monsitj

Performance and net asset value Quarterly returnтАа 6.25% NET ASSET VALUE PER UNIT AT 30 SEPTEMBER 2024тАа $1.1621 тАа after all ongoing and performance fees. High watermark at 30 September is $1.1628/unit

Click to enlarge

The Dynasty Trust NAV increased by 6.25% during a volatile quarter; variable currency moves by the A$ (up versus US$, lower versus тВм) reduced NAV by 0.87% and were notably strong in September. The strong return emanated from our larger positions: Odet (OTCPK:FCODF) and Catapult International (OTCPK:CAZGF) both rose over 20% (21% and 29% respectively) and each contributed 1% or more to performance. Our best gainer was Virtu Financial (VIRT), up 36% + dividend. Four other securities, which reported strong results in the period, added 40bp or more to the portfolio in the quarter: Harworth Group PLC, Robertet (OTCPK:RBTEF), Magellan Financial (OTCPK:MGLLF), and E-L Financial (OTCPK:ELFIF). The two largest detractors were Occidental Petroleum (OXY, oil price weakness) and TFF Group (OTCPK:FRFTF, global spirit weakness, impacting demand for barrels).

We acquired two new holdings in the quarter – Avolta (OTCPK:DUFRY), a Swiss-based airport retailer across the spectrum of duty free, food service and convenience – discussed briefly in QR#6 as was the other new holding, Sportrader, a data provider for sports gaming companies. We reduced our holding of Catapult International with the shares having reached our valuation, gaining 180% since acquisition. We still retain a significant position given the tailwinds for the industry and the company’s positioning. We fully divested FRP Holdings (FRPH) where we have greater question marks over future valuations of the commercial portfolio.

Dynasty Trust’s top twenty positions as at 30 September 2024 as a percentage of net asset value are:

Click to enlarge

At quarter end, we retain around a 4.5% cash weighting. After recent wider market gains, we are more cautious on the equity outlook given the re-rating of $1 of unchanged near-term US earnings expectations by 19% over the course of the 2024 year – despite minimal change in long-term bond rates. We are conscious that the price demanded of some of the very best global businesses have risen even more sharply, requiring a longer, overly optimistic high-growth runway to justify purchase.

International Man of Mystery

Two of our larger portfolio exposures – Bollore and D’Ieteren – made significant announcements in September. They are moves designed to take each grouping into a new structure (Bollore) or set the group for the next generation (D’Ieteren). Unlike yen carry trades and what Jensen Huang had for lunch, these changes have far more than an ephemeral impact. It is incumbent upon us to analyse and report.

But starting on page 9 is a detailed analysis we have been seeking to write for some time on a mysterious Dutch/Caribbean treasure trove, which many have walked away from – HAL Trust.

The HAL analysis serves a wider purpose other than simply assessing a company at which most investors would not take a second look. We have followed this business for well over five years – a period during which share price performance has been barren at best.

The entity is the most secretive of any of the 37 securities we currently hold. HAL Trust (HAL, HAL.AS)- is a Bermudan Trust whose sole asset is shares in a Dutch (formerly Cura├зao) company, HAL Holding NV which was operated out of Monaco but from April this year, moved to be operated from “hometown” Rotterdam. Like most major Dutch corporates, HAL Holding has a supervisory (non-executive) board and a small two-person Executive Board (CEO, CFO).

HAL is ~70% controlled by “International men (and women) of mystery” – the van der Vorm family – who in their third generation hold two of the five Supervisory Board seats and appear to us as becoming yet more opaque.

By looking at HAL’s history since Micky Arison dumped US$625million in its lap in November 1988 to acquire Holland America Line, and the family opted to retain the funds and invest them, we can learn so much about the pressures and benefits of other publicly listed family-controlled entities. Why some prosper and nurture public stockholders, with others for illogical reasons staying listed but not embracing public capital. There are the pressures of expectation – wealth and IQ are often confused – but also with the cycles any investor will endure. HAL went through a stellar period, where each major investment and business decision paid off, and net NAV compounded at 16.5% per annum plus a 4% dividend pa for a thirteen-year period.

If HAL wasn’t already popular amongst retail investors in the Netherlands by allowing you to invest directly alongside one of the country’s very richest families in its key wealth creating vehicle, this sustained period of strong returns provided further endearment. Even after HAL NAV had peaked, HAL’s share price at end 2016 (тВм180) traded at a 10% premium to NAV (тВм162.50).

The returns of thirteen-year period from 2002 to 2015 abruptly slowed, with some very poor individual investment decisions; however, the ballast from past periods – for many wealthy families wealth retention rather than return is the key driver – means that opportunity cost rather than permanent diminution in value is the issue.

In our view, investors seem to have written off HAL Trust because of these erroneous decisions. The key feature of this Quarterly Report is a detailed breakdown of why we believe HAL to now be significantly undervalued, where investors are potentially missing more rapid pace of NAV growth at HAL, but also how this value may seep into the publicly quoted shares of HAL Trust.

Bollor├й: opening the road to a “roll-up”: Odet the probable 2025 target

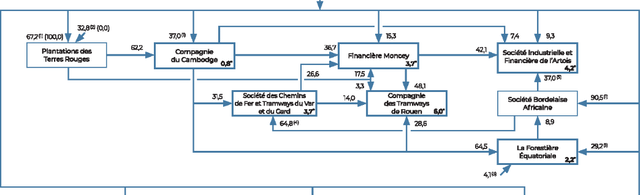

We sincerely apologise for once again writing about the Bollor├й galaxy. The announcements in the past quarter were unexpected and of genuine meaning. Why? The Bollor├й galaxy is undertaking its first mop-up/squeeze out transactions in the Rivaud Group of companies1 since the exercise on Plantations Des Terre Rouges (‘PTR’) in 2013. These are highly relevant since they involve privatising the three key holding companies – Compagnie du Cambodge (“Cambodge” mkt cap тВм5.3billion), Financiere Moncey (“Moncey”; cap тВм2.2billion) and Soci├йt├й Industrielle et Financi├иre Artois (cap тВм2.5billion) and the two smaller intermediate companies “Var et Gard” and “Tramways de Rouen” via respective mergers with Cambodge and Moncey. Events in the Bollor├й galaxy seem to be progressing more rapidly than expected.

PTR is the largest shareholder in Cambodge which in turn is the largest owner of Moncey (with PTR the second-largest owners); Moncey is the largest owner of Artois.

Bollor├й aficionados will, of course, find multiple fascinations and conspiracy theories, but there are three genuine wider ramifications with these moves:

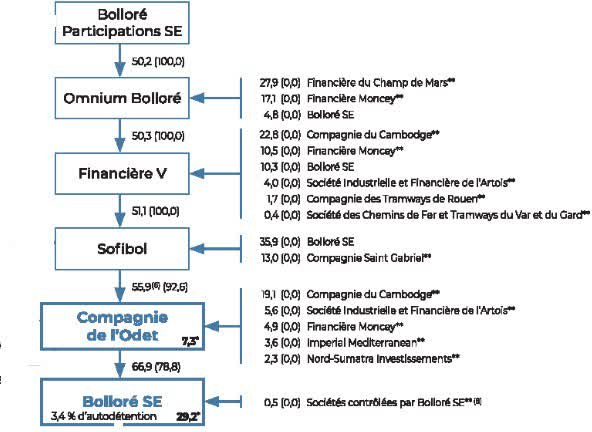

All three of the larger companies have direct and indirect shareholdings in the listed holding company, Compagnie de L’Odet (Odet); as a consequence, we can drive each company down to an implied value being offered by Bollor├й per Odet share; The implied value per Odet share is relevant because under French takeover law, with Vincent Bollor├й’s interests having effective control of 93.05% of Odet2, they can launch a takeover offer, followed by a “squeeze out” because less than 10% of the shares are in “minority” hands. Indeed, the squeeze out laws are being used to privatise Cambodge, Moncey and Artois. However, the squeeze out price has to be approved by France’s AMF3 with an independent report4 since the shares are effectively being expropriated5. A successful completion of these deals will leave the control companies above Odet as effective joint ventures between the individual holding companies (Sofibol, Financi├иre V, Onium Bollor├й) – which are all ungeared – and Bollor├й. To open the way to “rolling-up” the holding companies (see chart below, where all the companies on the right-hand side just become “Bollor├й”) only necessitates the privatisation of Odet.

The need for the cascading control structure required in the early 1980s to grow, raise capital but retain control is now much diminished. The Bollor├й family can retain control of the main group assets without as many levels of the pyramid having built up significant equity in the group. The brilliant structure of “Breton Pulley’s” erected by Antoine Bernheim will increasingly act as a discount mechanism to a relatively transparent group of underlying assets – made less opaque by the break-up of Bollor├й’s 30% owned Vivendi into four composite fungible pieces. The analysis which follows suggests that over the next couple of years, there is a strong possibility of rolling up at least two levels of the pyramid, to bring out the value of the assets to the ultimate controllers – especially given the тВм6billion of cash within the group.

There does appear to be significant shareholder discontent with the take out offers on the Rivaud shares; given the residual shareholder base of long term committed and smart individuals, the quality and level of company argument to date is rather poor.

If Odet is privatised via a squeeze out, by Bollor├й, then it could distribute its only effective only asset6 (1.993billion Bollor├й shares) to its two shareholders – Sofibol with 56.4% and Bollor├й with 43.6%; Since Bollor├й would then acquire 875million shares of itself (43.6% of 1980million) which would be cancelled7, Bollor├й’s share capital would reduce substantially from a full 2,852million shares to ~1,977 million (cancelling a small amount of existing Treasury stock). Sofibol would own 1,118million Bollor├й shares.

We can do the same exercise for Sofibol to distribute ITS Bollor├й shares (its only asset of note), which would give Financi├иre V 571mn shares (1,118million x 51.1%)and Bollor├й 546m – to be cancelled.

This exercise can theoretically go further up the chain, but runs into a roadblock around Financi├иre V. All the while, the “public” own an unchanged ~858million Bollor├й shares, which becomes proportionately larger as Bollor├й shares are cancelled as part of the roll-up. The roadblock arises since the proportional ownership of Vincent Bollor├й (Bollor├й Participations) falls as the pyramid is dismantled. At the Sofibol stage it is ~56.6%, falling to 40% at Financi├иre V and 25% at Omnium Bollor├й. If the pyramid was FULLY rolled up, then the family’s stake in Bollor├й SE would only be 14.4% of the 1,003million shares which would remain on issue if that occurred.

mn shares

Hold Co name

HoldCo %

Hold Co

Bollor├й %

Stock cancelled

public

Issued Capital

Family

Now

Odet

1993.0

858.5

2851.5

69.9%

1

Sofibol

56.1%

1118.1

43.9%

874.9

858.5

1976.6

56.6%

2

Financi├иre V

51.1%

571.3

48.9%

546.7

858.5

1429.8

40.0%

3

Omnium Bollor├й

50.3%

287.4

49.7%

284.0

858.5

1145.9

25.1%

4

Bollor├й Participations

50.2%

144.3

49.8%

143.1

858.5

1002.8

14.4%

Click to enlarge

All our discussions with other Bollor├й experts suggest that would never happen. We agree. The family are obsessive about control -why was the structure there in the first place? To retain proper control (50% + 1) would also require ongoing buybacks of Bollor├й’s own shares which, as the share count is reduced in a roll-up, have much more meaning. Of course, it is a cementing of complete control by the family using Bollor├й’s own funds; bluntly, what controlling entrepreneur hasn’t done that! Given we estimate Bollor├й shares would be worth тВм15-16 each on a full roll-up- just on the current asset base – which would still have тВм4.8billion of cash under the assumption below – who would be complaining?

Our best guess is that the roll-up would go as far as “level 2” – Financi├иre V (ironically the original vehicle) – accompanied by progressive buybacks of ~300million shares would accomplish the outcome. We believe the chance of Odet and Bollor├й merging with shares are unlikely to eventuate; moreover, it is to the family’s advantage for the Bollor├й share price to remain subdued for the time being.

So what’s the cost of an ODET squeeze out?

Many analysts, ourselves included, have a transparent see through value of Odet being upwards of тВм4,000 a share. Because the extinguishment of Odet would be through expropriation with an independent report, the outside expert will use indicators such as “share price” as “valuation” tools8, and MAY get some solace from the current round of privatisations of the Rivaud group, which, because the companies all have direct and indirect exposure to Odet, can be driven down to a value per Odet share.

The brilliance of Bollor├й’s alternative offer of UMG shares for each company deliberately offers an arbitrage and takes the attention away from the implied values in the cash offers.

The table below is a simplified summary of the implied value of Odet contained within the тВм257million worth of Rivaud offers prior to the very minor adjustments required for the Var et Gard and Rouen mop-ups; we assume NO value for IER, the ticketing system (loss making) and apply NO discount for differing levels of holdings for Odet shares – direct versus indirect:

тВмmillion or per share

Artois

Moncey

Cambodge

Minority offer consideration

103million

90million

64million

Shares issued (pre stock split)

266,200

182,871

533,972тАа

Offer price (cash)(pre stock splits)

тВм9,300

тВм11,800

тВм9,300

Market Cap of company at offer

2,476

2,158

4,966

Value of non ODET share assets

1,496

640

1,193

Value of ODET shares

980

1,518

3,773

Actual number of ODET sharesтАб

446,215

904,190

2,053,939

Value per ODET share

тВм2,195

тВм1,679

тВм1,837

Click to enlarge

тАа adjusted for 4.6% holding within Plantation de Terre Rouges treasury loop

тАб assumes no debt in Sofibol, Financi├иre V, Omnium Bollor├й and proportional interest on Odet shares

Click to enlarge

In our opinion – we have no horse in this race, but the result is of major interest – the offer for Moncey, even allowing for four “levels” of exposure to Odet seems very low, whereas the Artois offer, which was the highest premium above undisturbed price – seems more “realistic” judged against Odet, though well below full value of that company.

If we reverse engineer the highest price, within Artois, of тВм2,200per Odet share, we arrive at a price of тВм7.35 per Bollor├й share.

тВмmillion (updated for 30 June 24 balance sheet)

Eliminate

SCLтАа

Don’t eliminate

Comments

“value” / ODET share

тВм2,200

тВм2,200

Issued ODET shares

5.649m

6.586m

MARKET CAP

12,428

14,489

Vivendi shares (тВм10.30)

62

62

6.05million

UMG shares (тВм23)

138

138

6.2million

Debt

(360)

(360)

Via deconsolidation

IMPLIED VALUE BOLLOR├Й SHARES

12,888

14,649

Bollor├й shares

1709m

1993m

IMPLIED VALUE/BOL share

тВм7.37

тВм7.35

27% premium to current price

Click to enlarge

тАаself-control loop between Odet and Bollor├й

Click to enlarge

As part of Bollor├й’s buy-back tender offer at тВм5.75/share in mid-2023, the Independent Expert furnished a valuation range of тВм7.93 -тВм9.33/share9, before applying a large discount based on a cohort group of listed holding companies, of whom only one – Exor – had a track record of NAV growth anywhere near comparable to Bollor├й. Given that a squeeze out is “expropriation” these discounts would not be applicable, and the analysis subject to far greater scrutiny.

Hence, in our view, there is a chance that Bollor├й may have to raise their offers for the Rivaud companies. Moreover, we don’t see any application of these implied Odet prices in an ultimate take out, which whilst not full value, would have to be closer to тВм3,000 per Odet share being ~тВм10/Bollor├й share – a cost of тВм1.44billion.

With only ~480,000 Odet shares to squeeze out, each incremental тВм100 per share costing ~тВм48million and a cash pool of тВм6billion, it is hardly beyond the scope of Bollor├й to not risk legal recourse from a highly informed 7% minority group, when the day comes, which we now have enhanced expectations of being in 2025. Any which way you explore the tactics and strategy, these valuations are significant premia to prevailing share prices, with value accretive moves to come.

D’Ieteren: the seventh generation divides opinion10

The 60% “D’Ieteren family” control (63.6% by votes) of the listed company (DIE.BR) is split between the descendants of the fifth generation Pierre D’Ieteren: grandson Nicolas with 32.9% (17.7million shares) and Nicolas’ 80 year old aunt Catheline P├йrier D’Ieteren (a renowned art historian) whose son Olivier P├йrier manages SPDG (s.a.de Participation et de Gestion) with 27.3% (14.7million shares). The P├йriers have been diversifying SPDG for some time and have now reached a stage where they wish to reduce the shareholding in D’Ieteren which will be done – subject to shareholder approval – by a block sale of about 9million shares at тВм223.75/share leaving the remaining 5.7million shares (10.6%) to be reduced over five years.

To partly fund the тВм2billion investment by Nicolas’ vehicle, Nayarit, which will advance to 50.1% of D’Ieteren, the company are raiding every available piggy bank to pay a тВм74/share dividend to all shareholders, being ~тВм4billion. The piggy banks? тВм850million of parent company liquidity, new bank debt of тВм1billion into the parent, a ~тВм4.3billion dividend paid by the ~50% owned Belron (DIE.BR share тВм2.2billion), bring Belron’s debt up to тВм8.9billion.

There are two sides to this story: conservative and liberal.

The conservative group have certainly been ascendant since the announcement. DIE.BR shares have fallen 16% from тВм226 to тВм189.90 on the basis that Belgian retail investors are petrified by the new debt exposure which hasn’t been seen in the group, the gearing of the holding company, which is unusual when subsidiaries are also geared, and such quantums of debt in businesses which are “auto-related” albeit with a lot of “replacement”- Belron (vehicle glass replacement, D’Ieteren Auto – VW-based vehicle distribution, and 91% of Parts Holding Europe). Moreover, the vast majority of shareholders are subject to tax on the dividend of 30%. The conservative’s fear is that any slowing of European economies will work through increased gearing to significantly reduce the equity value of Belron and, to a lesser degree, the other businesses.

The liberal viewpoint has a more American slant, which has relevance not only through numerous US based funds as significant DIE.BR shareholders, but American owners (CD+R, Hellman & Friedman and BlackRock) holding an estimated 32% of Belron.

This viewpoint acknowledges:

the strength of the businesses, the belief – expressed in the latest half-yearly report – that Belron’s US profits will start to re- accelerate as a result of higher auto insurance rates in the US (the most sluggish of Belron’s regions in the latest results); the pressure from the private equity owners to facilitate a Belron IPO; the likely location of the IPO being in the US being used to refinance Belron as well as facilitate reductions/exist of existing holders; and the fact any IPO raising will be constrained by the lower equity value of Belron given higher debt and lower rating from gearing.

We can see both sides of the equation, but are happy holders at present. At the reduced price of тВм189.90 (implied тВм115.90XD), using a similar tabulation and values to the D’Ieteren/Belron piece in QR#5 (March 2024, page 11) we believe on an ex-dividend basis(ignoring tax):

we are gaining exposure to Belron at a P/E below 12x; we are gaining exposure at EV/Operating profit multiple again below 12x; and Adding back the dividends and capital returns in 2022, 2023 plus the proposed dividend -тВм6.25billion in total – to implied enterprise value, gives an equivalent of -тВм21.7billion. This is 3% above the Clayton, Dubilier and Rice, Hellman & Friedman, GSIC and BlackRock private equity transaction of December 2021 of -тВм21billion (тВм17.2billion equity; -тВм3.8billion debt) since when operating profit is up over 56%.

тВмmillions

Equity value

estimate

Equity capitalisation DIE.BR

10,338

54.437mn x of тВм189.90

Dividend paid

(4,208)

EX dividend market capitalisation

6,310

Parent company debt

1,041

Cash 787, Belron dividend 2,200, dividend paid (4,028)

Enterprise value

7,351

(‘A’)

Other subsidiaries:

TVH (40%)

1,170

Purchase price late 2021

PHE

1,019

cf purchase price 571m in August 2022 (gearing)

Moleskine

250

Equity and loan exposure

D’Ieteren Auto

1,904

12.5x P/E

Est. holding company costs

(310)

After tax estimate of тВм24million at 13x

Property

42

Total subsidiaries/Holdco costs

4,075

= тВм74.86/issued share (54.7million) (‘B’)

IMPLIED VALUE BELRON STAKE

3,276

for 50.3% (A-B)

IMPLIED 100% BELRON EQUITY

6,513

(‘C’)

Belron Operating profit (est 2025)

1,310

Finance costs

(555)

New Belron debt тВм8,930million

PRE TAX PROFIT

755

NET PROFIT

550

(‘D’)

Effective P/E

11.8x

(‘C’)/(‘D’)

Implied EV Belron

15,440

Implied EV/Operating profit

11.8x

Click to enlarge

Aside from the cashflow qualities of Belron, which we expounded in QR#5 in March 2024, the modest rating, even allowing for debt, leaves us happy to take on the higher risk and remain holders.

HAL Trust: cracking the enigma to solve the mystery and unwrap the riddle11

“I know I’ve made some very poor decisions recently, but I can give you my complete assurance that my work will be back to normal. I’ve still got the greatest enthusiasm and confidence in the mission”. – HAL 9000 as Dave commences disconnection “2001: A Space Odyssey” (Kubrick 1968)

If I said to you, we are invested in a company where:

NAV/share at 30 June 2024 is below the level of 31 December 2015 17% of the shares are owned by a probable (at least part) seller; There is only a further 15% free-float; our company spent тВм700m cashing out a private equity firm at four – six times the PE firm’s investment in ProGamers made only three years before, but three years later, HAL handed our equity to lenders at zero; our company acquired 31.5% of ProDrive Technologies in February 2022 for тВм211million; by end December 2022 it had impaired the stake by тВм130million(>60%) before buying out one of the co-founders; management make no public presentations – ever; and have further trimmed the level of external disclosure using IFRS accounting standards only, removing some useful pro forma management accounts

you would reasonably wonder if I had taken a nasty blow to the head. We hope the following pages will explain why we feel we have no neural impairment.

HAL Trust is ~68% controlled by two entities connected to various members of the van der Vorm family notionally based in Rotterdam; a further 17% is owned by the descendants of Hans Melchers, a wealthy Dutch investor who passed away in November 2023. Collectively, the van der Vorm family are reputedly amongst the wealthiest in the Netherlands, but have a myriad of historic structures in low tax Caribbean jurisdictions. HAL is a company which does not court publicity. There are no existing investment presentations, and the only information available to shareholders is an interim report, two small quarterly updates and a statutory annual report plus any other required continuous regulatory disclosure. Contact with the investment community is minimal, and usually only with trusted counterparties. However, it is a long-term favourite amongst Dutch retail investors.

The basic thesis: cheap and ignored, transition to operating earnings, exposure to alternate energy

HAL is much more a conglomerate than a traditional European holding company in the tradition of family-controlled investment entities. HAL has high levels of operating income from majority owned businesses which facilitates significant cash flow generation, as well as ownership of a ~тВм4.3billion quoted equity portfolio, some highly profitable real estate exposure plus bonds and other net liquidity. At тВм118.40, the shares trade at a 26% discount to stated NAV at 30 June 2024, which substantially understates the real value of the entity, which, we believe, is over тВм200/share.

HAL is priced in a consistent manner with European holding companies at ~40% discount to “assessed” NAV; to break this nexus, requires the clearance of an “impediment”. For example, Exor (EXO.AS) continues to trade at ~ 44% discount to NAV despite its astonishing performance of 18.6% per annum12 since the reorganisation in March 2009; this reflects more conservative investor fears over the total automotive exposures and the specific 44% net portfolio exposure to Ferrari. HAL’s situation is different in that the world’s largest non-Chinese dredging company, Boskalis makes up 47% of asset value within our assessed NAV, this maritime behemoth is wholly owned with HAL having full access to cash flow.

HAL’s inability to grow NAV over a lengthy period of time, allied to embarrassing slip-ups such as those noted above, which has vastly diminished its share price rating versus NAV, stalled since the mid-2000s.

There are signs this period of difficulty is concluding. The acquisition of the 54% of Boskalis then in public hands in 2022 was hard-nosed and has proved to have been a bargain, valuing the company at around half what it is worth today. The creation of ~тВм4bn of value in this deal pays for a lot of ProGamers, but more meaningfully, appears to have given the company the wherewithal to pursue other “maritime”-type assets in areas it knows well, unlike Gen-Z gaming enthusiasts stuck indoors during COVID. There is a strong exposure to servicing alternate energy via Vopak, parts of Boskalis, parts of SBMO plus Anthony Veder Group – all up (with a slight finger in the air) about тВм4billion worth of exposure.

Valuing and assessing HAL is a bit of a chore, because of the volume of businesses owned and the need to avoid double-counting. But the company’s reports have been templated for some years so that once you become familiar with the format, the analysis is not too difficult, despite the company’s predilection for disclosing – but hiding – disclosures such as write-offs.

HAL’s structure is not that complex, and we broadly use the stated template of four areas – with some minor adjustments – to assess and value HAL, including post 30 June 2024 known changes:

Assessed value of HAL Trust as at 30 September 2024 on a deconsolidated basis13

тВмmillion

Per HAL

share

Comments

Listed securities

4,661

тВм51.58

VPK.AS, SFL.MI, SBMO.AS, TE.PA,

WAF.DE + undisclosed

Book value of operating subsidiaries

3,225

35.69

as at 31 December 23 annual report disclosure adjusted by East 72 (see discussion)

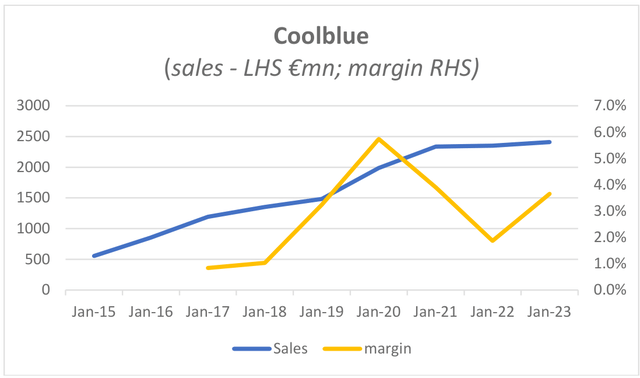

Coolblue (56.4%)

320

тВм3.54

Includes increased investment

Koppert pref shares

140

тВм1.55

US real estate

206

тВм2.28

Includes recent Seattle sale

Netherlands real estate

84

тВм0.93

Boskalis (enterprise basis)

8,750

тВм96.82

includes Smit-Lamnalco deal (not settled)

TOTAL VALUE

17,386

тВм192.39

Debt

(1,926)

(тВм21.31)

Deconsolidates Vopak and Safilo

Cash (excluding cash held in Boskalis)

1,745

тВм19.31

Fixed interest

1,415

тВм15.66

NET CASH

1,234

тВм13.65

Excludes тВм680million in Boskalis

TOTAL

18,620

тВм206.04

90.37million shares

Click to enlarge

HAL has an equity market capitalisation of тВм10.7billion, a 42.5%, discount to our valuation(50% adjusted for cash); however, our valuation is 29% higher than the stated valuation in the 30 June 2024 interim report.

The following sections look at the backstory of HAL Trust, discuss their strategies, assess whether there are catalysts to close the discount to value gap, before separately assessing the listed portfolio, unlisted companies, real estate and Boskalis to verify our valuation assessment.

Click to enlarge Backstory14

“van der Vorm did not like to be on a pedestal, he preferred to remain Mr. X. After his death all personal archives had to be destroyedтАжhis hiers saw to that. ” (translated from Dutch) -“Willem van der Vorm: a figurehead illuminated” 2007 Thesis by Elly de Leeuw Hilberts (available online)

Tracing the history of the company and its family controllers back to 1873 sounds like pedantic overkill; believe me, it’s not. The current administration shares common traits with the “founding patriarch” Willem van der Vorm: an overwhelming desire for privacy and secrecy15 yet social generosity16.

Open every HAL Trust annual report and on the inside cover “the history of HAL dates back to April 18, 1873, when the Nederlandsch-Amerikaansche Stoomvaart-Maatschappij (N.A.S.M.) was founded in Rotterdam, the Netherlands. NASM, of course, became the “Holland-Amerika Lijn” with its original voyages from Rotterdam to New York.

The van der Vorm involvement in maritime and ancillary activities doesn’t start with HAL, although coincidentally, Willem van der Vorm was also born in 1873 in Rotterdam. After qualifying as an accountant and operating in the port business, van der Vorm joined American Petroleum Company, which in turn formed SSM (a shipping and coal trading company) in 1896. APC sold SSM in 1905 – with van der Vorm appointed as a Director and becoming a co-owner and growing its fleet to 8 ships by 1914.

Van der Vorm gradually expanded SSM’s range of interests to rope making, gas, photography and began to merge as a key businessman in Rotterdam; in turn, he became a key leader in the salvation of Robaver, a bank holding company in the early 1920s – a position he maintained for twenty years.

The connection between van der Vorm and HAL begins in 1933, as head of a syndicate to rescue HAL, after being impacted by prevailing depression conditions. HAL operated under a supervisory committee for five years, and in a typical initiative of the times, build a significant new vessel “Nieuw Amsterdam” – with Government assistance – launched in 1938.

In May 1940, the linkage to Cura├зao, the semi-autonomous Dutch island in the Caribbean, came about after the bombing of Rotterdam and the loss of three vessels; this feature persisted with HAL Holding NV (see below) having its place of “effective management” on the island until April 2024.

HAL Holding was listed on the Amsterdam Stock Exchange in 1954 to include the shipping line and other investment activities; the entity was restructured in 1977 with an effective scrip swap to HAL Trust, which now holds all the shares of HAL Holding NV. The trust is incorporated in Bermuda, which with assorted clauses of the trust deed leave little leeway for minority shareholders.

Willem van de Vorm died in 1957, with no successors, having never married.

Effective succession passed to his nephew William Henry van der Vorm, through whose lineage the current family management representation, resides through his grandson, 66 year old Chair Martijn van der Vorm. However, the current Chair’s father, Nico, is responsible for the most seminal move of the company: the US$625million (tax-free) sale, in November 1988, of Holland America Line to Carnival Cruise Lines.

This transaction is the basis of the current HAL, leaving the Trust with US$675million of equity at 31 December 1988, which as compounded at 9.2% net of any taxes over 35.5 years, on stated values.

Patient stalkers and consolidators

Stripping down the building of HAL Trust post divestment of Holland America Line shows some common themes:

A love of industry consolidation plays; A willingness to stalk, over extended time periods, to obtain what they truly want; A willingness to be a backstop financier (with debt or equity) for financially troubled businesses; Parsimony on takeovers, occasionally to their long-term detriments; and Extreme privacy.

The consolidation/roll-up is evident throughout the existing portfolio. Timber and Building Supplies, Broadview, Auxilium and arguably Boskalis. What worked spectacularly in eyewear retailing and hearing aids hasn’t really done so elsewhere – yet. But there are signs.

HAL made gains of тВм4billion on two end game transactions in “care” retailing over periods of 15 and 25 years respectively:

Building from 2001, with virtually no mention in annual reports before 2008, HAL built AudioNova from scratch via acquisitions of store groups across Europe until selling the business in September 2016 to Sonova Holding (OTCPK:SONVF), the Swiss owners of Sennheiser and Advanced Bionics for тВм830million and a gain of тВм490million; Two brilliantly executed optical care roll-ups starting in 1996 purchasing a 78% interest in Pearle Vision’s stores in the Netherlands from the UK’s Grand Metropolitan subsidiary, Pillsbury as Cole National, a US listed company acquired the domestic business and retained 22% of the Netherlands enterprise. HAL continued to add to Pearl Europe through acquisition of smaller groups across the continent, as well as acquiring a 19% stake in Cole National. When Cole was acquired by Luxottica in 2004, this stake gave HAL the leverage to acquire the 21% residual minority of Pearl Europe from the Italians. A takeover in 2004 of GrandVision, the French eyewear retailer for тВм600million in the publicly listed group after building its stake from 6% to 32% and teaming up with its management to thwart the counter-bidding parting – coincidentally the private equity group PAI who control Mercolin, the key competitor to HAL controlled Safilo in eyewear manufacture; The July 2010 merger of Pearle Europe and GrandVision The IPO of the enlarged GrandVision in early 2015 at an effective equity value of тВм5billion, with HAL taking ~20% off the table to the public; and The eventual acquisition of Grand Vision, after all clearances, in July 2021 by Luxottica for of HAL’s stake for тВм5.5billion and a gain of тВм3.5billion.

HAL supported Boskalis for many years, buying its first 20% holding in 1989, gradually increasing its stake to 31% by December 2003. In 2009, HAL took a placement to facilitate the acquisition of SMIT International, diversifying Boskalis activities. HAL slowly crawled up the Boskalis register, acquiring shares almost annually, crossing the 40% mark in 2018, becoming more aggressive in 2019 and 2020 acquiring over 5% of the company. From its position of 46.2% in March 2022, HAL launched its offer of тВм32 a share, begrudgingly increasing it to тВм33 in August 2022. As we show in the discussion of Boskalis, the offer was very well-timed before revenues and profits increased sharply.

Other public takeovers have been heavily contested for small amounts of money. As we see with Westag (part of Broadview) a minor increase in the takeover offer would probably have secured 100% of the capital, but HAL are stuck with 83% of the shares, with Westag sat on тВм35million of cash. Likewise, HAL are stuck with 94% of TABS Holland in the building material sector after a bid in 2019, that in our opinion, was very stingy – the more so when earnings exploded two years later pricing the bid just above 2x 2021 EBITDA.

Are there any catalysts or end games to close the discount to NAV? Do you need one?

Other than the moribund NAV growth, a key reason for the large NAV discount is that the secrecy and lack of HAL’s own public discourse about the company extends particularly to sensitive subjects such as succession. The wider world has no idea who the van der Vorm family successor is, or even if there is one – the patriarch, Martijn van der Vorm is 66 years old, so it’s a reasonable question.

We could run a whole capital markets academic course just on HAL Trust and potential capital management initiatives which would enhance shareholder value. Sales of some of the moribund unlisted businesses to buy back shares. Using some of the cash pile for a buyback would potentially assist. A further change of dividend policy from the current cash dividend based on a 2.5% yield on the December share price. But a more consistent growth in NAV is clearly the best starting point, since we know that even if large discounts remain, that provides the return to investors (see EXOR). Our contention is that this NAV growth is in the throes of recommencement.

Given this is a Bermuda Trust structure, there is no real avenue for activist shareholders, other than to be noisy; there’s nothing they can enforce. Accelerated catalysts need to be “friendly” The most obvious accelerated catalyst touches on the secrecy issue and the largest non van der Vorm shareholders, the Melchers family, who have 17% of the shares.

The shareholding was established by Hans Melchers, who died aged 85 in November 2023. Melchers built up a chemical company, Melchemie17, which he sold in 2002 to H├╝ttenes-Albertus. Melchers used part of the proceeds to invest in HAL in a meaningful way around that time, and would have derived significant benefit from the rapid growth of NAV from 2002 onwards.

The investment in HAL – a very discreet public entity, where because of the Bermudan home base, the level of disclosure on shareholdings is far less, was very desirable. Mr. Melchers daughter, Claudia, then 37, was kidnapped in September 2005 by three men, but released two days later18. Ms Melchers is now 55 and runs a catering business. The question of whether her advisors suggest diversification of this тВм1.8billion stock holding – and such advice if given is acted upon – is a key issue for all HAL shareholders.

HAL clearly has the financial means to facilitate a share buy-back to assist Ms. Melchers19 but would probably have to “pro rata” such an exercise with other non-van der Vorm holders. It’s why the exercise within the D’Ieteren family (see earlier piece) is not totally irrelevant.

The sale of major shareholdings or businesses seems unlikely in the near term – most are priced slightly cheaply – unless a strategic buyer arrived. Could an enterprising private equity firm (Blackstone, KKR) acquire the whole of HAL on an agreed basis, at an equilibrium price for the company suiting both buyer and seller, say NAV of тВм160?? None of us have any real clue as to the emotional ties to parts or all of HAL except they won’t be zero.

We view HAL as having no catalyst priced into the shares, so don’t really worry about letting our imagination run wild on that front. Anything that hints of capital management -Vopak and SBMO have had buybacks this year and Vopak’s overall capital management is really attractive – should be a positive in driving down the discount.

Based on our numbers, HAL “parent” – estimating public company dividend payments added to private earnings – will have тВм650-тВм700mn a year after capex but before asset sales to allocate to dividends (around тВм270mn per annum on current policy) and other capital management, alongside its тВм1.2billion of net liquids. Real flexibility if HAL chooses to use it.

HAL TRUST: 22 YEAR COMPANY STATED NAV/SHARE PROGRESSION

shares (mn)

NAV (тВм)

per share

unlisted uplift

US RE

uplift

NAV TOTAL

per share

Dividend (XD following May)

31-Dec-02

63.674

1,532

тВм 24.06

тВм 1,532

тВм 24.06

тВм 1.25 тАа

31-Dec-03

63.682

1,885

тВм 29.60

415

тВм 2,300

тВм 36.12

тВм 1.45 тАа

31-Dec-04

63.674

2,000

тВм 31.41

612

тВм 2,612

тВм 41.02

тВм 1.80 тАа

30-Jun-05

63.687

2,280

тВм 35.80

662

тВм 2,942

тВм 46.19

31-Dec-05

63.673

2,864

тВм 44.98

652

тВм 3,516

тВм 55.22

тВм 3.00 тАа

30-Jun-06

63.684

2,939

тВм 46.15

652

тВм 3,591

тВм 56.39

31-Dec-06

63.490

3,591

тВм 56.56

888

тВм 4,479

тВм 70.55

тВм 3.15 тАа

30-Jun-07

63.508

3,914

тВм 61.63

888

тВм 4,802

тВм 75.61

31-Dec-07

63.506

4,354

тВм 68.56

1287

тВм 5,641

тВм 88.83

тВм 3.25 тАа

30-Jun-08

63.527

4,236

тВм 66.68

1287

тВм 5,523

тВм 86.94

31-Dec-08

63.541

3,341

тВм 52.58

1174

тВм 4,515

тВм 71.06

тВм 2.00 тАа

30-Jun-09

63.563

3,611

тВм 56.81

1174

тВм 4,785

тВм 75.28

31-Dec-09

63.569

4,713

тВм 74.14

761

тВм 5,474

тВм 86.11

тВм 2.85 тАб

30-Jun-10

63.630

5,189

тВм 81.55

761

тВм 5,950

тВм 93.51

31-Dec-10

65.388

5,879

тВм 89.91

863

тВм 6,742

тВм 103.11

тВм 3.75 тАб

30-Jun-11

67.280

5,776

тВм 85.85

863

тВм 6,639

тВм 98.68

31-Dec-11

67.275

5,976

тВм 88.83

614

тВм 6,590

тВм 97.96

тВм 3.40 тАб

30-Jun-12

69.381

6,587

тВм 94.94

614

тВм 7,201

тВм 103.79

31-Dec-12

69.386

7,255

тВм 104.56

621

тВм 7,876

тВм 113.51

тВм 3.90 тАб

30-Jun-13

71.553

6,917

тВм 96.67

621

тВм 7,538

тВм 105.35

31-Dec-13

71.557

7,326

тВм 102.38

703

тВм 8,029

тВм 112.20

тВм 4.10 тАб

30-Jun-14

74.088

7,148

тВм 96.48

703

тВм 7,851

тВм 105.97

31-Dec-14

74.033

7,678

тВм 103.71

4311

тВм 11,989

тВм 161.94

тВм 5.05 тАб

30-Jun-15

76.266

12,635

тВм 165.67

159

тВм 12,794

тВм 167.75

31-Dec-15

76.273

13,180

тВм 172.80

159

тВм 13,339

тВм 174.88

тВм 6.50 тАб

30-Jun-16

78.500

12,348

тВм 157.30

159

тВм 12,507

тВм 159.33

31-Dec-16

78.505

12,754

тВм 162.46

228

тВм 12,982

тВм 165.36

тВм 7.10 тИЖ

30-Jun-17

80.041

12,636

тВм 157.87

228

тВм 12,864

тВм 160.72

31-Dec-17

80.040

12,122

тВм 151.45

253

тВм 12,375

тВм 154.61

тВм 6.20 тИЖ

30-Jun-18

81.691

11,556

тВм 141.46

253

тВм 11,809

тВм 144.56

31-Dec-18

81.689

11,238

тВм 137.57

297

тВм 11,535

тВм 141.21

тВм 5.30 тИЖ

30-Jun-19

83.396

11,663

тВм 139.85

297

тВм 11,960

тВм 143.41

31-Dec-19

83.398

13,694

тВм 164.20

346

тВм 14,040

тВм 168.35

тВм 5.80 тИЖ

30-Jun-20

83.363

12,692

тВм 152.25

346

тВм 13,038

тВм 156.40

31-Dec-20

85.313

12,791

тВм 149.93

360

тВм 13,151

тВм 154.15

тВм 4.70 тИЖ

30-Jun-21

86.701

13,111

тВм 151.22

691

110

тВм 13,912

тВм 160.46

31-Dec-21

86.701

13,111

тВм 151.22

691

110

тВм 13,912

тВм 160.46

тВм 5.70 тИЖ

30-Jun-22

88.599

12,811

тВм 144.60

691

110

тВм 13,612

тВм 153.64

31-Dec-22

88.599

13,087

тВм 147.71

358

122

тВм 13,567

тВм 153.13

тВм 5.00 тИЖ

30-Jun-23

90.371

13,527

тВм 149.68

тВм 13,527

тВм 149.68

31-Dec-23

90.371

13,563

тВм 150.08

тВм 13,563

тВм 150.08

тВм 2.85тАа

30-Jun-24

90.371

14,474

тВм 160.16

тВм 14,474

тВм 160.16

Click to enlarge тАа cash dividend only тАбdividend paid only in shares тИЖdividend paid 50% cash & 50% shares

Click to enlarge CORE LISTED PORTFOLIO

HAL’s listed portfolio exposures at 30 September 2024, up just over тВм300 million (тВм3.30/share) mark-to- market since 30 June 2024, are as follows:

тВмmillion or million

ticker

% held

shares held

price

value

Vopak

VPK.AS

50.3%

61.55

тВм 41.68

тВм 2,565

Technip Energies (OTCPK:THNPY)

TE.PA

16.2%

29.33

тВм 21.62

тВм 634

SBM Offshore (OTCPK:SBFFF)

SBMO.AS

22.9%

36.77

тВм 16.39

тВм 603

Safilo (OTCPK:SAFLF)

SFL.MI

49.8%

206.2

тВм 1.10

тВм 226

Siltronic (OTCPK:SSLLF)

WAF.DE

5.3%

1.59

тВм 68.35

тВм 109

Other undisclosed

тВм 295

TOTAL

тВм 4,432

Click to enlarge

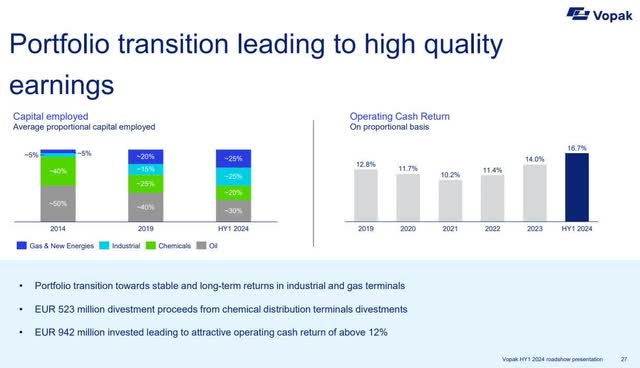

Vopak is the key-listed exposure, not just because of size, but the transformation wrought on the company in the past three years by new management with capital discipline – something NOT evident at HAL who have one of six Supervisory Board representatives. Vopak is an extremely complex company given its geographical spread, end markets exposure, masses of joint ventures all allied to a fixed cost base. Consequently, analytical coverage is very specialist, and scanty – which is unlikely to change. (Bluntly, HAL should have privatised it two years ago.)

Without penning a 50-page tome we can only skim the surface for Vopak to bring out the key messages; similarly, the analysis below tries to bring out the key points of the other listed entities, where further information can be derived elsewhere.

Vopak: strategic reset has paid significant dividends

Vopak was created in 1999 from the merger of two long-standing Rotterdam-based storage, shipping and related service companies dating back to 161620. The basis of the merger between van Ommeren (34%) and Pakhoed (63%) to have global scale – was not easily executed given competition in the home market between the two businesses, plus Pakhoed’s acquisition of Univar, a chemical distribution business when the companies had initial discussions in 199621. The two companies had further talks and made a public announcement in March 1998, only for the merger to founder on European Commission demands of divestments in June 1998.

After widespread criticism, and the clear logic of the merger, the two companies resumed talks and consummated the transaction in November 1999. In the early period of the merged entity, there were strategic and cultural tensions, adding to the difficult business environment with global recession in the period. With supposed linkages between the businesses hard to find, in April 2002 Vopak cleared a pathway to focus on tank storage as the key business, divesting other assets and spinning off Univar, the chemical distribution entity.

With the share price depressed through the early stages of the combination, having owned a small stake in van Ommeren before the merger, HAL aggressively acquired shares; less than a year into the merger HAL held 29.1% of the company by August 2000 and 39% (but only 26% of voting rights) by September 2000. To facilitate the chemical split, тВм150million of new capital was required, 60% of which – by agreement – was provided by HAL at тВм20/share (тВм10 in current terms), giving the investor 46% of the common shares and 33% voting rights.

In April 2006, HAL sold 20% of its Univar shares for тВм41.60 a share and in July 2007, realised the remaining 8 million shares at тВм53.50/share into a takeover offer by CVC Capital Partners. The Univar exercise generated тВм675million of proceeds and тВм320million of capital gain.

Strategic reset from 2021

Vopak’s post-merger strategy of focusing on tank storage and tightly related activities has led them to become the largest global independent terminal storage provider with activities in 76 terminals across the globe encompassing 34.7million cubic feet (equivalent) of TOTAL storage capacity. The company classifies the activities as independent in that it does not produce any of the product being stored, unlike, for example, an integrated oil major.

The economics of terminal storage range from highly attractive annuity style income, to cyclically tricky operations; consequently, valuations of these companies can vary dramatically both as component parts and as a whole. At the most positive extreme, Vopak operates storage for LNG on a take-or-pay basis, which provides a fixed fee per period income stream over a long-term contract (10 years) irrespective of whether the tank capacity is utilised. Alternatively, other storage facilities are subject to significant changes over short periods, and exhibit airline-style economics: capacity and pricing are key to a return. An “empty tank” just attracts fixed costs of maintenance with no revenue.

The business has significant “moats” given that the terminals are waterside, and expensive to build, and are quasi monopolies; moreover, the moats are fortified by the need for strong customer relations, due to contract length, safety and quality. In many cases, the terminals are held in joint ventures and associated entities with co-investment; the most graphic example for Vopak is in Prince Rupert, Canada where Vopak is building a C$1.3billion 95million cubic metre (cbm) LPG export terminal in a joint venture (“REEF”) with the supplier, AltaGas to come on stream in 2026; it will sit adjacent to the existing Ridley Island terminal, a 95million cbm affair also jointly owned by Vopak/AltaGas opened in 2016. Vopak has 35 joint venture partners globally, and is the leading independent player in India and China.

REEF encompasses two key aspects of the “new” Vopak, which took shape after significant management change – new CEO and CFO – at the start of 2022:

A heavy focus on industrial and “new” gas, which now represents 50% of capital employed; and Discipline in respect of capital deployments away from cyclical chemicals terminals to the new environmentally attractive areas, with a significant improvement on Vopak’s measures of ROIC seen above (RHS of slide) Vopak has potentially much further to travel – long term

In our opinion, Vopak is still analysed as a very cyclical terminal company; as ROIC is sustained at higher levels, and the company utilises its NOW deep capital discipline to retire capital through buybacks and sustainable dividends, this should present a further chance for valuation uplift.

At 30 September 2024, Vopak has a market capitalisation of exactly тВм5billion (119.95m shares x тВм41.68) with consolidated net debt (excluding leases) of ~ тВм2.1billion, for an EV of тВм7.1billion. This calculation simply counts the equity value of some of the JV’s and associated companies or fully consolidates entities as required by IFRS despite significant minority interest; however, as with other infrastructure businesses, investors are increasingly focused on what lies underneath in respect of the true operating performance to Vopak of these entities (proportional basis). By its own admission, Vopak has still not fully completed the capacity to publicly show everything on a proportional basis, most notably future capital expenditure profiles.

On a proportional basis, net debt excluding leases is ~тВм2.7billion for an EV of тВм7.7billion. Current year 2024 guidance, updated at the June half, is for mid-point proportional EBITDA of тВм1.165million; this boils down to full year EBIT of ~тВм700million, leaving the shares on an EV/EBIT (proportional basis) of 11x.

As the company brings on stream more than тВм1billion of industrial and gas terminals and тВм1billion in new energies and sustainable feedstocks by 2030, with targeted returns on ROIC of 12% (currently >16%), we expect Vopak to grow profitability and retire further equity over the next two-three years. Analyst expectations are that the current year is a high return part of the cycle, with capacity utilisation at 92% and EBITDA margins close to 59%.

Vopak shares are up 225% in the past two years from low points in the mid тВм18.50 range as investors have grasped the early part of the management initiatives and are up ~40% in the current calendar year as operating conditions have continued to be strong.

We see scope for the shares to move ahead into the mid тВм50’s if conditions in the key markets hold together and the company is able to maintain financial discipline and bring projects to fruition on budget. The difficulty of analysing the company is reflected in flat-line forecasts over the next two years, which seem unlikely, either way. But the biggest impact of Vopak – we hope – is on HAL managementтАж.

Technip Energies: Unwanted cheap construction spin off

Technip (TE.PA) is a French-based engineering and technology company focused on downstream gas and liquids projects with a significant emphasis on the Middle East and Africa. Together with a more European focused technology business (renewables, furnaces and refineries). The company was spun off from Technip FMC to ensure its focus on more upstream business.

The TE.PA investment is very typical of HAL – writing its own ticket with the erstwhile parent company and feeding off its own expertise – Vopak, SBMO – elsewhere in the broad sector. At the time of the February 2021 spin, Technip FMC continued to hold 49.9% of TE.PA with an intent to sell down over time. As a consequence, the share price laboured over an extended period at between тВм10 – тВм13 (market capitalisation тВм1.8 – тВм2.35billion) leaving the shares extraordinarily cheap given the net cash balance of тВм2.5billion.

In September 2021, HAL acquired 9.9% (17.6million shares) of the company from TechnipFMC at тВм11.15/share; over the next three years, this stake has built to 29.2million shares or 16.2% at an estimated average price of around тВм13.

TE.PA trades at an EV/EBIT multiple on 2024 consensus forecasts of 3x (EV тВм1368m; EBITтВм тВм460million per mid-point guidance) and a mere 2.5x based on analysts forecasts for 2025. This is partly attributable to the obvious country and project risk profiles, but in our view, will likely improve if the company delivers with no major catastrophes, given the clear growth profile of “green” projects on its books.

Further capital management initiatives are also likely, with TE.PA having just completed an on-market buyback of 2.5% of its shares. Subject to price, we expect to see HAL build the stake even further, having re-categorised it to “listed minority” from “liquid investments during 2023.

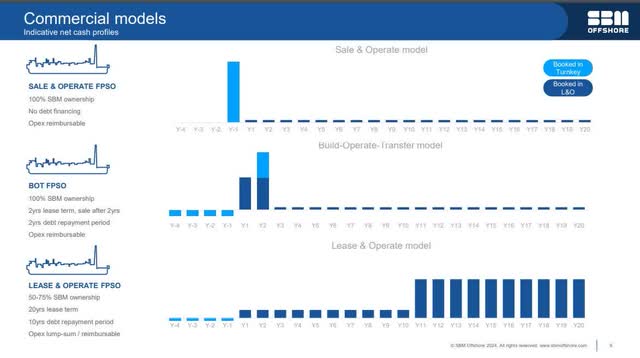

SBM Offshore: more complexity but long-term income streams

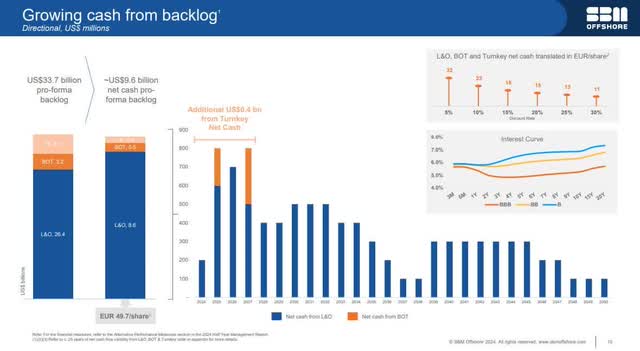

SBMO has been around since 1965 and has developed into a global leader in the ownership, leasing and supply of FPSOs: floating, production, storage and offloading vessels in the offshore oil and gas industry. SBMO has an equity market value of тВм2.9billion and using its own “directional” accounting convention, net debt of US$7.1billion and has given guidance based on EBITDA which we estimate equates to EBIT of ~US$750million for the current year. (SBMO shares trade in тВм; accounts are in US$)

SBMO builds assets to sell, operate for a period and transfer ownership (BOT), or lease out and operate (L&O) in joint venture; the company currently has 17 operating assets with four more under construction, and illustrates the cash flow profile from each model as follows:

SBMO is the largest independent operator of these vessels, notably deepwater units, given that many of the planet’s FPSO’s are owned by the integrated oil companies. The company is starting to use its expertise in other areas, in particular floating renewables (offshore windfarms).

HAL’s position in SBMO came about in late 2012 when the company’s oil production platform, built for Talisman Energy to restart production of the Yme oilfield in the Norwegian North Sea blocks, previously abandoned by Statoil, was discovered to have cracks in cement grouting. The cracks raised concerns of the platform’s collapse in winter storms, and all personnel were evacuated. By agreement, the platform was decommissioned, removed and scrapped. In total, given previous construction overruns, SBM took charges of US$1billion.

To restore bank covenants, SBM placed 10% of its capital to HAL, who already had a 3.5% holding; HAL underwrote a rights issue at тВм10.07/share and emerged with 13.5% of SBM’s capital in early 2013. HAL build steadily until 2020, when it acquired a further 5% of the company over the course of that calendar year. We estimate HAL’s entry price to SBMO to be just below тВм11.

SBMO is an accounting nightmare thanks to IFRS approach to leases, joint ventures and associates. In particular, there are differences relating to:

the treatment of operating leases in “Directional” become finance leases in IFRS, inflating the profits under the turnkey “business”; and similar consolidation of ventures issues as in Vopak where IFRS forces ventures to be either fully consolidated or equity accounted rather than percentage of ownership.

SBMO shares have rebounded to their highest level since 2019 on strong “capacity utilisation” – 96% uptime in the latest half – and build to a record “pro forma Directional backlog” which is tabulated below at December year-end; given the operating model, the company has high visibility of its cash flows out to 2050 (see chart above) based on the lease terms for the FPSO, given the client pays for operating expenditure:

year

Backlog US$bn

year

Backlog US$bn

year

Backlog US$bn

year

Backlog US$bn

2012

14.5

2015

21.6

2018

14.8

2021

29.5

2013

21.0

2016

17.1

2019

20.7

2022

30.5

2014

22.1

2017

16.8

2020

21.6

2023

30.3

Click to enlarge

The backlog is a key alternative performance measure for SBMO and grows with contract length, new assets, and is transparently communicated with assumptions regarding operation of specific assets. Backlog at 30 June 2024 is a record $33.5bn.

SBMO also provide an undiscounted net cash backlog based on the same assumptions, net of overheads, tax and debt service, which might be equated to an embedded value within an insurance contract. At 30 June 2024, this equates to US$9.6billion or тВм49.70 per share.

We believe with further FPSO additions – most recently for Woodside Petroleum in Brazil and significant scope in the offshore windfarm space, we see significant scope for SBMO to be re-rated. Of the 17 operating FPSO’s and 4 under construction, 10 are deployed (o/w 3 under construction) in Brazil, 4 in Guyana (1 under construction) and 3 in Angola suggesting the hydrocarbon component of SBMO – despite obvious long-term threats – remains intact in the foreseeable future.

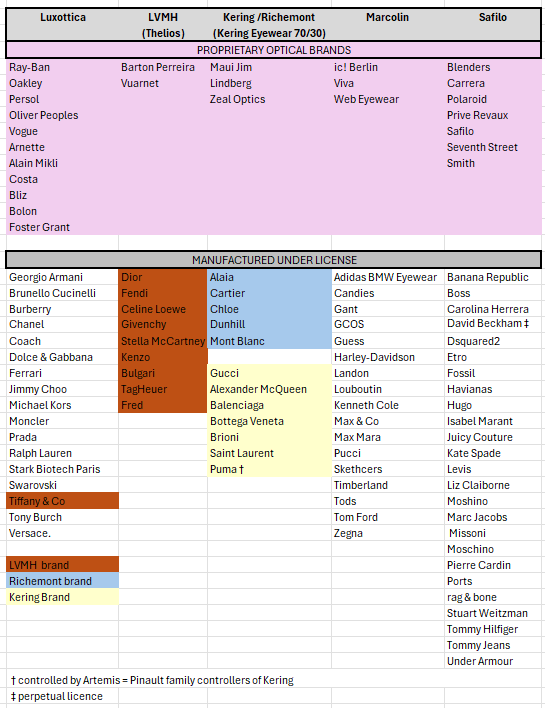

Safilo: One of the great business school lessons22- cleaned up for a deal. What deal? Hollowing out the industry: from LBO to the present

I’d be surprised if you’ve seen a sadder business story about a company that’s still alive, with revenues of over тВм1bn, but which has been systematically gunned down and pick-pocketed by 600lb gorillas. It’s a brilliant example of how the three biggest players in diversified luxury – LVMH, Kering and Richemont – cherish, guard and control their brands and use their financial firepower.

Safilo is largely irrelevant to HAL these days in the absence of the GrandVision business – it’s worth тВм2.50 per HAL share – and despite those folks who invested in the 2005 IPO and subscribed for the three subsequent rights issues having averaged down to a тВм5.46/share entry and so being down 80% on their money – HAL is actually slightly ahead, in nominal terms on its holding.

Despite its lack of financial relevance, It’s worth spending a few lines on Safilo – it’s an eye-opener to a wider world in luxury where the peripheral players struggle, shows how loyal HAL are to some of their investee companies, but more than anything shows how poor strategic positioning and lack of financial muscle is ruinous. Also, how HAL deals with Safilo from its present situation is very instructive on the wider thought processes within HAL. Can they cut a deal?

Safilo was founded in the nineteen century as Calalzo di Cadore, a lens and frame manufacturer. In 1934, Guglielmo Tabacchi acquires the business and uses it to found Safilo – Societ├а Azionaria Fabbrica Italiana Lavorazione Occhiali. Over time, there is a strong focus on new designs and new material for frames, especially in the post-war period. Tabacchi died in 1974 and his two sons -Giuliano and Vittorio – took over the business, which they publicly listed in 1987, retaining a combined 60% stake. Growth had come from a significant series of brand licensing deals and the acquisition of a US business, Starline Optical.

In late 2001, Vittorio bought out Giuliano and undertook a leveraged buyout to privatise the company in December 2001; a year later, the LBO debt was refinanced via a тВм270million equity stake provided by CSFB Private Equity.

Three years on, in December 2005, Safilo was back on the Milan Bourse relisting via raising тВм313m through a listing of 64million shares at тВм4.90 and total market capitalisation of тВм1,388million (283mn shares); CSFB made exactly тВм100m profit on the sale of its 34% stake.

With the onset of the GFC, by the end of 2009 the company was in significant difficulty; operating profit had collapsed to тВм8.7million,and with net debt of ~тВм600million, Safilo was up for тВм54million in interest charges a year. At the eleventh hour, HAL made its move underwriting a 131:50 equity issue, purchasing bonds at 60% of par value and in early 2010 with 34% of Safilo plus acquiring its retail businesses in Spain, Australia and China.

In many ways, keeping Safilo alive was perpetuating the pain. The company never had the funds to purchase (or develop) other major brands, didn’t have a retail presence, and was perennially at risk of not being able to renew the contract manufacturing licences for luxury brands upon their expiry.

Bad things come in threes. In 2017, Safilo’s world started to fall apart in front of it. Neither it – nor HAL – did anything to respond.

Firstly, on 17 January 2017, the 600lb gorilla – Luxottica – you had been playing against in your home town for years23 bulked up even more with its merger with Essilor, the world’s largest manufacturer of ophthalmic lenses; the тВм24billionmarket value company, merged into another – driven by Luxottica’s controlling del Vecchio family; the тВм48billion merger creation, which due to regulatory scrutiny did not fully complete until March 2019. EL.PA is now valued at тВм97billion.

Secondly, a major blow, with Kering (Gucci, Saint Laurent, Bottega Veneta) having hatched an eyewear plan in 2014, brought it to real fruition in March 2017 when the company joined up with Richemont to contract manufacture its eyewear under licence with Richemont taking a 30% stake in the venture24 It brought all its brands in-house, including those manufactured by Safilo.

Thirdly, quietly planning, in January 2017, LVMH joined forces with another venerable Italian manufacturer Marcolin (revenues ~ тВм500million, so half Safilo’s size) to create a JV – Th├йlios25- to bring LVMH into the eyewear industry. Don’t go looking in the 2017 LVMH documents for it; in October 2017, LVMH acquired 10% of the private Marcolin.

The completion of the EssilorLuxottica transaction came just after Safilo had finished raising equity through a 3.4:1 rights issue at тВм0.704 a share – bringing in тВм150million. What was the point? In 2014, Safilo manufactured all of Kering’s brands under licence and from 2017 had none, albeit with a compensation payment. In December 2019, LVMH announced it would be bringing all of its brands into the Th├йlios JV from 2021 – notably Dior and Fendi – with a loss to Safilo sales of тВм200million.

Moreover, Th├йlios built the first new factory in 60 years in Longarone – opened in August 2018, and just 40 minutes drive from Agordo where Safilo were headquartered; in October 2023, Safilo sold its Longarone plant to LVMH.

In December 2021, Safilo raised a further тВм135million in equity via another rights issue at тВм0.98 with HAL contributing its share and by now holding 49% of Safilo – in the same month that LVMH really took the wraps off by moving to 100% of Th├йlios, acquiring the 49% for тВм158million, selling its 10% of Marcolin for тВм30million and ensuring eyewear was a key new vertical of the behemoth.

What now for Safilo?

The major strategic hurt for Safilo has realistically concluded – the major luxury houses now manufacture all of their eyewear brands in house so whilst there will be gains and losses of the non LVMH/Kering/Richemont brands, and some will hurt (as seen by the loss of Jimmy Choo) none will be as fundamental as the loss of the LVMH brands.

The current landscape of “high-end” eyewear manufacturing, a ~тВм20billion pa market can be assessed per the table below:

The obvious strategic industry play is to merge Marcolin and Safilo. Marcolin is 83% controlled by private equity firm PAI Partners, who have been involved since December 2019, but is heavily indebted. A brief financial comparison of the two is given below:

Marcolin

Safilo

тВмmillion

FY 2022

FY2023

6/2024

FY 2022

FY2023

6/2024

Revenue

547.4

558.3

297.6

1076.7

1024.5

532.0

Gross Profit

319.0

337.9

190.4

597.4

585.7

319.2

GP (%)

58.2%

60.5%

64.0%

55.5%

57.2%

60.0%

Recurring EBIT

25.7

47.4

36.7

53.5

49.6

30.6

Pretax

1.0

16.8

20.4

64.1

22.4

24.8

Net debt (ex leases)

166.2

374.7

368.9

69.6

43.7

62.6

Click to enlarge

PAI Partners are looking to exit the Marcolin business and engaged Goldman Sachs to assess interest. There should be no real interest from the other three major groups, since the sales are incidental to Luxottica – besides the obvious regulatory intervention. Kering and LVMH are brand owners, not manufacturers for others. The magnitude of brand value can be seen in the Marcolin net debt figure movement in 2023: in April 2023, the company paid Est├йe Lauder US$250million for a perpetual license agreement on the “Tom Ford” brand (c.f. Safilo $38million for David Beckham)

In our opinion, if reports published in June 2024 are correct26, PAI Partners must live in a different universe to everyone else. Safilo made an undisclosed offer to acquire Marcolin, but apparently the offer was “reportedly incompatible with the company’s valuation of тВм1.35 billion”.

It is at this point it becomes clear why we have spent considerable time on an investment worth 2% of market capitalisation and less at realistic value. There is obvious logic in a merger with Marcolin – the balance of power will shift away from the non-major brand owners towards these merged “oligopoly” manufacturers – but anything Safilo does must be driven by HAL as its major shareholder and the backstop funder.

Will HAL be prepared to invest a further (say) тВм300million27 to assist Safilo in acquiring Marcolin? Will they be hard-nosed and figure that Marcolin’s main tranche of debt (тВм350million) comes due in 2026? Will a third-party player see an opportunity to acquire both? Something has to happen, since neither company can afford to keep paying to renew their contracts. There are potentially other players in the mix – privately owned deRigo by the eponymous family (Fila, Chopard, Furla amongst others) or the US based Marchon/VSP (Paul Smith, Ferragamo, Calvin Klein and Mrs. David Beckham). Is there sufficient money available for HAL to extract themselves from Safilo via merger? At around 10x EBIT (14x P/E) the equity market’s pricing of Safilo at present appears to reflect this balance. We expect a deal, one way or the other in 2025.

Portfolio thoughts – where to?

One of the subtle issues with closing HAL’s NAV discount is that two of the portfolio holdings – Vopak and SBMO – are immensely complex to analyse, especially with lease and JV accounting. That becomes a deterrent to analysing HAL because prospective investors just take the stock prices of the two and dig a little deeper. If HAL interacted with the investment community, in our opinion, there would be a better understanding of Vopak and SBMO.

It would not surprise if HAL moved to increase its Technip Energies holding. The issues with Safilo are dealt with in detail – some move from the status quo by mid-2026 seems inevitable.

UNLISTED BUSINESSES: analytically neglected – upside from more than Boskalis

At end December 2023, the last disclosed number, HAL carried their unlisted subsidiaries/associates at a valuation of тВм7,145million as follows; our estimates of value discussed in this section are appended:

тВмmillion

2023

2022

East 72

comment

UNLISTED MAJORITY OWNED

estimate

Broadview Holding B.V.

758.7

798.2

671

See 2A

Timber and Building Supplies Holland N.V.

332.9

325.7

634

See 2B

IQIP Holding B.V.

250.8

–

250

See 2C

ProDrive Technologies Group B.V.

159.2

81.0

159

See 2D

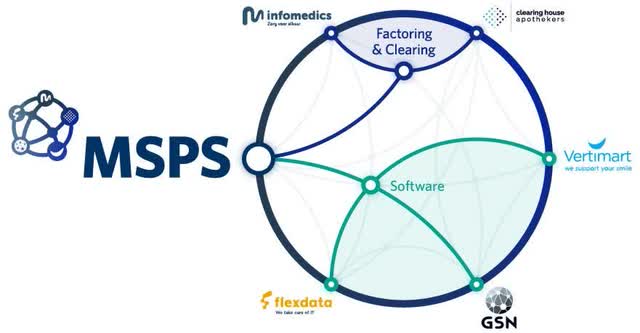

MSPS Holding B.V. (formerly Infomedics Holding B.V.)

144.9

131.7

625

See 2E

Van Wijnen Holding B.V.

142.6

148.1

143

No comment

Anthony Veder Group N.V.

138.9

133.5

132

See 2F

GreenV B.V.

128.1

96.2

128

No comment

Auxilium

nd

nd

175

See 2G

OtherтАа

393.8

461.2

308

adjusted

TOTAL

2,449.9

2,175.6

3,225

Koninklijke Boskalis B.V.

4,441.7

4,160.7

8,750

Section 4

Coolblue Holding B.V.

253.5

251.6

320+

See 2H

GRAND TOTAL

7,145.1

6,587.9

12,295

Click to enlarge

Source: p131 HAL Trust 2023 Annual Report and East 72 estimates

тАа FD Media (business news), Ahrend (fit out), RyK (eyewear in Chile), HR Top Holding (certification), AN Direct (hearing aids), Atlas (labour hire)

Click to enlarge

In each annual report, HAL discusses about 15 businesses, providing little other tan revenue, EBITA and a perfunctory sentence on conditions, number of employees and the year in which HAL originally invested in the business. The purpose of this section is NOT to discuss and value each business. Given the van der Vorms charitable instincts towards Rotterdam and the Netherlands generally, there are businesses which they appear to have altruistically funded. From an analytical standpoint, FD Media groep clearly pays its way with тВм16million of operating profit as the published of ” het financieele daglad” – the Netherlands Financial Times- plus its associated media. However, the pricing of old world media which doesn’t have a proprietary statistical appendage (e.g. Wall St Journal for News Corp) is valued very lowly; arguing the case for higher multiples doesn’t move the needle. Similarly, the тВм1.23billion turnover van Wijnen housebuilding business is at a low ebb, and it’s pointless to increase the valuation or push it down to nominal levels.

The table below shows business level EBITA contributions since 2018:

тВмmillion EBITA

2018

2019

2020

2021

2022

2023

Broadview Holding B.V.

54

81

56

53

43

53

Timber and Building Supplies Holland N.V.

49

57

73

132

89

48

MSPS Holding B.V.

13

26

25

34

42

48

van Wijnen

21

28

19

3

Ahrend

7

12

-4

4

3

12

Anthony Veder Group N.V

22

23

17

25

24

42

Atlas

9

6

3

5

4

3

FD Mediagroep

7

8

11

18

16

16

Auxilium

20

22

22

Divested businesses

6

12

11

68

12

28

SPECIFIED

167

225

213

387

274

275

Other

10

8

15

17

(22)

34

PER HAL ANNUAL REPORT (ex Boskalis)

177

233

228

404

256

309

Source: HAL annual reports compiled by East 72

Click to enlarge

We note that:

we ascribed a value of тВм3,225 to the collective (prior page) which in total equates to 9.9x estimated EV/EBITA for 2024 (тВм325million) but covers a real business mix; Broadview’s roll-up of laminate businesses is yet to pay off; The two health related businesses – practice management/billing and aid equipment are likely very underpriced at their carrying value; Additional investment in Coolblue suggests potentially significant valuation upside (if successful) but not for a couple of years; and Overall, investors’ view on the valuation of HAL’s unlisted businesses have been tainted by the ProGamers and ProDrive experiences, together with a few dull ones which have been around a while,D reducing their inclination to dig deeper.

The analysis below focuses on seven businesses of interest where we want to:

Verify a ~ тВм500million valuation in the context of a тВм10-11billion market capitalisation; Highlight some businesses which look really interesting for valuation uplift, further investment and build out and have dug deeper into the KVK28- HAL seem to have a great niche in ancillary health; and Coolblue where the тВм3billion float isn’t a happening thing, but the businesses is being accelerated somewhat.

Boskalis is dealt with separately in section 4.

Broadview Holding: specialism in high-pressure laminates but overpaid for low growth acquisitions

Broadview, which was incorporated in 2008, continues to operate a small energy distribution business (turnover ~тВм86million) but is built around a series of “HAL roll-up style” acquired businesses with a тВм1.3billion turnover mainly specialising in high-pressure laminates for use in external and internal decorations and surfaces. Broadview is heavily funded by over тВм500million in internal loans and has struggled for real growth over an extended period. The company issues its own separate accounts, which are especially useful in deciphering the HAL version of events.

Trespa is a Dutch cladding manufacturer acquired in March 1996 by HAL from Hoechst AG, mainly manufacturing external cladding and was the initial investment into what HAL terms its “material technology” cluster. In August 2008, Broadview added the тВм80million turnover Italian business Arpa Industriale, mainly specialising in internal cladding and design products at a cost of тВм79million, creating Broadview as the holding company for this business focus at the same time.

In May 2018, Broadview reached agreement with Gethalia Foundation to acquire its ordinary (voting) and non-voting preference shares in the German listed Westag & Getalit AG, giving Broadview a 75% voting stake in the company and requiring a takeover offer to the Frankfurt-listed company (ticker WUG.FRA). Broadview’s offer to minority shareholders was not well received, and Broadview still holds only 73.5% economic interest – despite a buyback of non-voting shares – and 83.5% stake. WUG.FRA shares still trade (very thinly) around the тВм31/share offer – valuing the whole company at тВм141million, reflecting the fact that revenue from the laminate, frames and doors business has not grown from the 2017 levels of тВм234million some seven years later.

In 2019, the struggling NZ-based construction and building materials concern, Fletcher Building, sought to sell Formica, the world’s largest high pressure laminate business, having fallen in breach of its debt covenants; Fletcher had acquired the business in 2007 from Cerebus Capital and Oaktree for US$700million29 having earned a “normalised” EBITDA of US$75million on revenue of US$737million in calendar 200630. Fletcher’s cycle-peak acquisition was shown in the final year to June 2019 revenues of US$600million equivalent and EBITDA of US$49million twelve years later.

In a logical step, Broadview acquired Formica in June 2019; in a not so logical step, it paid тВм680million (US$840million) for the business. Distressed seller, overly keen buyer, unfortunate pre-COVID timing.

In July 2020, Broadview acquired the UK business Direct Online Services, which is a multichannel seller of kitchen worktops, for тВм44million. Hence, on our estimates, aside from Trespa, Broadview has shelled out тВм950million for its four major laminate related acquisitions.31 32

Valuing Broadview

HAL’s major issue in creating a “cluster” of material technology companies – to date – is that the industry has been in a downturn across the western world since 2019. Growth in housing starts and other construction activity has been mundane, resulting from the financial impact on builders from supply side inflation, despite ultra-low interest rates until 2022.

A guide as to the structural imposts of the past few years can be seen from this simple table of financials comparing FY23 with revenue and EBITA in the year prior to acquisition – note that incremental acquisitions have been minor:

тВмmillion

Formica

Westaq

Arfa

Trespa

DOS

Acquired