The British Virgin Islands: A Forbidden City – Unmasking Secrecy and Economic Complexity

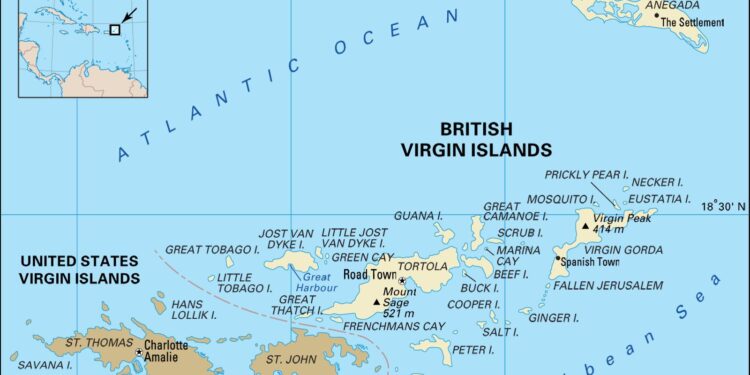

In the heart of the Caribbean lies the British Virgin Islands (BVI), a tropical haven renowned for its stunning beaches and crystal-clear waters. However, behind this picturesque façade lies a complex and often murky financial landscape that has captured the attention of global investigative organizations. The International Consortium of Investigative Journalists (ICIJ) recently unveiled a comprehensive report that paints the BVI as more than just a paradise for vacationers; it depicts the territory as a “forbidden city” of illicit finance and shadowy transactions. This article delves into the ICIJ’s findings, exploring how this seemingly idyllic archipelago has become a pivotal player in international finance, serving as a crucial hub for tax avoidance and secret financial dealings. As calls for transparency and accountability intensify, the BVI’s unique regulatory environment continues to draw scrutiny from governments and activists alike, raising critical questions about the balance between economic sovereignty and global financial ethics.

The Shadow Economy of the British Virgin Islands Unveiled

The British Virgin Islands (BVI) have long been known for their idyllic beaches and luxurious lifestyles, but they also harbor a less glamorous reality: a clandestine financial landscape that enables significant capital flight and tax evasion. This offshore paradise, often cloaked in a veil of secrecy, is home to a vast network of shell companies that facilitate the movement of wealth away from the scrutiny of regulatory authorities. Key contributors to this shadow economy include:

- Financial Institutions: Banks and investment firms that operate with minimal oversight.

- Legal Advisors: Lawyers and accountants who specialize in creating complex financial structures.

- Tax Havens: A plethora of jurisdictions that welcome foreign investment with lenient tax policies.

Compounding the issue is the digital age’s ease of access to information and capital, which has allowed for the rapid globalization of illicit finance. A recent investigation by the International Consortium of Investigative Journalists (ICIJ) uncovers how the BVI serves as a nexus for wealthy individuals and corporations seeking to obscure their financial activities. Analysis reveals striking insights, summarized in the table below:

| Aspect | Details |

|---|---|

| Total number of registered companies in BVI | Over 400,000 |

| Estimated annual revenue lost to tax evasion | Up to $25 billion |

| Countries most affected by capital flight | Various developing nations |

Investigating Offshore Financial Havens and Their Impact on Global Transparency

The British Virgin Islands (BVI) have long been synonymous with secrecy, serving as a cornerstone for offshore financial activity that often evades scrutiny. This tropical haven has become a focal point for individuals and corporations seeking to shield their assets from taxes and regulations. The allure of such jurisdictions lies in their minimal transparency and lucrative regulatory environments, which invite everything from wealthy expatriates to multinational corporations. Notably, the BVI’s legal framework enables the establishment of anonymous companies, thereby facilitating financial practices that can obscure the actual ownership of money and assets.

As the global community intensifies its scrutiny of financial practices, the implications of BVI’s practices on international transparency cannot be overstated. The shift towards stricter compliance regulations worldwide is influenced by the need for increased accountability and the fight against corruption. This paradox raises critical questions about the integrity of financial systems and emphasizes the urgent need for reform. Here are some key points regarding BVI’s role in offshore finance:

- Tax Evasion: BVI entities often operate in ways that reduce tax liabilities for stakeholders.

- Regulatory Loopholes: Weak regulations allow for the circumvention of laws designed to prevent illicit financial flows.

- Secrecy Jurisdiction: The ability to maintain anonymity fosters an environment ripe for money laundering activities.

| Aspect | BVI Status |

|---|---|

| Tax Rate | 0% |

| Corporate Transparency | Low |

| Ease of Business Setup | High |

Strategies for Reforming Tax Regulations to Combat Financial Crime in the BVI

In the wake of increasing scrutiny over the role of offshore financial centers in facilitating financial crime, the British Virgin Islands (BVI) must reconsider its approach to tax regulations. A multifaceted strategy that encompasses increased transparency, robust due diligence requirements, and international cooperation is essential. Stakeholders in both local governance and international finance should prioritize the establishment of a public register of beneficial ownership that is accessible to relevant authorities worldwide. This would mitigate anonymity in corporate structures that often serve as a shield for illicit activities. An enhanced framework should also enforce stringent sanctions against non-compliance, ensuring that entities engaging in financial transactions maintain transparency and accountability in their operations.

Furthermore, the implementation of an educational program aimed at local businesses and international investors could foster a culture of integrity. This program should offer insights into the legal ramifications of financial crimes and the potential impacts on the BVI’s reputation as a financial hub. Emphasizing the importance of ethical practices, the initiative could include workshops, seminars, and online resources covering a range of topics, such as AML (Anti-Money Laundering) regulations, KYC (Know Your Customer) protocols, and the consequences of non-compliance. Additional measures could involve regular audits and assessments to ensure adherence to these guidelines, consolidating the region’s commitment to combating financial crime.

Future Outlook

In conclusion, the investigation into the British Virgin Islands reveals a complex web of financial secrecy and regulatory loopholes that have allowed the territory to thrive as a haven for international wealth and, at times, illicit activities. As the International Consortium of Investigative Journalists illuminates, the implications of such a system extend far beyond the sun-soaked beaches and tranquil waters of this Caribbean archipelago. The findings call for a renewed dialogue on global financial transparency and regulatory reform, as policymakers grapple with the vital questions of accountability and oversight in an increasingly interconnected world. As the narrative continues to unfold, the British Virgin Islands stand as a poignant reminder of the challenges and responsibilities facing nations in the pursuit of justice and integrity in global finance.