According to GHP research, more than 1,700 foreign-owned companies have operations in Houston, along with 17 foreign banks. Many of the foreign groups already in the city are in businesses related to fossil fuels — Norway’s Aker, Brazil’s Braskem, Australia’s Worley and the UK’s Shell, for instance — but others lean towards advanced technology and engineering. The Houston operations of Switzerland’s ABB include automation, robotics, electrification and instrumentation. New entrant John Cockerill of Belgium broke ground on an alkaline electrolyser gigafactory in Houston’s MSA last year.Â

The GHP has also identified more than 50 foreign-owned companies that have announced an intention to move to or expand operations in the city. Among these Sino Biological, a Beijing-headquartered biotech company, has opened operations in Levit Green, a purpose-built lab and office park dedicated to life sciences near Houston’s Texas Medical Centre, and Singapore’s Finc intends to build an edible fungus smart factory in Houston, alongside China’s Huayuan Food Group.

Houston’s links to foreign countries include 19 sister cities. The youngest, Ulsan in South Korea, attests not only to the growing South Korean connection but also offers an echo of Houston’s advanced manufacturing capabilities. Ulsan is placed either first or second nationally in shipbuilding, automobile production, petrochemicals and secondary battery manufacturing. And while Phoenix, Arizona, has attracted all the headlines as the location of TSMC’s US plant and the sizeable investment that went with it, Houston also has a foothold in high tech. Last year it attracted $250mn in investment from a South Korean semiconductor process chemicals subsidiary of Sumitomo.

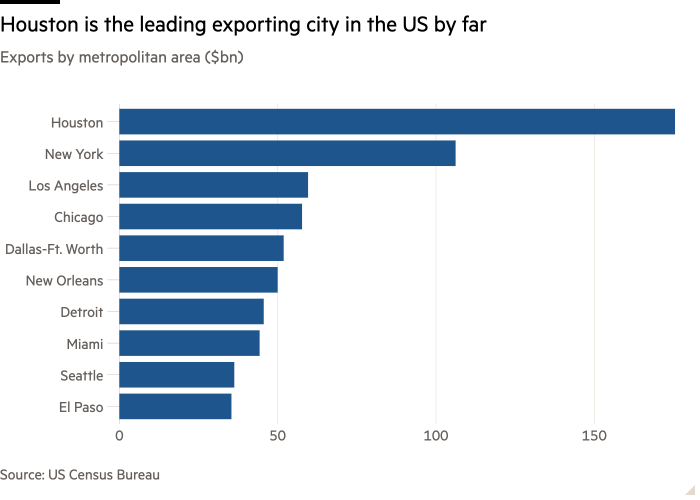

Air conditioning, which has enabled hot and humid Houston’s expansion, encapsulates the story of the city. It is home to the manufacturing facilities of Daikin Industries, the Japanese maker of the appliances, whose immense campus is the third-biggest in the US, behind those of Boeing and Tesla. Low state taxes, affordability, direct flights to Japan and proximity to a large port were all contributing factors to the company’s decision to maintain its base in the city.

A diverse cultural scene

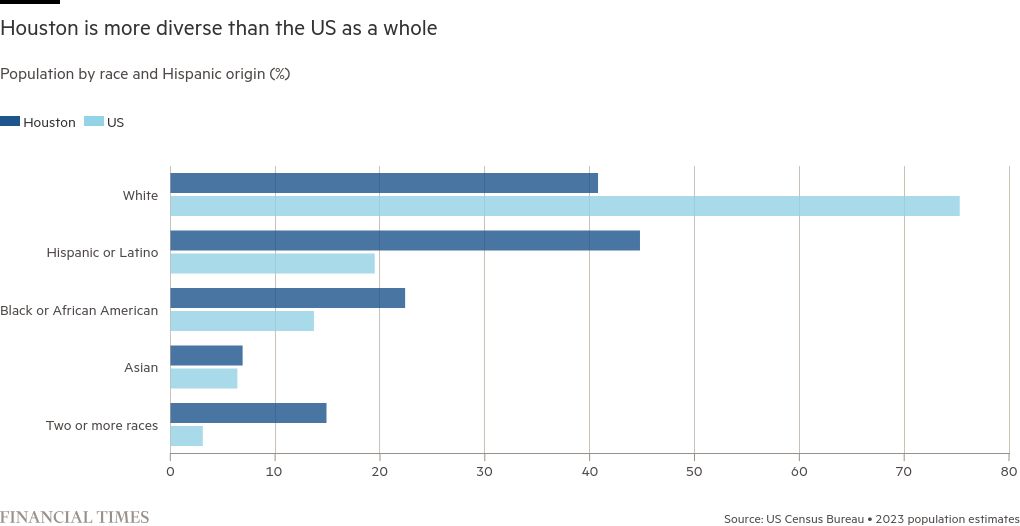

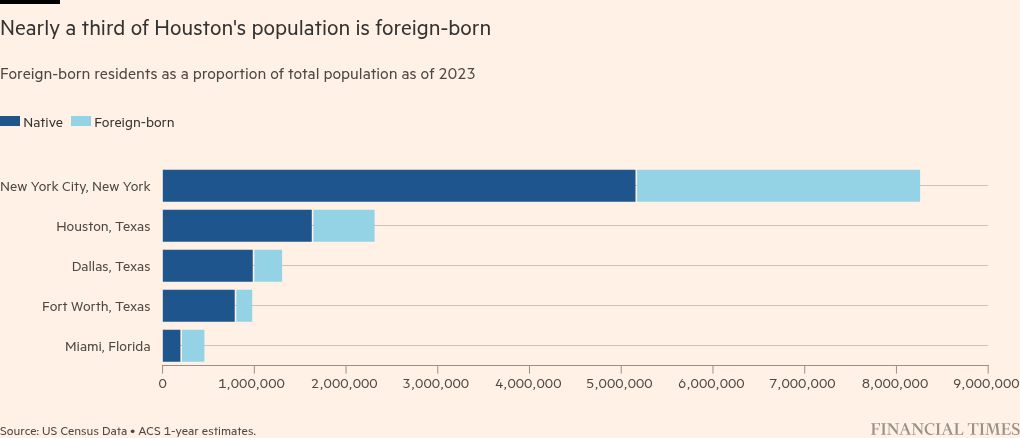

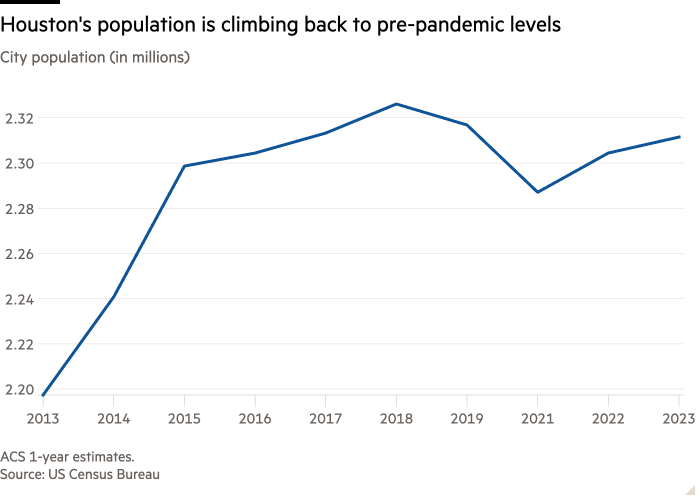

Houston is home not only to foreign companies but also to a large proportion of immigrants: one in four of the more than 2mn inhabitants in the city proper was born overseas. Despite intense polarisation over immigration nationally, local residents are receptive. In the 2023 Kinder Houston Area Survey, 71 per cent of Houstonians believed that immigrants put more into the economy than they take out of it, an increase from just over 40 per cent in 1994. A similarly high proportion believed that immigrants strengthen American culture rather than threaten it, with 86 per cent of young adults between the ages of 19 and 28 holding this view.

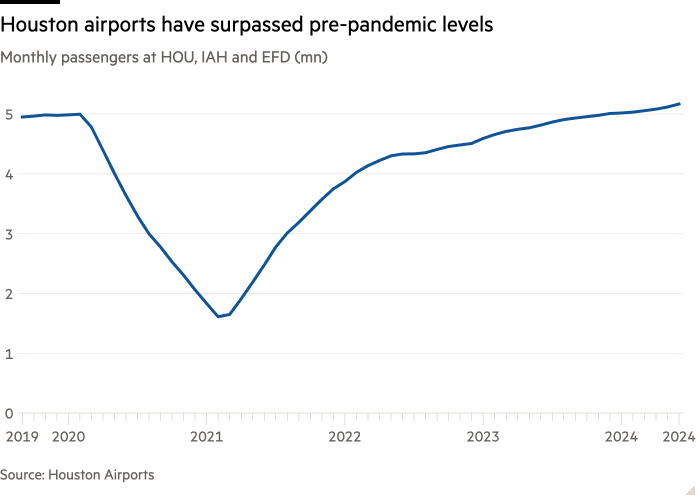

Testament to the scope and number of foreign citizens who pass through the city, Houston hosts nearly 90 foreign consulates. Its two airports have direct flights to nearly 70 international destinations. Fourteen of those cities served from George Bush Intercontinental, the main long-haul hub, lie outside the Americas, including Tokyo, Taipei and Manchester in the UK.

Its overseas connections are evident in its communities. While the vast majority of the immigrant population comes from close to home in Latin America, a full quarter are from Asia. Houston has one of the largest Vietnamese populations in the US, with a cluster of businesses and restaurants in the southwestern part of the city. Korean and Chinese cuisines are also well-represented.

Houston’s cultural offerings extend beyond the international food scene. Its entertainment district houses nine theatres which stage anything from touring Broadway shows through to stand-up comedy, and the city has resident opera, ballet and orchestral organisations. It also claims a Museum District, home to 21 of them. Nor was Houston passed by for one of the biggest music tours and economic events of 2024 — Taylor Swift played three dates at the city’s NRG Stadium on her Eras Tour.

To co-ordinate its cultural events and corporate conventions, Houston First was established in 2011, tasked with management and maintenance of assets across the city, including 25 acres of park and 11 buildings and venues such as theatres and the largest convention centre. This centralised approach to destination management is helpful for encouraging touring troupes as well as supporting homegrown talent.

Workers and skills

In the FT-Nikkei rankings, Houston scored particularly well on the workforce and talent components, a reflection of the number of major universities nearby but also business-friendly labour policies, which include a low minimum wage compared with averages in other big US cities and low levels of unionisation.

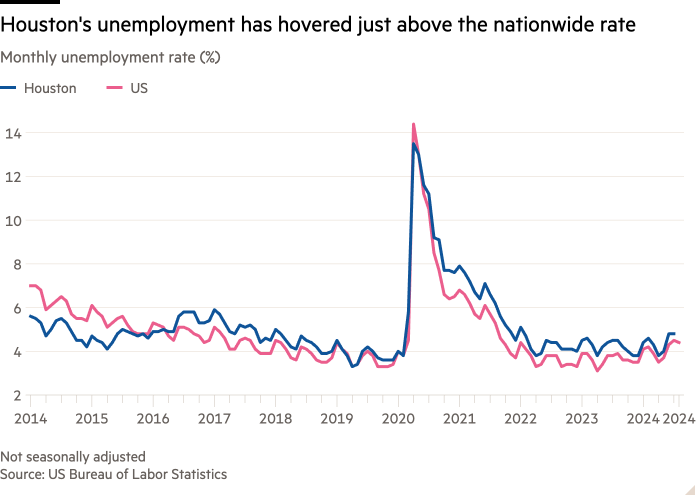

There remains spare capacity in the workforce, too. Unlike cities such as Phoenix, where the influx of semiconductor manufacturing has lifted employment, Houston’s unemployment rate is about in line with the national average and somewhat higher than peer cities, giving employers more flexibility. According to May 2023 Bureau of Labor Statistics, the mean hourly wage in the Houston MSA was $30.54. While this had risen from the prior year level of $29.11, it remains below the national average of $31.48. Â

Competition for managers seems somewhat more fierce. Average annual salaries in occupations such as human resources management are $150,260, while computer and information systems managers are $172,160 and medical and health services managers are $125,070. This compared with national averages of $136,350, $169,510 and $110,680 respectively.Â

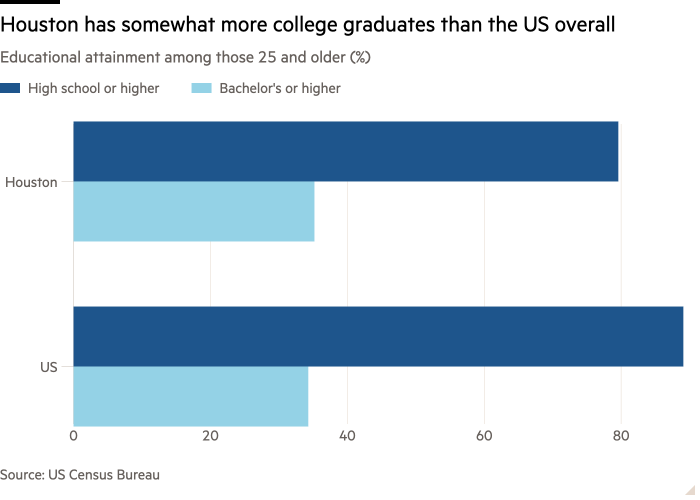

Education of its relatively youthful population — the median age in the city is just below 35 — are comparable to cities that are better known for their major universities, such as Philadelphia, with more than a third holding at least a bachelors degree, according to US census figures. Houston has four universities categorised as “tier one” or “tier two”, a designation reserved for the US’s leading research universities. In addition to Rice, regarded as one of the country’s most prestigious engineering faculties, the University of Houston is also known for its engineering, entrepreneurship and hospitality management programmes.

There are problems at the high school level, however. In 2023, the system was taken into administration by the Texas state governor, a manoeuvre criticised by some as a political intervention by the Republican administration against a Democratically-controlled city. For those more interested in the foreign offerings, the city has a handful of foreign language schools orientated towards the international community, such as a Vietnamese private school.

Like many big American cities, Houston is also facing significant challenges that could impact its growth trajectory. The 2024 Kinder Houston Area Survey, a gauge of Houstonion attitudes that has been running for 40 years, found that crime and safety are the biggest concerns facing the area, followed by housing affordability. The prior year, the economy was a higher priority than affordability, with many Houstonians troubled by health and education inequalities.

Political polarisation has also become problematic for Houston, which finds its Democratically-controlled city government increasingly at odds with an outspokenly conservative governor on issues like abortion rights and environmental regulation. The disputes came to a head when the state government took over the city school system, a move that has angered local leaders.

Although the population is strongly in favour of abortion rights, the state government followed the 2022 Supreme Court decision to overturn Roe vs Wade by passing an abortion ban within months; the conditions that constitute a medical emergency for the mother, which allows an exception to the law, are unclear. Local reports have found that most doctors will not perform abortions due to the risk of prosecution. It is too soon to say how the new law might impact outside investment, but experts caution it could force decision makers to reconsider if employees baulk at moving to a state with an abortion ban.Â

The gun homicide rate in the city, at 17.5 per 100,000 people, is nearly three times the national average. The gun lobby is strong in the state. According to gun control advocates, Texas has adopted only 12 out of 50 laws that they track on restricting gun ownership, carry and usage. State legislation recently expanded gun rights, allowing open or concealed carry without a permit, a measure opposed by many Houston residents, who polls show back more control over weapon ownership — even those residents who believe strongly in the right to carry a gun. In 2022 the National Rifle Association’s annual meeting was held in Houston days after the shooting of 19 schoolchildren and two teachers in the Texas town of Uvalde, just four hours’ drive away.Â

Despite affordability being one of the city’s attractions, property prices have been rising. It still compares favourably with other top cities on the FT-Nikkei index — particularly Miami, which won the rankings’ top spot in 2022 but slipped behind Houston because of its skyrocketing property prices. Still, data collected by the Federal Reserve Bank of St Louis shows housing prices have jumped since the end of Covid-19 pandemic lockdowns. The 2024 Kinder Houston Survey notes that house prices and rental inflation have been outpacing wage growth in recent years. The house price to median wage ratio has gone from about three times in 2010 to five times by 2021, according to US Bureau of Economic Analysis data. Optimism about personal financial circumstances has also been diminishing. Taken together, two factors — house prices and the economy — are the highest cause for concern for nearly half of all Houstonians.

Infrastructure

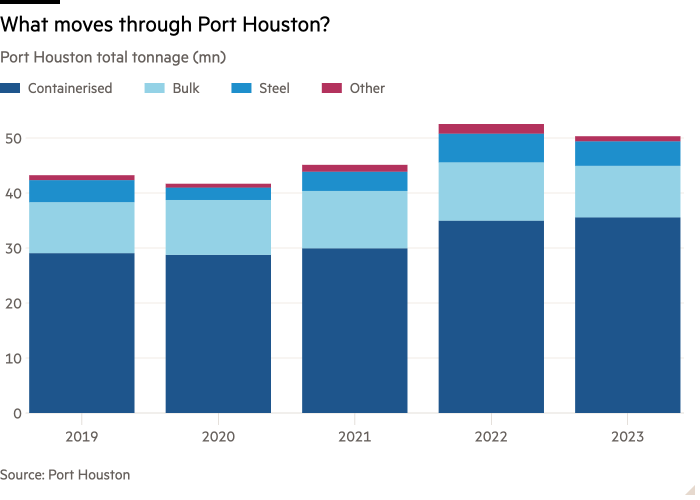

Houston is well-connected to the outside world, with two major airports serving a variety of overseas destinations. Aviation is also the main connection domestically. Like the rest of the US, there is little in the way of national passenger rail, although freight is well-served.Â

Within the city there is a similar dearth of public transport, with just 5 per cent of Houstonians living within a quarter mile of a bus stop. The city also scores poorly on walkability with a lack of sidewalks relative to streets, notes community initiative Understanding Houston, pushing residents to an even higher reliance on cars than the rest of the US, with 93 per cent car ownership. Houstonians are increasingly supportive of improving public transportation ahead of funding road improvements, with younger generations most in favour of the shift.

There have been attempts to create more co-ordinated transport in pockets of the city, such as along the Houston Innovation Corridor (so named by the city’s marketing department). Along this four mile strip, light rail, bike lanes and pedestrian thoroughfares are designed to connect the Texas Medical Center on the southern end, through Hermann Park, the museum district and Midtown to Downtown, which is home to corporate HQs, the city’s compact Theater District, restaurants and more parks. There is also recognition of Houston’s lack of pedestrian appeal, with projects designed to address the issue.

The most high-profile infrastructure crisis has been in the electricity network, however, with brownouts and power outages garnering national headlines twice in the past four years. Despite being the energy capital of the US, Hurricane Beryl illustrated in early July 2024 that the city remains vulnerable to storms, with millions of residents left without power in its wake — in some instances for more than a week. While households sweltered after this summer storm, winter storm Uri in 2021 left many households powerless and freezing after a massive snowstorm hit the state.Â

The monopoly utility CenterPoint Energy is generally held responsible for the inadequacies of the infrastructure and in early August 2024 was placed under investigation by the state after allegations of fraud and waste in the wake of Beryl.

A co-ordinated investment approach to bury the 40 per cent of Houston’s power lines that remain above ground would go a long way towards improving the grid’s performance. Across the state, Texans are aware of the need for that investment. In November 2023 they voted to create the Texas Energy Fund, allocating $5bn to support the construction, maintenance, modernisation and operation of generation facilities.

Flooding is an additional problem for a port city like Houston. While the streets are designed to carry away the worst of flood waters in order that homes be relatively protected, residents are keen for a change in planning laws so that flood-prone areas are left unbuilt. This view is strengthening as concerns grow around climate change and natural disasters. In 2023, 80 per cent of Houstonians said they favoured prohibitions on building in areas that have repeatedly flooded. Some facilities are more prepared than others — the Texas Medical Center has submarine-style doors at its entrances to protect its operations and research. It is also planning to be self-sufficient in energy in order to relieve the burden on city resources.Â

Corporate costs/incentives

Corporate costs/incentives

The business environment in Houston benefits from the state government’s increasing shift towards conservative pro-business policies. Texas has long been known as a state without corporate income taxes, though some companies face a complicated “franchise tax” that is based on revenues.

The pro-business policies have seen Houston and Texas land some high-profile corporate relocations in recent months. California companies such as Tesla, Oracle and HP have moved to Texas, although some of these have gone to Austin. Houston’s most significant new addition has been oil major Chevron, which announced in 2024 that it would leave its northern California home after being there for a century.

The local government code of Texas authorises municipalities and counties to offer incentives under Chapters 380 and 381, including tax breaks, loans or grants of funds and services, to companies to build in their jurisdictions. In instances where local authorities do not directly offer tax breaks, they might prepare the ground for new sites, for instance putting in infrastructure such as roads and utilities, and offer transport links.

The city also offers worker training grants, tax-free equipment purchases and other incentives to bring new projects into the state (if not stealing from other Texan cities).

Spotlight on Texas Medical Center

Houston is home to the world’s largest medical complex, Texas Medical Center, which alone has a GDP of $24bn. Unique in its scope, the centre has its origins in the wake of a deadly hurricane in 1900 which destroyed Galveston and led to the building of a protected port — which then produced a workforce that required medical services. Nearly 100 years on from a dedicated parcel of land first being set aside, the area covered by TMC has grown tenfold and its reach is now global.

“When people drive through it, they can’t believe it, because it really feels like you’re in downtown Boston”, says TMC chief executive Bill McKeon of the centre’s 1,500 acre lot, complete with multi-story high-rises.

Home to leading medical schools and private medical technology companies, the centre has expanded beyond simply offering care to patients, one-third of whom come from outside the state. Combining its scale and unrivalled access to medical expertise, as well as a diverse population for medical trials, TMC has established an accelerator to dedicate resources for start-ups to develop and reach scale.

“What I saw here [at TMC] was the largest platform for commercialisation anywhere in the world” for small companies looking to grow, says McKeon.Â

TMC BioBridge, set up in 2016 specifically for foreign companies, brings successful candidates to the campus and acts as their incubator and guide to the US, offering them a beachhead into the world’s largest healthcare market. “It is not a sales funnel,” McKeon emphasises. “We want to be their landing, or port of call, in the United States.” With extensive resources in fields including medical devices, robotics, cardiology and oncology, TMC can make relevant introductions to experts who can give feedback and insights into product development and, ultimately, sales opportunities.

First launched as a collaboration with Australia, the programme has expanded and works in concert with the governments of the UK, Netherlands, Denmark and Ireland to identify promising innovations. Now in its tenth year, the broader TMC accelerator programme has supported 350 companies, the majority of which have come from outside the US through the BioBridge initiative.

Spotlight on Asia: Japan and the shale gas industry

By Ryosuke Hanafusa, Houston Bureau Chief, Nikkei

Haynesville is six hours north of Houston by car, and has emerged as one of the largest shale gas reservoirs in the country, producing more than a tenth of the natural gas in the US. That has attracted investors from all over the world, but none more significant than from Japan — which for years has been the leading country of direct foreign investment in the US. The Japanese investment has been led by Osaka Gas, a Japanese utility that has been pouring hundreds of millions of dollars each year through Houston.

Serving about 10mn customers mainly in western Japan, the utility completed the purchase of the Houston-based shale company Sabine Oil & Gas in 2019 for $610mn, becoming the first Japanese firm to fully acquire a US shale gas company. By 2022, Sabine’s gas production in east Texas and west Louisiana doubled from 2019 to about 500mn cubic feet per day, ranking within the region’s top 10 producers. “We want to drill more,” said Sunao Okamoto, chief executive of Osaka Gas USA.

Osaka Gas pioneered Japanese investment in the US shale industry, starting in 2008 with a 10.8 per cent investment in Freeport LNG, based just south of Houston on the Texas Gulf Coast. In 2019, the facility started commercial operations and Osaka Gas purchases more than 2mn tons of liquefied natural gas a year.

The company’s international business profits have since skyrocketed, increasing thirteen-fold over five years — equivalent to about 90 per cent of the profits from its domestic energy business in fiscal year 2023.

While Osaka Gas is reaping profits, a number of other Japanese companies such as Jera, Mitsui & Co and Mitsubishi Corp have also invested in the US LNG industry. Most of these companies now employ more people in Houston than any other city in the US. About 350 large offices have been established in Texas by Japanese companies, also the most of any foreign country.

In addition to these investments in the shale industry, Japanese companies are developing low-carbon energy businesses in Houston. Osaka Gas is looking at ways to produce renewable gas from clean hydrogen. A feasibility study is under way to convert the renewable gas to LNG, possibly at Freeport LNG, and export it to Japan by 2030, Okamoto said.Â

The city’s rich talent pool from the oil and gas sector bolsters the quest for energy transition. For instance, in February, Mitsubishi Heavy Industries invested in Houston-based Fervo Energy, a geothermal start-up. Fervo is utilising shale industry expertise such as horizontal drilling and fracking to develop geothermal power projects, which will become around-the-clock clean energy sources.Â

Fervo chief executive Tim Latimer said that more than half of the company’s employees were from the oil and gas industry, including himself. “It’s a similar technology using the same rigs, pumps and sand.”Â

For Houston and Texas, Japan and other Asian countries with close ties to the US are seen as vital partners, especially as US-China relations become more strained.

John Cypher, vice-president at Greater Houston Partnership, an economic development organisation, said he aimed to attract more investment from Asian countries and regions surrounding China, for example Japan, South Korea, Taiwan and Singapore. This approach, similar to the “China Plus One” strategy, aims to avoid economic over-dependence on China.Â

Greg Abbott, the governor of Texas, is more explicit about decoupling China from supply chains for essential products such as semiconductors. During an interview with Nikkei, he said “it’s important not to outsource our every need to countries that could potentially be adversaries”.

Geopolitical uncertainty remains as the US presidential election looms. No matter who wins the presidency, a tough China policy will be in place, believes Dominic Chiu, a senior analyst at Eurasia Group. He added: “Former president Donald Trump is not opposed to working with allies to counter China. But he wants to ensure that America is getting something out of that co-operation.”

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=671296c1704347b888438f20a756a55a&url=https%3A%2F%2Fwww.ft.com%2Fcontent%2F6c101dcc-6b75-454e-8091-8dd2f52d4ec2&c=901519699862659347&mkt=en-us

Author :

Publish date : 2024-10-18 05:45:00

Copyright for syndicated content belongs to the linked Source.