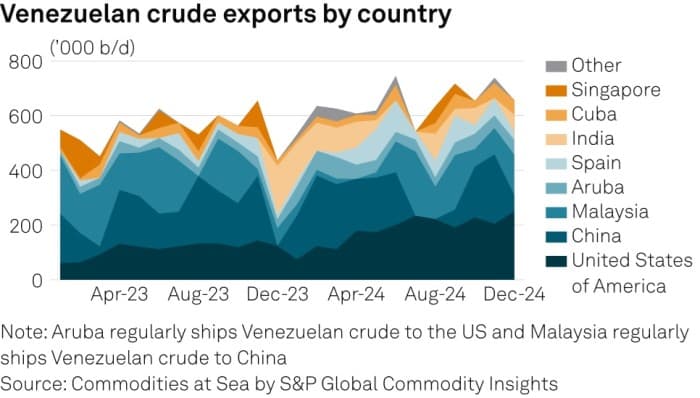

– Venezuela is bracing for chaos and confusion as both Nicolas Maduro and his exiled opposition rival Edmundo Gonzalez prepare to be sworn in as presidents at the countryтАЩs January 10 inauguration. ┬а

– With Trump coming back to office, analysts expect the US to scale back sanction waivers and potentially even cancel all licenses except for ChevronтАЩs as Venezuelan oil has recently started to flow to India, Spain, and Italy.

– Venezuela has reported its December production at 998,000 b/d, a 24% increase year-over-year as more naphtha diluents from the US and Europe have helped PDVSA run its crude upgraders higher. ┬а┬а┬а┬а

– Following the recent arrest of previous oil minister Pedro Tellechea, Maduro has shuffled Energy Ministry and PDVSA officials, claiming that the South American nationтАЩs new focus would be on natural gas.

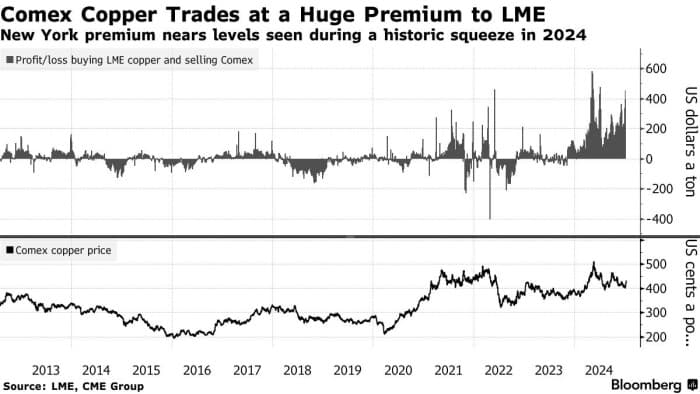

Trump Risk Premium Sets New York Futures Above Market

– New York futures of copper and silver have been rising above rival international price benchmarks in what could be described as the emergence of a тАШTrump premiumтАЩ as markets weight the probability of import tariffs. ┬а

– Front-month COMEX silver futures traded at above a $0.90 per ounce premium compared to London prices, whilst New York copper futures were higher by 623 per metric tonne than equivalent LME futures.

– The Washington Post reported that the Trump administration will seek to implement narrower import tariffs on critical goods, a category that might potentially include copper, subsequently denied by Trump.

– The threat of import tariffs has most probably led to traders rushing to ship copper and silver into US warehouses before any Trump action, with drained silver inventories globally posing a risk of a bullion squeeze.

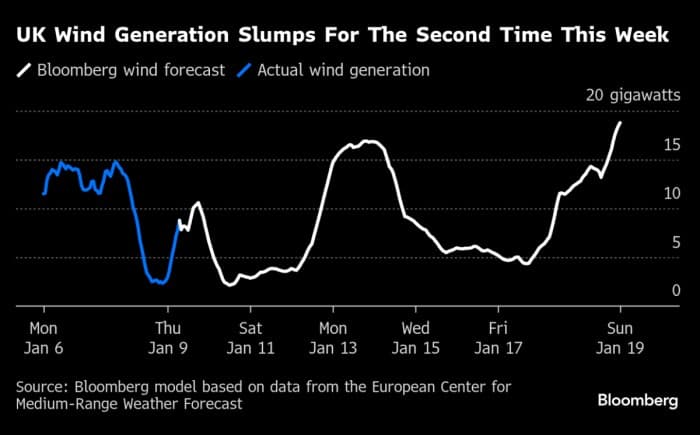

UK Power Prices Spiral Out of Control as Winds Ease

– UK markets have been the talk of the town in Europe this week after 10-year government bonds surged to their highest since 2008 and hit 4.925%, but securities arenтАЩt the only problem affecting Great Britain. ┬а

– Intra-day power prices skyrocketed to ┬г1,778 per MWh ($2187/MWh) earlier this week and day-ahead power prices continue to trade around ┬г390/MWh ($480/MWh) as wind generation ground to a halt just as a prolonged cold snap gripped the UK.┬а

– Operators of gas-fired power plants have been raking in huge profits as the grid operator invited non-intermittent generators to step up their output, with VitolтАЩs Rye House plant in Hertfordshire selling electricity to London for ┬г5,000 per MWh.

– Gas flows from Belgium through the Zeebrugge-Bacton interconnector jumped to the highest since 2021, prompting UK buyers of LNG to expedite their purchases of spot cargoes after halving LNG imports in 2024.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=678161c2639b48d3b1a196117fb4495a&url=https%3A%2F%2Foilprice.com%2FEnergy%2FEnergy-General%2FAmericas-Reliance-on-Natural-Gas-Is-Only-Growing.html&c=16974546856834645667&mkt=en-us

Author :

Publish date : 2025-01-10 00:30:00

Copyright for syndicated content belongs to the linked Source.