Market analysts are warning that tariffs proposed by President-elect Donald Trump may have a negative impact on Arkansas farmers.

During a virtual panel discussion Wednesday, analysts with global market intelligence firm RaboResearch warned that if tariffs are placed on imports from China, farmers who export commodity crops to the Chinese market could face a potential backlash.

Throughout his campaign, Trump spoke about a universal tariff of up to 20% on many foreign-made products, and tariffs of 60% or more on Chinese goods. The Biden Administration kept many tariffs on China in place, especially on steel, solar panels, clothing and other goods.

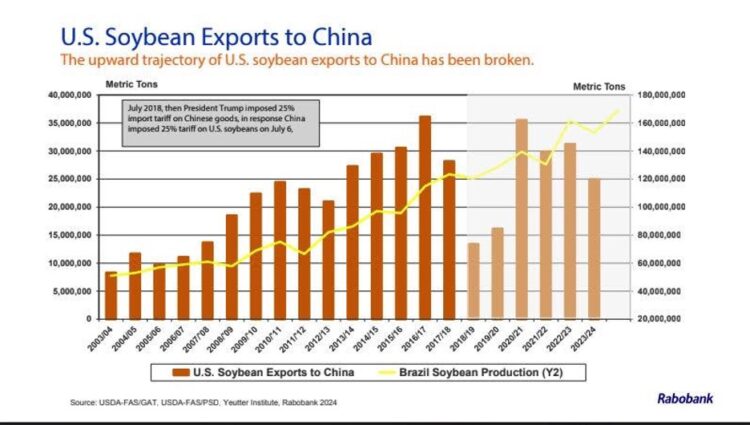

“His campaign has been that we are going to raise tariffs on everyone 20% and China is going to get an extra dose of up to 60% tariffs, but I don’t think he has named a specific commodity,” Steve Nicholson, a global strategist at RaboResearch, said. “When 2018 and 2019 came along and the former Trump administration put in the export-import tariff to China, they retaliated, and United States soybeans suffered as did prices. We’ve recovered, but only when Brazil had a bad crop year, and this is something we need to be wary of as we go forward in these next four years.”

Nicholson presented a graph with data from the U.S. Department of Agriculture showing Brazil’s soybean production outcompeting the U.S. as the trade war with China began during Trump’s previous term as president.

“And I understand the concern from a place like Arkansas, which is very tied to exporting soybeans, rice and cotton down the river and out of the United States,” Nicholson said.

RaboResearch is part of Rabobank, a cooperative bank that focuses on the food and agriculture sector globally. Four analysts joined to share forecasts on the future of the agricultural industry in North America in a media event Wednesday.

China is one of America’s largest trading partners for agricultural products according to data from the U.S. Department of Agriculture, with exports to China being valued at $33 billion.

If tariffs increase on Chinese imports, China may place tariffs on American imports, inflaming the trade war as the Chinese have done in the past. Reuters reported earlier in November that since the trade war with China during the first Trump administration, China has since shifted its agricultural imports to Brazil, Argentina, Ukraine and Australia while also bolstering domestic production.

“China’s push to shift its food import sources since 2018 has put it in a better position to impose tit-for-tat tariffs on U.S. farm goods with less harm to its food security if trade friction with Washington flares after the U.S. presidential election,” Reuters reported.

Agriculture is Arkansas’s largest industry, and Arkansas farmers grow their fair share of commodity crops like rice, soybeans, wheat and corn to export to markets abroad. According to Arkansas Farm Bureau, a trade association representing farmers, 50% of soybeans and 60% of rice produced in Arkansas are destined for export.

Annually, Arkansas farmers grow more than three million acres of soybeans and rice.

According to Nicholson, it is still uncertain Trump could unilaterally impose the universal tariff he has proposed on the campaign trail.

“The President does have the power to make specific tariffs or protectionist measures for particular industries in the United States,” Nicholson said. “So I think the law is fairly settled that he can do that. The steel or sugar industries are good examples. But when you think about overall tariffs, the law is a little more unsettled. There have been some arguments that he cannot make that decision without congressional approval. There will be a lot of arguing over that and it will probably go to court.”

Other analysts discussed how an inflamed trade war between the U.S. and China may redirect farmers from exporting toward trying to fill niche domestic and specialty markets.

“One approach could be to continue to hammer away at this commodity model, trying to produce more commodities at the lowest price possible,” senior analyst Owen Wagner said. “But I think we all need to approach this mentality with caution. Recognizing just how competent our Brazilian competitors have become and leveraged trade wars to their advantage.”

Wagner said that commodity row crop farmers may transition to supplying domestic markets to earn a better income in an era of protectionist trade policies.

The U.S. Department of Agriculture is projecting massive losses in income for Arkansas delta row-crop farmers this year because of lackluster prices for commodity crops on global markets.

“This is not the end of agricultural commodities in the United States. We are home to some of the best farmland in the world, if not the best,” Wagner said. “But we need to start thinking about other alternatives. Do we want to continue to feed Chinese pigs or consumers in California, organic wheats, and some of these products that have come in vogue for which [consumers] have demonstrated a willingness to pay a premium. Maybe this is the realistic way out.”

Previously, the Arkansas Times reported on efforts to expand specialty crop growth in Arkansas, but challenges do remain.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=67354a35c16d40c1b849bddf233aaf2e&url=https%3A%2F%2Farktimes.com%2Farkansas-blog%2F2024%2F11%2F13%2Fanalysts-warn-that-arkansas-farmers-will-likely-face-backlash-from-trump-tariffs&c=6311745064080913222&mkt=en-us

Author :

Publish date : 2024-11-13 09:44:00

Copyright for syndicated content belongs to the linked Source.