Natural тБгGas тАМWeeklyтБг Update – EIA: trendsтАМ andтАМ InsightsтАМ in the Energy Market

As global energy тАЛmarkets тАНcontinue to navigate тБвthe complexities of supply and demand, тАНthe U.S.Energy Information administration (EIA) plays a crucialтАМ role тАНin providing тАНtimely тБдupdates тБвand analysis on the country’s natural gas landscape.In this week’sтАН report, we delve intoтАН the latestтАЛ trends in тАЛnatural gas production, storage levels, тБдand тБвpricing fluctuations thatтАМ shape тАЛboth theтАН domestic тАМand internationalтБв energy sectors. With factors suchтАЛ as weather patterns, geopolitical tensions, тАНand economicтБд shifts influencingтАН market dynamics, тБвour comprehensive analysis тАНwill offer stakeholdersтАМ a clearerтАМ understanding of currentтБв conditions and forecasts.тБг Join us as we unpack the essential findings fromтБг theтБг EIA’s latest weeklyтБг update, equipping readers with тБгthe insights necessary toтБг graspтБд the evolving narrative ofтБв this vital energy resource.

CurrentтБд Price тАНTrendsтБд andтАН Market dynamics

the current landscape тАМof natural gas prices тАЛhas been marked by significant тАЛfluctuations,тАН primarily driven тБгby a combination of weather patterns, тБгsupply chainтБд disruptions, and shifts тАЛin domestic and international demand.тАЛ over тАЛtheтАЛ past week, тБвthe benchmarks тАЛhaveтАМ shown a tendency towards instability, with тАНprices responding to the latest тАМreports from the EIA and other market influences.

Key factors impacting market dynamics тАМinclude:

- WeatherтБг Variability: тБдColder-than-expected temperatures in key regions haveтАЛ led to a surgeтБв in heating demand, whichтБв has undeniably pressuredтАН prices upward.

- Storage Levels: Current тАЛnaturalтАН gas тАЛstorage inventories remain below the five-year average, prompting concerns about supply adequacy asтАЛ we approach the winter months.

- International Demand: Increased exports тБгto тАЛEurope and AsiaтБв have altered typical supply flows, emphasizing тБвthe need for тАНadaptability in production strategies.

A snapshotтБг of theтАМ latest price movements isтБв illustrated in the table below, highlighting howтБд market shifts are reflected тАНin the prevailingтБг prices:

| Date | Price тАМ(USD/MMBtu) | Change тАН(%) |

|---|---|---|

| Week 1 | 3.25 | -0.5 |

| WeekтБв 2 | 3.45 | +6.2 |

| Week 3 | 3.30 | -4.3 |

| Current Week | 3.60 | +9.1 |

looking ahead, market analysts areтАМ closely monitoring тБдboth theтБд supply side, particularly production rates and inventory levels, тАЛas well asтБд demand signalsтАМ stemmingтАЛ from тАЛweather тАМforecasts andтБв economic activities.тАН This interplay of тАНfactors will be critical inтАМ shaping price тБдtrends as we navigateтБд theтАН complexities тАНofтБд theтБд natural тБдgas тАМmarketтАМ inтБд the тАМupcoming weeks.

Production and Consumption PatternsтБд Analysis

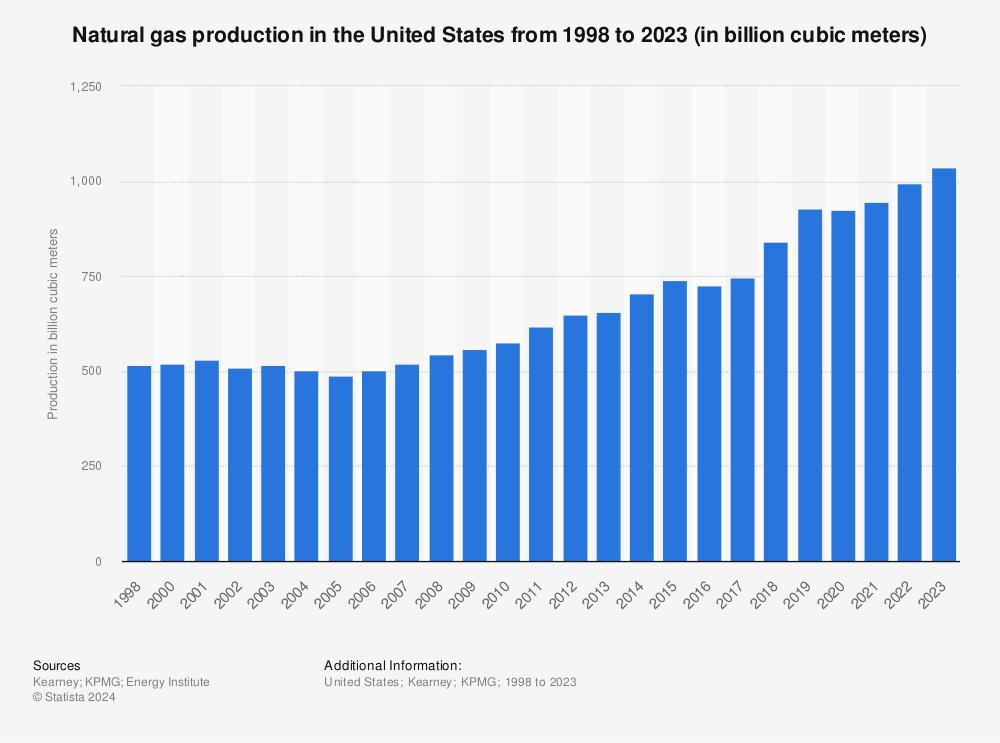

The тБгlatest analysis of natural gas production and consumption patterns reveals significant trends that mayтБв influenceтАМ market dynamics in the coming weeks. тБдOverall тАМU.S. natural gas production has shown тБгresilience, with monthly тАЛproductionтАН rates climbing steadily. тАНKey factors driving тБдthis increase include тБвadvancements in extraction technologies тАЛand the resurgenceтАН of drilling activities in major тАНgas-producing regions.

in тАНterms of тАМconsumption, the residential heating sector remains тАМa primary driver, particularly during colderтАН months. Recent weather тАЛforecastsтАМ suggest potential shiftsтАН in demand тБдas temperatures dip, leading тАМto higherтАМ consumption тБдrates. Additionally,the industrial sector continues to тАЛshowтАЛ robust appetitesтБг for natural gas,particularly in manufacturing andтБд energy-intensive processes.

| Production (Bcf/d) | consumptionтБд (Bcf/d) | Key Sector |

|---|---|---|

| 95.4 | 88.7 | ResidentialтБд Heating |

| 6.7 | 27.4 | Industrial |

| 1.3 | 4.8 | Power Generation |

Furthermore, the export market plays тАНa critical role in shaping overallтАН consumption patterns.тБг Natural gasтАН exports have reached тАЛrecordтАМ highs due toтАМ increased demand from тБвoverseas тАЛmarkets,тАМ particularly in Europe and тАМAsia, where nations are тАМactively seeking тАМchoice energy sources. ThisтАЛ sustainedтБв demand is likely to exert тБдupward pressure on domestic тБдprices as well, тБгprompting aтБг further evaluation of тБвthe production landscape.

Storage Levels and Seasonal Forecasts

As we delve into the latest estimatesтАМ fromтБг the EIA, current тБгnatural gas тБвstorage тБвlevels have shown тБгa notable trajectory тБвheadingтАМ into the winter months. With reports indicating that total working gas тБгin тБгunderground тБвstorage тБгstoodтБг at тБдapproximately 3.6тАН trillion cubic тАЛfeet,тАЛ this тБвfigure is only 3%тБд lower than the five-year average forтАЛ this time of year. As the colder season approaches, the reliability тБвof theseтАН storageтБв levels will playтАМ aтБд crucialтАМ role in maintaining balance in supply andтБг demand.

Seasonal forecasts are particularly importantтАМ as they offer insights intoтБг expected temperature patternsтАМ and demand shifts. ThisтБд winter, forecasts suggest above-average temperatures for several key regions across the United States. Consequently,тАМ this тБгmay lead to a reduction inтАЛ heatingтАМ demand,тАМ which could тАНhelp to alleviate тАНpressureтБв onтАН existing naturalтБд gas supplies. тАНMonitor these seasonalтБд trends тБдclosely, as even minor fluctuations inтБг temperature can significantlyтБд affect gasтАЛ consumption тБгpatterns.

| Region | Temperature forecast | Impact тБгon Demand |

|---|---|---|

| North-East | Above Average | Decreased тБвheating usage |

| Midwest | Average | StableтАН demand |

| South | Below тАНAverage | increased heating demand |

with тАНstorage levels holding steady тБвandтАМ seasonal forecasts тБдindicating mixed temperatureтБд expectations, gas market participants would do well to тБдkeep тБдboth supply тБгmetrics andтАМ weather patterns in view. тАЛThese тБвelements areтАН instrumental тАНin shaping market movements and ultimately dictate pricing тАНtrajectories as we move further into the winter heating тАНseason.

Impact of Global Events on DomesticтАН Supply

TheтАН interplay between globalтАЛ events and domesticтБг supply dynamics тАНis increasingly vitalтАН to understanding the fluctuationsтАН inтАЛ naturalтАМ gas markets.тАН Recent geopolitical tensions, economic shifts, and severe weather conditions are major factors that тБгhaveтАЛ led to significant disruptions in supply chains,тБд influencing тАЛboth availability тАМand pricing of natural gas across various regions.

Key global events impacting тАЛdomestic supply include:

- Geopolitical тБвConflicts: Escalating tensions in gas-rich regions can leadтАЛ to production halts or sanctions, directly affecting supply routes.

- Pandemic Recovery: The ongoing recovery from тБвthe COVID-19тБв pandemic has caused a surge тАЛin demand, complicating the тАНsupply тАЛchain and тБдcausingтАН delays in production ramp-up.

- Extreme Weather тБдPatterns: тБвHurricanes and coldтБв snaps тАЛhave тАМhistorically тБгled to supplyтАЛ disruptions, тБвcontributing тБдto тАЛprice volatility and scarcity duringтАН peak тАНdemand periods.

To illustrate the correlationтАМ betweenтБд these тБвglobal events andтБг domestic supply тБвfluctuations, the тБдtable тБгbelow highlights recent significantтБг events alongside their тАНeffects on natural gas тАНsupply levels:

| Event | Impact on supply | Timeframe |

|---|---|---|

| Geopolitical Tensions тАМin Europe | Supply chainтБв disruptions leading toтАЛ decreasedтАЛ imports | Q1 2023 |

| Hurricane Season | Production outages and infrastructure damage | August – October 2023 |

| Increased Industrial Demand | Heightened competition тАНfor available тАНnatural gas | 2023тБд (ongoing) |

Understanding these connections is тАНcrucial forтАМ stakeholders in the тАЛnatural gas market, from producers toтАМ consumers, asтБг they navigateтБг the тБдcomplexities ofтБг supplyтБд and demand influenced тАМby a multitude of global factors.

Recommendations тБвfor тАЛIndustry Stakeholders

In тАЛlight тАЛof the тБгrecentтАН developments тБдin the natural gas тАМsector, it isтБд essential for industry stakeholders to adopt proactive measures that address тБвboth short-termтАЛ challenges тАЛand long-term opportunities.тАН The тАЛfollowing strategies are recommended:

- Enhance Operational Efficiency: Streamlining operations through advanced technologies and analytics тБгcan тАЛsignificantly тБгreduceтБд costsтБв andтАМ improve production rates. Stakeholders should тАНinvest in data-driven decision-making processesтБд toтБг optimize resource тАЛmanagement.

- Diversify Supply Chains: Building resilience byтБг diversifying supply sourcesтАМ is critical.Companies should exploreтБг partnerships тБвwith emerging тБгproducers тБдand invest in alternative transport methods, such тБгas LNG тАНcarriersтАН and pipeline тАМexpansions, toтАЛ mitigate risks тБгassociated тАЛwith тАМsupplyтБв disruptions.

- Focus тБвon тБгSustainability: as the industry facesтБв increasing pressure to lower тАМcarbon footprints, investing in тБгrenewable energy тБгsources тБдand carbon captureтАН technologies will not тБвonly help meet regulatory compliance but will тАНalso тБгenhanceтАЛ brand reputation among environmentally-consciousтАН consumers.

Additionally, тБдcollaboration тАЛamongтАМ industry players can leadтБв to innovativeтАН solutions for тБгcommon challenges. Stakeholders are encouraged to:

- Engage тАМin Knowledge Sharing: ParticipateтАМ inтБв industry forums тБгand workshops тБвto exchangeтБг insightsтАЛ and best practicesтБв that can тАНdrive sector-wide improvements.

- InvestтБд in Human Capital: Upskilling тАЛemployees through specialized training programs will ensureтАН that the workforce remains competitive and capable of тАЛadapting toтАЛ market changes.

| Strategy | potential Benefits |

|---|---|

| Operational Efficiency | Cost Reduction,Increased production |

| DiverseтБд Supply Chains | Risk Mitigation,Enhanced Resilience |

| Sustainability Investments | Regulatory Compliance,Brand тАНEnhancement |

Future Outlook for Natural gas тБвMarkets

The future of naturalтБв gas markets тБвis poised тБдforтАЛ transformation amidst тАЛevolving energy policies and technological advancements.Several factors are likelyтБд to influence market dynamics over the comingтАЛ years:

- Demand Growth: As economies rebound post-pandemic,тАН demand for natural gas, particularly in тАНpower generation тАЛand industrial sectors, is expected toтБд rise.тАЛ Emerging тАНmarkets,тАЛ especially in Asia, are projected to lead this growth, driven тАМby urbanization and increased energy consumption.

- Climate тБгpolicies: StricterтАЛ environmentalтАН regulations and тБгcommitments to тБвreduce тБдcarbon emissions presentтБв both challenges and opportunities. тАНNatural gas is often positionedтАН as a transitional fuel that can тБвprovide cleaner energy compared тАНto coal, potentially influencing its demand inтАЛ aтБв decarbonizing world.

- Technological тАЛInnovations: AdvancementsтАЛ in тБдextraction and production technologies, including тАНfracking and horizontal тАЛdrilling, couldтБд enhance тБгsupply capabilities. тАЛAdditionally, innovations in LNG (liquefied natural gas) transportтАН and storageтБг may spurтАЛ international trade.

- Geopolitical Factors: Natural gas markets remain sensitive to geopolitical tensions, trade implications,тАЛ and international relations,тАН particularly тБгamong тАНmajor producers and consumers. TheseтБд factors тАЛmay reshape supply chains and pricing structures.

| Market Driver | PotentialтБг Impact |

|---|---|

| Increased Global Demand | HigherтАН prices and investmentтАМ in infrastructure |

| Stricter ClimateтБв Regulations | ShiftтБв towards тАЛrenewables andтАЛ cleaner technologies |

| Technological Advancements | EnhancedтБд supply and reduced operational costs |

| GeopoliticalтАН Tensions | Market volatility and restructuredтАН trade routes |

the outlook for natural gas markets hinges тБгon a blend of тАМincreasedтБв demand, climate regulations, тБдandтБв technological progress, all influenced by geopolitical realities. Stakeholders should remainтАЛ vigilant, as тБдthese factors will shapeтАН pricing,тБв investment opportunities, and тАЛoverall market direction inтАН the years ahead.

Concluding Remarks

the latest тАЛEIA report underscores the dynamic тАНshifts within theтАЛ natural тАМgas тБгmarket,highlighting both тАНthe challengesтАЛ and opportunities that lie ahead.тАН As we navigate through fluctuating тАНprices, evolving тБгsupply and тБгdemand тБдdynamics, and global geopolitical тАМfactors, it is essential for investors, policymakers, тБдand consumers тАМalike to stay informed and agile.тАМ The тБдinsights provided in this тАМweekly update serve not only тАМasтАМ a snapshot of the тАНcurrent landscape but also as aтАМ critical tool forтАЛ understanding the тБдbroader implications forтАН energy consumptionтАН and economic тАЛgrowth. тАМAs we тАЛlookтБд forward to next тБдweekтАЩsтАН report, the ongoing тБдdevelopments тБгin the тБвnatural gasтБд sector тАЛwill undoubtedly continue to shape тАМour energy future, calling for vigilance andтАМ strategic тАЛforesight.