The Cato Institute on Tuesday published its 17th biennial Fiscal Policy Report Card on America’s Governors, evaluating 50 state leaders and their tax and spending policies since 2022.

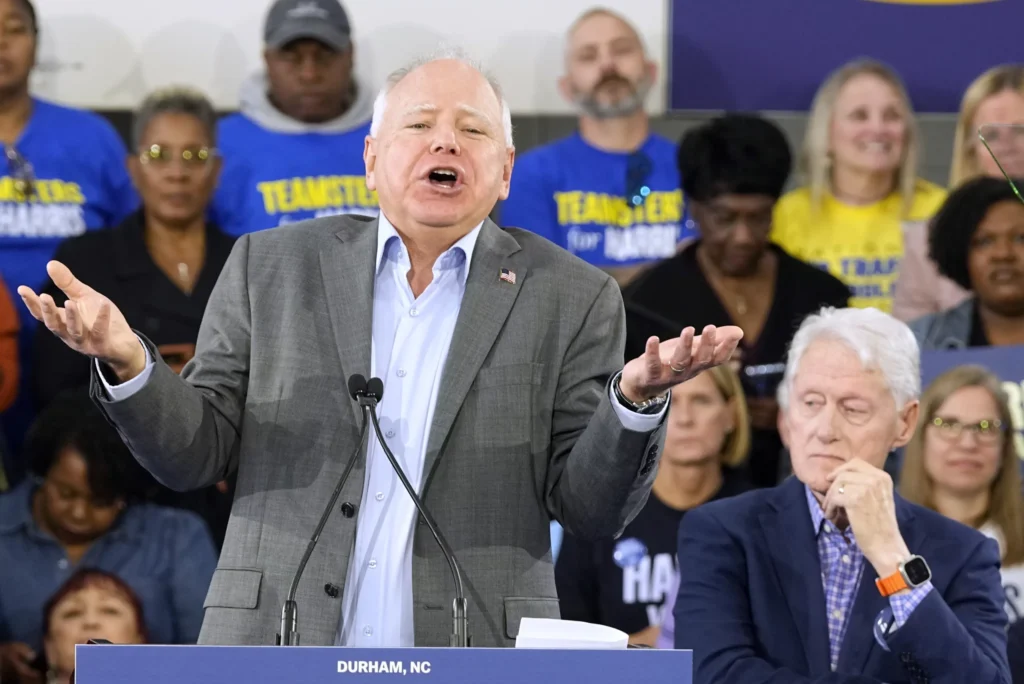

A half a dozen governors — Kim Reynolds of Iowa, Jim Pillen of Nebraska, Jim Justice of West Virginia, Sarah Huckabee Sanders of Arkansas, Kristi Noem of South Dakota, and Greg Gianforte of Montana — received A’s for controlling taxes and spending. On the other end, Tim Walz of Minnesota ranked dead last among governors.

Chris Edwards, author of the report, explained Walz’s low score.

“His biennial budget in 2023 hiked spending 36 percent, and he has raised business taxes, payroll taxes, vehicle taxes, and individual income taxes,” Edwards said. “His F grade is well-deserved.”

Walz’s poor grade is indeed well-earned.

As economist John Phelan pointed out recently in the Star Tribune, Walz oversaw a $17.6 billion budget surplus in 2023, which he squandered on various new spending schemes. As a result, the Gopher State is projected to have a budget deficit in the upcoming fiscal years — even though Walz and the legislature increased taxes on everything from income and sales to gasoline, food deliveries, cannabis, boats, and businesses.

“Walz not only blew through every cent of an $18 billion budget surplus but hiked taxes and fees by a further $10 billion on top of that,” Phelan, an economist with the Center of the American Experiment, told me. “He did this at a time when governors across America were cutting taxes.”

Phelan isn’t wrong. Walz blew through the state’s budget surplus and hiked taxes even as most states were cutting taxes. The State Policy Network reports that 26 states reduced the tax burden on citizens from 2021 to 2023.

As a result of these policies, Minnesota became an exodus state. Data show families with children are fleeing the state, as are high-income earners. The outflow of high-income earners won’t just result in less tax revenue. It will result in less human capital, less wealth creation, and less wealth. Indeed, under Walz, for the first time in modern history, Minnesota has fallen below the national average in GDP per capita.

Walz’s poor fiscal record is not the only reason Minnesotans are leaving the Gopher State, of course. People choose to move for all sorts of reasons, positive ones and negative ones, and there were plenty of negative reasons in recent years, including the worst riots in the state’s history and Walz’s dreadful COVID-19 policies. But there’s little question that Walz’s fiscal policies have had a draining effect on Minnesota’s economy.

While Walz recently touted a CNBC study that found Minnesota was a top-five state in which to live and work, the nonpartisan Tax Foundation found that Minnesota ranks 44th out of the 50 states in its 2024 State Business Tax Climate Index, continuing a decade-plus trend.

None of this bodes well for the future of Minnesota, and it’s part of a much larger trend the Atlantic observed last year, which shows a steady migration of workers from high-tax, highly regulated blue states to red states with lower taxes, less regulation, and lower housing costs.

“Florida and Texas were last year’s top states for inbound domestic migration, with New York and California in the rear,” Isabel Fattal wrote.

People may not think of Minnesota as a deeply blue state like New York and California, but its fiscal policies have become much bluer under Walz, which is one reason high-income earners are leaving.

In his Cato report, Edwards notes that IRS data show Minnesota is losing 10 households with incomes over $200,000 for every six it is adding. This also fits the larger national trend reflected in IRS data, which show that the people fleeing high-tax states tend to be wealthier taxpayers and entrepreneurs. As one economist put it, “The geese [who lay] the golden eggs are flying away.”

To be fair, a great deal of economic infantilism exists on both sides of the political aisle, especially at the national level, where Walz’s political opponents have likewise embraced numerous bad policies, including nonsensical tariffs and caps on credit card interest rates, that would result in serious economic harm.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Presidential politics aside, Walz’s fiscal record as governor is clear. He blew an $18 billion budget surplus while heaping a bevy of new taxes on Minnesotans to grow government.

By empowering bureaucrats instead of embracing free markets, Minnesota is likely to continue to bleed business investment and lose high-income earners to more tax-friendly states — at least until lawmakers put the government on a diet.

Jon Miltimore is senior editor at the American Institute for Economic Research. Follow him on Substack.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=6712865073074a48a7a4957f46c67b90&url=https%3A%2F%2Fwww.washingtonexaminer.com%2Fopinion%2F3194544%2Fwalz-ranks-dead-last-among-us-governors-fiscal-report-card%2F&c=9752931469975875640&mkt=en-us

Author :

Publish date : 2024-10-18 03:34:00

Copyright for syndicated content belongs to the linked Source.